Expert on ETF/Tracker selection & analysis

2 membership options to access our investment ideas

- Full access to our daily investment ideas from a universe of more than 200 ETFs

- Full access to the holdings of our ETF portfolios, selected by both quantitative & fundamental criterias and adapted to different investment styles

- e-mail alerts provide you with all the trading operations

Robot Allocator - 11/09/2017

Tactical Allocation (Leverage & Shorts)

| ETF | NAME |

| UGL | ProShares Ultra Gold (X2) |

| LEVMIB | Lyxor Leveragex2 MIB |

| BIB | ProShares Lev X2 Biotech US |

Risk of Krach :

37.0/100

Analyses ETF

Chemicals Europe (CHM) : is this turnaround sustainable?

Lyxor ETF Stoxx600 Chemicals – CHM – 12/09/2017

Short term strategy : Positive

Long term strategy : Positive

DAX Index (DAX) : Back on track?

Lyxor ETF DAX 30 (DAX) – 11/09/2017

Short term strategy : Negative

Long term strategy : Positive

Spain (LYXIB) : in a high-risk zone

Lyxor ETF IBEX (LYXIB) – 08/09/2017

Short term strategy : Negative

Long term strategy : Positive

Achats, Ventes, Watchlist

We integrate European Banks (BNK) in our Watchlist (short) – 08/09/17

We integrate into our watchlist (on the downside) the ETF Lyxor BNK (European Bank index), whose…

L'actualité vue par les ETF

Brazil returns to growth – 04/09/17

While the Brazilian economy contracted by 3.8% in 2015 and by 3.6% in 2016, it has…

Relief between India and China – 29/08/17

India and China announce their military disengagement from the Doklam, at the junction…

20% of total French equity outstandings for the ETFs – 01/08/17

According to the latest figures from the Banque de France, Equity ETFs represent….

Nos analyses des marchés

Our Market Analysis : 09/09/2017

The markets ended once again on a stable note (Stoxx600: -0.1% and S & P500: -0.6%) after a difficult start to the week following…

Our Market Analysis : 02/09/2017

This week was marked by greater volatility in the indices, particularly the Stoxx600NR, which ended with a 0.6% rise after a…

Our Market Analysis : 26/08/2017

The stock market was rather quiet this week, both in the US and Europe where the indices ended on a slightly positive…

-

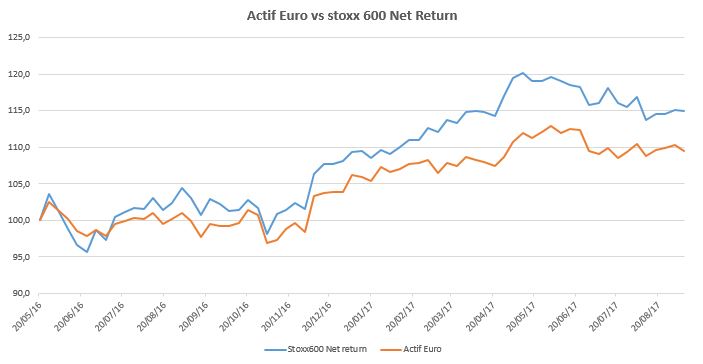

Active Euro Portfolio – 08/09/17

Performance

sincee 20/05/16+9,5% Weekly performance -0,8%

-

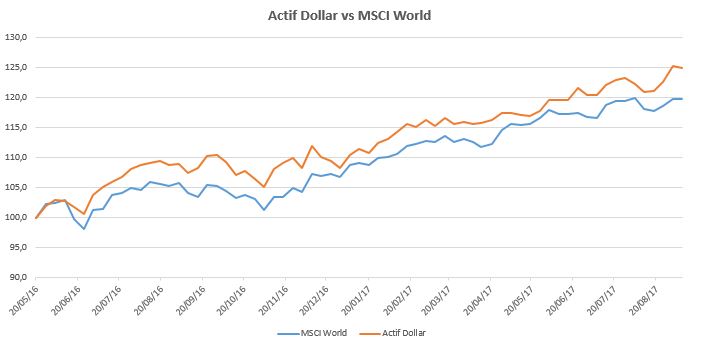

Active Dollar Portfolio – 08/09/17

Performance

since 20/05/16+24,9% Weekly performance -0,3%

-

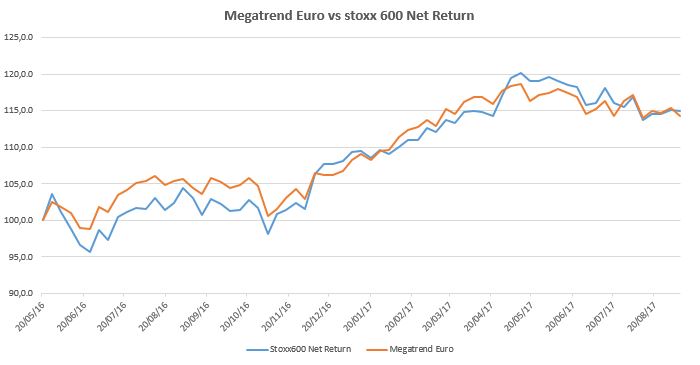

Megatrend Euro Portfolio – 08/09/17

Performance

since 20/05/16+14,3% Weekly performance -1,0%

Indicators as of 01/09/2017

Indicator Value weekly variation Short term

Long term S&P 500 2 461,4 -0,6% 60% 95% Nasdaq Composite 6 360,2 -1,2% 60% 95% Stoxx 600 Net Return 762,49 -0,1% 40% 95% Nikkei 225 (Japan) 19 275 -2,1% 10% 90% Shanghaï composite 3 365,2 -0,1% 80% 100% MSCI World 1 964,5 -0,1% 60% 95% Brent 53,76 +1,9% 50% 35% Gold 1 346,0 +1,6% 100% 100% CRB (commodities) 13,93 -0,7% 50% 5% Vix 12,12 +19,6% 50% 35% US - 10 years rate 2,021% -7,2 pts 100% 70% Bund 10 ans rate 0,234% -5,2 pts 100% 70% €/$ 1,204 +1,5% 100% 90% Y/$ 0,0093 +2,2% 100% 100% £/$ 1,320 +1,9% 100% 70% S&P500/Stoxx600 90% 100% Market Mood neutral risk-on Risk of Krach low low The momentum rating (Short Term and Long Term) is based on a maximum of 100% and a minimum of 0%. Above 50% the momentum is positive, below 50% the momentum is negative.

Indicators as of 08/09/2017

Sector Analysis

Weekly Europe : Stoxx600 US : S&P500 Top 3 Autos & Parts (+3,2%) Health Care (+1,6%) Utilities (+1,1%) Energy (+1,3%) Chemical (+1,0%) Utilitiesy (+1,0%) Down 3 Basic Resources (-1,7%) Consumer discretionary (-1,0%) Bank (-2,2%) Technology (-1,3%) Insurance (-2,3%) Financials (-2,8%)

-

-

One entry and one exit in our Megatrend Euro Portfolio – 11/09/17

One entry and one exit in our Megatrend Euro Portfolio – 11/09/17