DB X-Trackers (DBXD) - 05/02/2018

Short Term strategy : Negative (20%) / Trend -

Long Term strategy : Positive (90%) / Trend -

Characteristics of the ETF

The DBXD ETF (db x-trackers), quoted in Euro, replicates the DAX 30 index which is composed of the 30 largest listed German securities, representative of the main sectors of the economy, while the stocks are selected according to the importance of their market capitalization.

The costs of this ETF are low at 0.09% and AUM is quite high at 3922M €, which makes it one of the best vehicles in terms of costs / liquidity. The replication method is direct (physical) and the dividend distribution is capitalized.

Alternative ETFs: DAX (Lyxor in Euro), DAXEX (iShares in Euro)

Index & components

The top 10 stocks are mainly large industrial stocks such as Siemens or Bayer, while there are only 2 financial stocks: Allianz and Deutsche Post, the German master index is relatively small and mostly composed of large industrial groups.

Unlike the English, French or Italian indices, the DAX is also distinguished by the absence of large oil companies that weigh heavily in the weighting of the CAC40, FTSE100 or FTSEMIB40, which is double-edged according to the cycle specific to energy sector. In addition, the financials weigh only 16.8% of the index, half for the insurance giant Allianz, so the banking sector has a low weight reflected in the well-known weakness of Deutsche Bank and Commerzbank. Conversely, the automotive and chemical sectors are heavier than the other European indices, while the technology sector is mainly represented by SAP (9%) whose market capitalization exceeds € 100 billion.

In summary, the DAX is a fairly strong index from a sectoral point of view which can make it evolve differently from other European indices.

German fundamentals are very solid (GDP growth above 2%, historically low unemployment rate at 5.5% and accelerated deleveraging up to 2020). The main risks concern Germany's main customers, namely the United Kingdom, which could suffer from Brexit, the US in political uncertainty and threatening it with a trade war, Russia which remains a difficult and aggressive neighbor and China because of its commercial practices which also tend to limit access to its domestic market to Western industrialists, particularly in the automotive and technology sectors.

Latest developments

After an increase of 6.9% in 2016, the DAX30 grew by 12.5% in 2017, more than the stoxx600 (+ 10.6%). The index has fallen by 1% since the beginning of the year after a sharp correction in the cyclical compartments, which account for most of the weighting of the German index.

The strength of the Euro that already reaches 1.25 USD is not good news for the German industry that lives on its exports. In addition, the rise in German long-term interest rates is very fast, the 10-year bund has doubled in a few weeks to reach 0.76%, a level that is still very low but which is rising rapidly and is at a high since summer 2015. All of this points to a gradual return to inflation, while wage pressures in Germany are on the rise, as a result of the economic upturn and full employment, which could have a negative impact on the margins of German companies.

The coalition enters the final straight of the negotiations to form a government, while uncertainties remain on deep disagreements between the two parties.

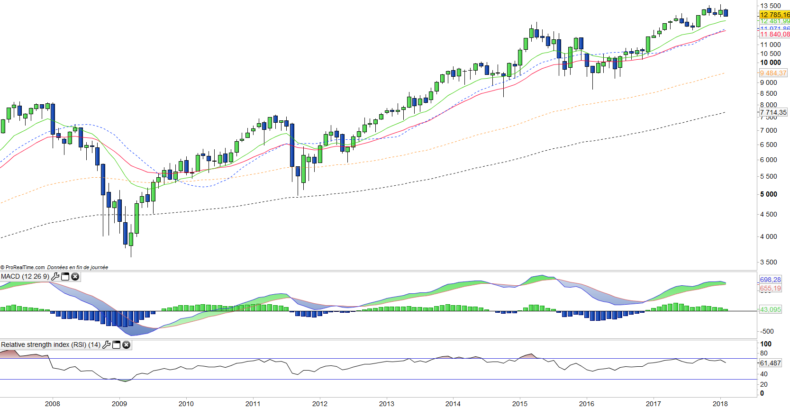

Monthly data

The monthly chart shows that the long-term trend of the DAX remains clearly bullish despite the correction that has just begun in February and which remains for the moment very moderate on a monthly scale. The technical oscillators are turning down, which calls for a return on EMA13E or EMA26 and a consolidation of the bullish phase of the last few months. There was no real excess on the rise which implies a correction of classical amplitude.

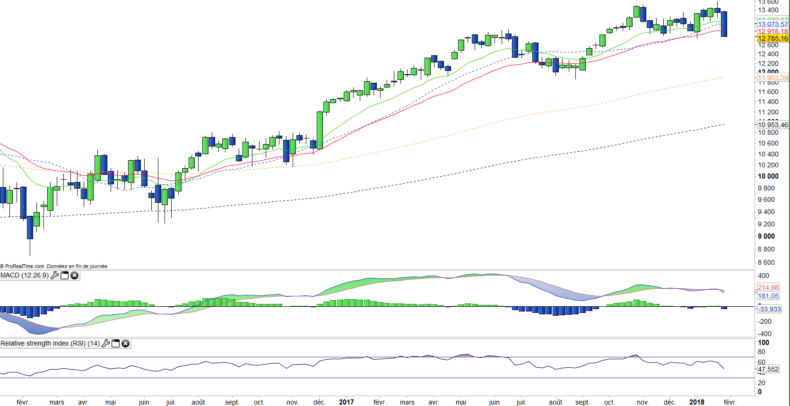

Weekly data

On the weekly chart, we can observe a fairly clear bearish start materialized by a large black candlestick that crosses the moving averages 13E and 26E and should be followed by a further decline next week towards 12,000 pts. The downward reversal of technical oscillators argues for a fairly wide correction expected to occur for much of February.

The EMA100 should play its supporting role and allow classes to bounce back afterwards.

ETF Objective

DBXD is a UCITS ETF which replicates the DAX Index (30 german companies)

Characteristics

| Inception date | 10/01/2007 |

| Expense ratio | 0,09% |

| Issuer | Lyxor |

| Benchmark | DAX 30 index |

| Code/Ticker | DBXD |

| ISIN | LU0274211480 |

| UCITS | Yes |

| Currency | € |

| Exchange | XETRA |

| Assets Under Management | 3 840 M€ |

| Replication Method | Direct (Physical) |

| PEA (France) | No |

| SRD (France) | No |

| Dividend | Capitalization |

| Currency Risk | No |

| Number of Holdings | 30 |

| Global Risk | 3/5 |

Country Breakdown

| Germany | 100% |

Sector Breakdown

| Consumer discretionay | 22% |

| Industrials | 19% |

| Financials | 16% |

| Health Care | 13% |

| Materials | 13% |

| Technology | 9% |

| Telecom | 6% |

| Others | 2% |

Top Ten Holdings

| Siemens | 9% |

| SAP | 9% |

| Bayer | 8% |

| BASF | 8% |

| Allianz | 8% |

| Daimler | 7% |

| Deutsche Telekom | 5% |

| Deutsche Post | 4% |

| Linde | 3% |

| Adidas | 3% |