Portfolios

22

Jul

2017

21

Jul

2017

Auto & Parts Europe : Short term opportunity (AUT) – 21/07/17

21

Jul

2017

Two exits and two entries in our Active Euro Portfolio – 21/07/17

19

Jul

2017

US Pharmaceuticals : An attractive short-term opportunity? (XPH) – 19/07/17

15

Jul

2017

Global Macro Portfolio – 14/07/17

15

Jul

2017

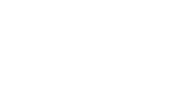

Megatrend Euro Portfolio – 14/07/17

15

Jul

2017

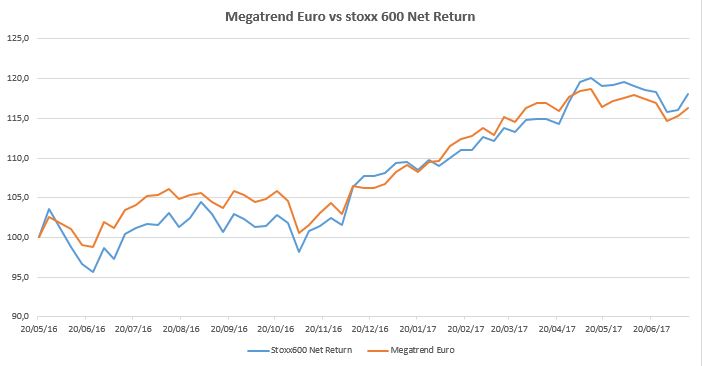

Active Euro Portfolio – 14/07/17

15

Jul

2017

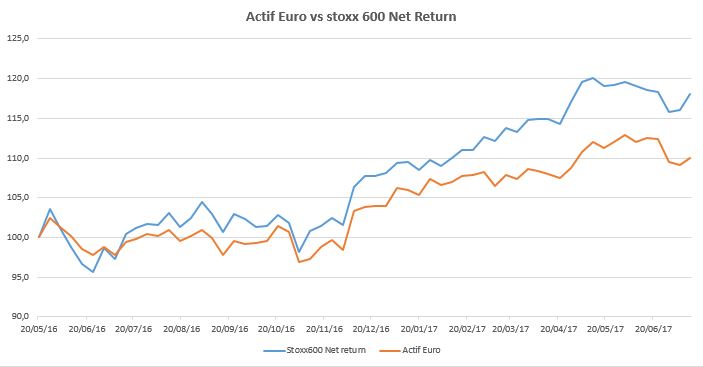

Active Dollar Portfolio – 14/07/17

15

Jul

2017

Our Market Analysis : 15/07/2017

14

Jul

2017

This week was rather corrective on European markets (Stoxx600 Net Return : -1.7%), mainly due to the strong appreciation of the euro against the dollar (1.167), and the actual breakout of the 1.15 level.

The ECB has tried to reassure investors, arguing that it was still too early to talk about the normalization of monetary policy despite improved fundamentals, and while inflation remains at a very low level.