Lyxor ETF World Water (WAT) - 14/11/2018

Short Term strategy: Negative (20%) / Trend -

Long Term strategy: Negative (30%) / Trend =

Characteristics of the ETF

The Lyxor WAT ETF (UCITS), created in 10/2007 is listed in Euro on Euronext and replicates the World Water Index CW Net Total Return index which is calculated by Dow Jones from a selection of values made by SAM (Sustainable Asset Management, a management company specializing in sustainable development created in 1995). Stocks are weighted by market capitalization, but to maintain effective diversification, no stock can weigh more than 10%. The index is revised every 6 months and rebalanced quarterly. It is a global index composed of 20 stocks, of which 49% are quoted in USD and only 9% in Euro, so the currency risk is significant.

The costs of this ETF are 0.6% and the AUM is approximately € 479M. The replication method is indirect (via a swap) and there is a dividend distribution method.

Alternative ETFs: IH2O (Ishares in USD), PHO (Powershares in USD), CGW (Guggenheim in USD).

Index & components

The WAT tracker gives the investor access to a basket of 20 international securities specializing in the production and distribution of water.

These values are for 44,2% US, and for the other half Asian (Japan 9%, China 6%) and European (UK 19%, Switzerland 9,1%, France 8.7%).

This ETF is listed on the Paris Stock Exchange, but with a high exposure to foreign currencies (especially USD, Pound Sterling and Swiss Franc). Companies with different activities are included in this index: there are specialists in water distribution and utilities (Veolia, American Water Works ...), companies specializing in technologies related to the water cycle who manufacture pumps and filtration and distribution systems (Xylem, Pentair ...), while other companies are more exposed to construction (Plumbing...).

The historical performance of this ETF is clearly positive since its launch in October 2007 (multiplication by 2.2x) and higher than that of the S & P500 and Stoxx600, which can be explained by the theme itself which benefits from powerful long-term catalysts (demography, urbanization, development of emerging countries), but also by financial dynamics: these companies have usually a very high capital structure that involves significant debt, they are therefore sensitive to interest rates.

The fall in interest rates, which has increased significantly since the 2009 financial crisis, has had a very positive effect on these companies, which have been able to finance their investments at a lower cost. A lasting and unfavorable change in interest rates could end up being negative for the sector.

This theme is promising for the long term, as the scarcity of resources coupled with the heavy demographic and urban trends offer a considerable market for these companies.

Latest developments

After 6 years of uninterrupted rise the Water World index shows a fall of 7.6% in 2018.

The theme of water can be assimilated to the "Utilities" sector because of its capital intensity and high leverage companies that comprise it, which implies a significant sensitivity to interest rates, as companies roll over their debt to make new investments.

Long rates are on the rise in the US, and much lower in Europe and Japan where they remain at very low levels due to monetary policy. However, in the US, the FED is entering a more restrictive liquidity cycle, with inflation tending to increase which creates a more negative context for this theme. The long-term factors are positive, but in the short term the evolution of the water theme is conditioned by interest rates.

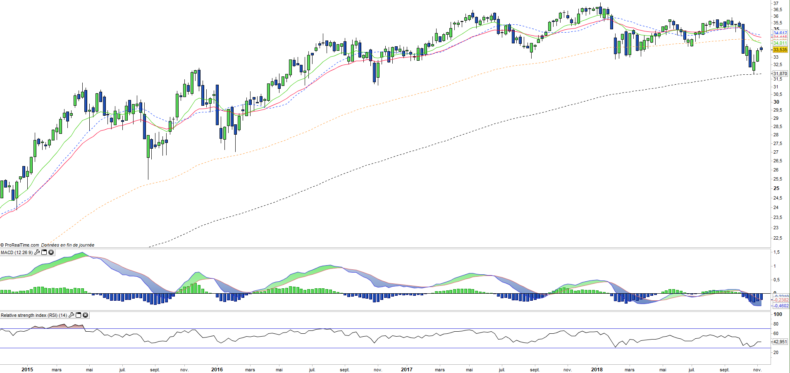

Monthly data

The monthly chart shows a positive long-term trend that has been dulled since 2017 by forming a kind of rounded top summit structure. However the index is bending under the current correction but does not break, and consolidates in a rather low volatility. As long as EMAs13 and 26 do not cross each other, we can hope for a recovery and then the recovery of the uptrend.

Weekly data

On the weekly chart, we can observe that WAT broke its EMA100 for the first time since 2011, which shows a marked weakening of the trend. The index has found a significant new support with the EMA200 which is the last bastion before the confirmation of a downward trend reversal. The current rebound is therefore to be monitored closely.

ETF Objective

WAT is a UCITS ETF, listed in EUR, which seeks to replicate the World Water cw Total Return index (20 companies)

Characteristics

| Inception date | 10/10/2007 |

| Expense ratio | 0,60% |

| Issuer | Lyxor |

| Benchmark | World Water CW Net Total Return |

| Ticker | WAT |

| ISIN | FR0010527275 |

| UCITS | Yes |

| EU-SD Status | Out of scope |

| Currency | € |

| Exchange | Euronext Paris |

| Assets Under Management | 490 M€ |

| Dividend | Distribution |

| PEA (France) | No |

| SRD (France) | Yes |

| Currency risk | Yes |

| Number of holdings | 20 |

| Risk | 3/5 |

Country Breakdown

| USA | 44% |

| United h Kore | 19% |

| Switzerland | 9% |

| Japan | 9% |

| France | 9% |

| Hong Kong | 6% |

| South Korea | 2% |

| Brazil | 2% |

Sector Breakdown

| Industrials | 56% |

| Utilities | 41% |

| Consumer discretionary | 2% |

Top Ten Holdings

| American Water Works | 11% |

| Geberit | 9% |

| Xylem | 9% |

| Veolia Environnement | 9% |

| Masco Corp | 7% |

| Pentair | 5% |

| United Utilities Group Plc | 5% |

| Smith Corp | 5% |

| Flowserve Corp | 5% |

| Spirax Sarco Engineering | 4% |