Portfolios

29

Jul

2017

29

Jul

2017

Portefeuille Actif Euro – 28/07/17

28

Jul

2017

Our Market Analysis : 29/07/2017

28

Jul

2017

Pan Africa : launching a medium term buy signal? (PAF) – 28/07/17

25

Jul

2017

Two exits et two entries in our Active Dollar Portfolio – 25/07/17

24

Jul

2017

Global Macro Portfolio : one entry – 24/07/17

22

Jul

2017

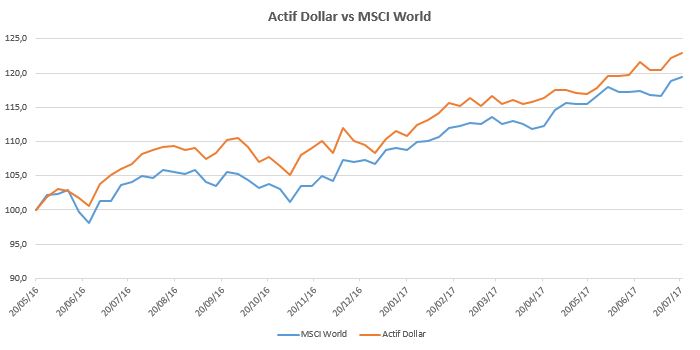

Active Dollar Portfolio – 21/07/17

22

Jul

2017

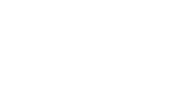

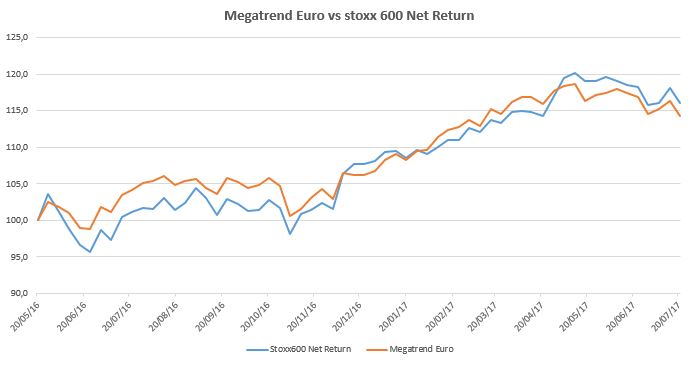

Megatrend Euro Portfolio – 21/07/17

22

Jul

2017

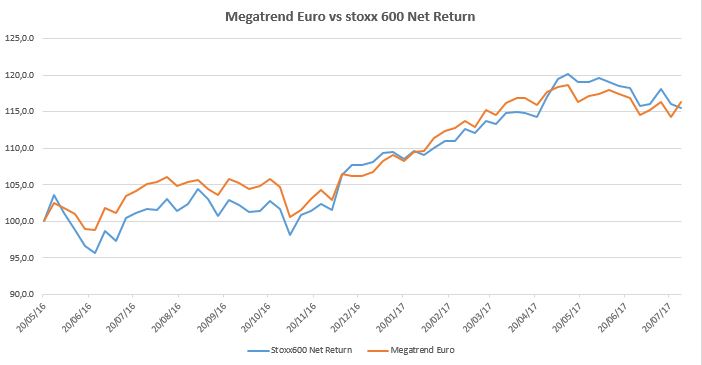

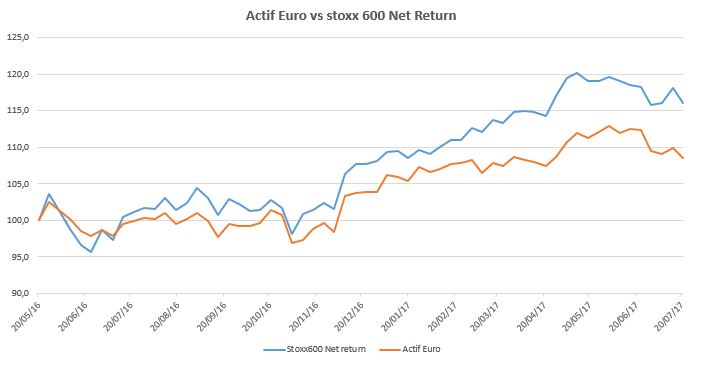

Active Euro Portfolio – 21/07/17

22

Jul

2017

This week was full of contradictions, which lead once again to flatness (-0,5% for the Stoxx600 and flat for the S&P500).

It was also a rich enough period with both positive and negative developments. Firstly, the Q2 corporate results are so far of good quality and exceed the expectations in Europe and the USA with encouraging prospects for the second half of the year, which is excellent news confirming a new cycle of rising profits has begun, and is expected to translate into a virtuous circle of lowering unemployment, rising consumption and increasing investment.