Portfolios

26

Aug

2017

26

Aug

2017

Active Euro Portfolio – 25/08/17

25

Aug

2017

Our Market Analysis : 26/08/2017

25

Aug

2017

Japan (JPN) : negative watch in our Watchlist – 25/08/17

22

Aug

2017

We include a bond ETF in our Watchlist (AM3A) – 23/08/17

19

Aug

2017

Global Macro Portfolio – 18/08/17

19

Aug

2017

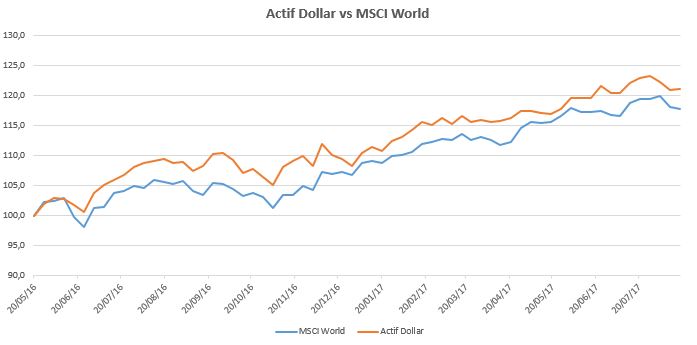

Active Dollar Portfolio – 18/08/17

19

Aug

2017

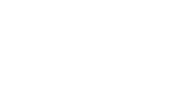

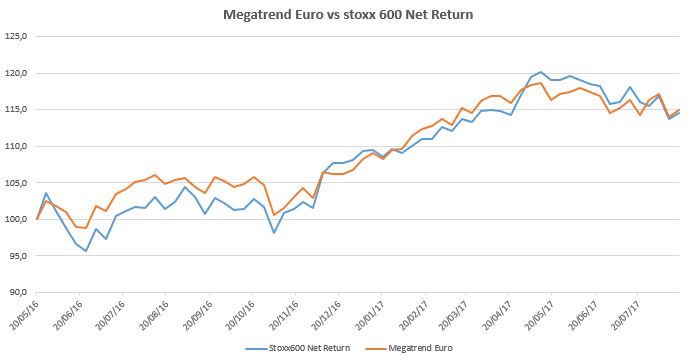

Megatrend Euro Portfolio – 18/08/17

19

Aug

2017

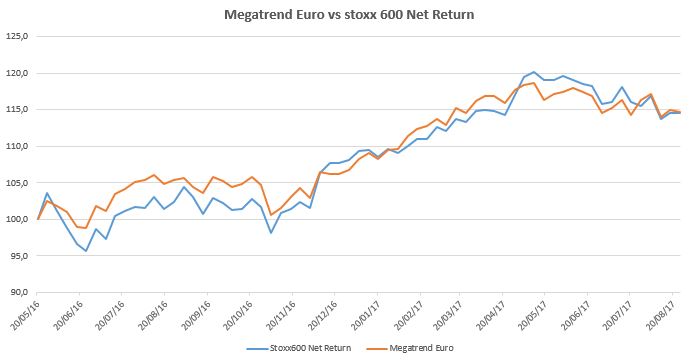

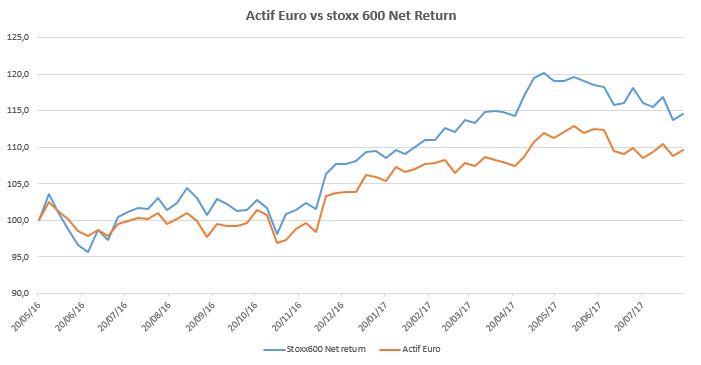

Active Euro Portfolio – 18/08/17

19

Aug

2017

The stock market was rather quiet this week, both in the US and Europe where the indices ended on a slightly positive note (Stoxx600: +0% and S&P500: +0.8%).

The geopolitical tensions decreased a notch, despite the military drills held since Monday between the US and South Korea for a period of 10 days.