Access by susbcription:

- To our Buy / Sell alerts on the Indices and Stocks, resulting from our algorithms, and to the transparent follow-up of the open positions and the realized performances.

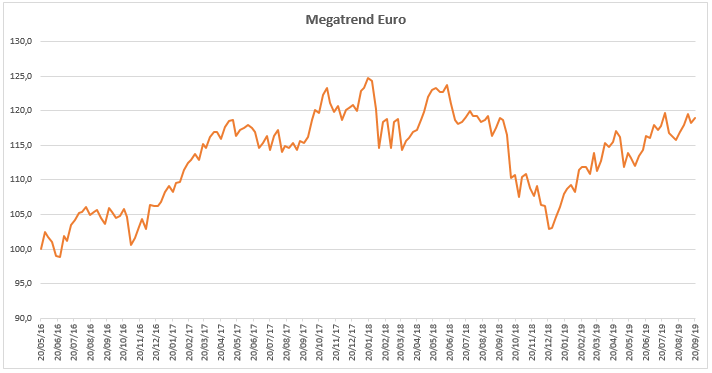

- To our arbitrage on our Megatrend portfolios in Euro and Dollar

- To our detailed asset allocation strategy based on proprietary algorithms, Crash's quantitative risk measurement and weekly analysis

Robot Allocator - 21/09/19

Portfolio performance (since 20/05/2016)

| Portfolio | performance |

| Megatrend Euro | +19.0% |

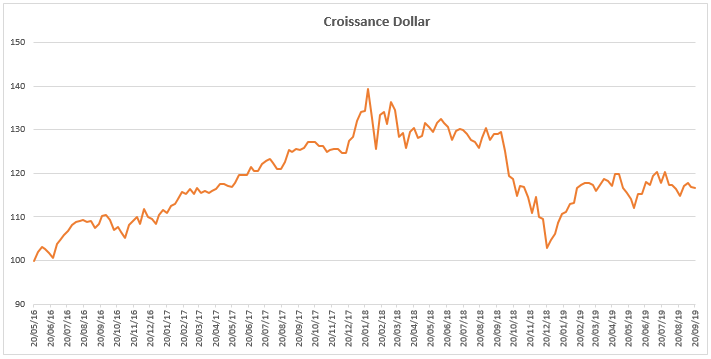

| Growth Dollar | +16.6% |

Risk of crash 21/09/19:

54/100

ETF Analysis

Indice CAC40 (PX1): Bullish breakout looks now unavoidable

CAC40 (PX1) – 16/09/19

Short Term trend: Neutral (100/100)

Long Term trend: Positive

Nasdaq100 (NDX): Is this bullish restart credible?

Nasdaq 100 – 09/09/19

Short Term trend: Positive

Long Term trend: Positive

Stoxx600 (SXXR) : New bullish start inside the range

Lyxor stoxx 600 Net Return (SXXR) – 04/09/19

Short Term trend: Positive

Long Term trend: Positive

US S&P500: Volatile but without direction

US S&P500 – 26/08/19

Short Term strategy: Neutral

Long Term strategy: Positive

Buy, Sell, Watchlist

Arbitrages in our Megatrend Euro portfolio – 08/08/19

Arbitrages in our Megatrend Euro portfolio – 08/08/19

Increase in the share of cash in our portfolio Megatrend Euro…

Our Market Analysis

Our Asset Allocation strategy: 23/09/19

Our Asset Allocation strategy: 23/09/19

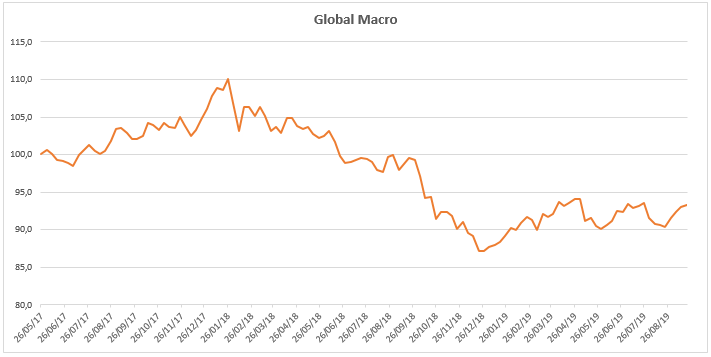

Equity markets were more mixed last week, with a slight increase in Stoxx600 (+ 0.3%) and a slight decline in the S & P500 (-0.5%). The quality values have…

Our Asset Allocation strategy: 16/09/19

Our Asset Allocation strategy: 16/09/19

Equity markets rebounded last week, as bonds and gold fell. The most striking fact remains the very strong sector rotation, with the decline of…

Our Asset Allocation strategy: 09/09/19

Our Asset Allocation strategy: 09/09/19

We arrive at a crossroads, with a crash indicator that has fallen sharply over the week, to return to 50/100 (under 50/100 markets are…

Our Asset Allocation strategy: 02/09/19

Our Asset Allocation strategy: 02/09/19

Our crash indicator remains at a high level, at 64/100, in the correction zone after a brief passage in the neutral zone (which shows once again that we must not…

-

Growth Dollar portfolio – 20/09/19

Performance

since 20/05/16+16,6% Weekly performance -0,3%

Retrouvez-nous désormais sur https://phi-advisor.com/fr/

pour bénéficier de nos signaux d’achat et de vente de plus de 300 ETFs !};});});My Weblog: Ümraniye elektrikçi üsküdar elektrikci usta elektrikci sisli elektrikci https://www.enigma-furnishings.co.uk/?p=584

https://alhajjabulkashemhosnearastudentconsultancy.com/?p=16620

https://asociacionderecicladoresdelmeta.org/?p=17407

https://contractorresults.com/?p=357

https://gabon-environnement.com/?p=3703

https://igyoushu.biz/?p=248

https://immd.kiev.ua/?p=5735

https://kimnammarine.com/?p=1366

https://kinglouis.fr/?p=3167

https://shemirancenter.com//?p=5652

https://smartaxconsultancy.co.uk/?p=929

https://tsamadopaco.fr/?p=4222

https://tvnasalsinus.com/?p=2111

https://yypark.net/?p=135Nous utilisons des cookies pour vous garantir la meilleure expérience sur notre site. Si vous continuez à utiliser ce dernier, nous considérerons que vous acceptez l'utilisation des cookies.Ok