Our Strategy

Analysis and ETF's selection :

We have developed an apporach wich combines the use of quantitative tools (momentum approach), market & fundamental analysis, as well as key futures of each ETF.

Through this methodology we seek a better understanding of the risk typology and to maximise the risk/reward of an operation.

In our ETF selection, we include the analysis of their key features :

- The replication method (direct - physical, or indirect - via a swap)

- Liquidity (The Fund's AUM)

- The quality of the issuer

- Reliability in the replication of the index (tracking error)

- ETF components (number of holdings, sector allocation, breakdown by geography)

- The currency exposure

We accordingly select ETFs competing in the same category, and also take into account their prices and their listing places, besides their main characteristics

Robot and quantitative tools :

The methodology relies on proprietary Algorithms, primarily based on relative strenght and trend following.

The methodology relies on proprietary Algorithms, primarily based on relative strenght and trend following.

The Robot computes trends ratings from our ETF library on 2 timeframes (Short Term / Long Term) finally set a hierarchy among the ETF according to their relative strenght.

We also use overbought and oversold patterns in order to identify the best risk/reward opportunities.

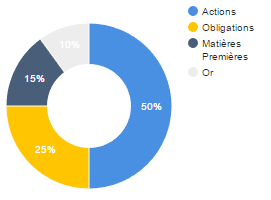

Our Asset Allocation is primarily quantitative, as our algorithms determine the weights of the different Asset classes.

However, our Robot is designed to select only ETFs in a positive momentum pattern, which may temporarily exclude one or several Asset classes. Diversification is favoured by our Algorithms if several Asset classes are qualified as positive momentum.

Megatrend Euro Portfolio

This portfolio aims to focus on positive and long-term trends in growth themes and Megatrend Stocks that focus on quality selections and hold them until the trend is rendered invalid or for more favourable arbitrage.

In theory, this portfolio is the least volatile of our selection and arbitrages are relatively scarce.

This portfolio has defensive characteristics, so we expect more outperformance during periods of falling than in bull markets.

Growth Dollar Portfolio

This Portfolio focuses on growth sectors in North America, country indexes and Stocks linked to the dollar zone, with positive medium term dynamics.

These positions are, in theory, not intended to be held in the long term due to their cyclical characteristics or for cyclical dan/or valuation reasons.

The investor will have to accept a certain level of volatility and a number of arbitrages, however less frequent than for the Active Euro Portfolio. The loosing positions may be sold within this portfolio for arbitrage purpose.

Global Macro Portfolio

The Global Macro portfolio is directly derived from the Selection of ETFs by our proprietary algorithms.

A hierarchy is established between ETFs according to their relative strength, based on a mix of short-term and long-term trends. The overbought and oversold dimension is also taken into account in detecting the best risk/reward opportunities.

The Global Macro Portfolio is designed for sophisticated and active investors, particularly suitable for hedge fund management. It is managed in USD, given the majority of ETFs listed in US dollars.

Our objectives

Our main objective is to record absolute performance. Thus, we expect to cushion market shocks, thus falling less than the market at negative stages and at least as well as the market in bull markets. This is the task that will allow us over time to deliver positive absolute returns, as financial markets are on a positive long-term trend (dividends reinvested), although often chaotic in the short term.

Our portfolios will therefore be able to experience periods of decline, but the possibility of diversifying ETFs across multiple asset classes and geographies is an undeniable asset.