Short Term and Long Term Trends by Asset classes

| Asset Classes | Indices / ETF | Short Term trend | Long Term trend | |||||||

| USA Equities | S&P500 USA - SP5 | Positive | Positive | |||||||

| USA Equities | Nasdaq 100 USA - NDX | Positive | Positive | |||||||

| USA Equities | Russel 2000 USA - RS2K | Positive | Positive | |||||||

| Europe Equities | Euro STOXX 600 - MEUD | Positive | Positive | |||||||

| Europe Equities | Small Cap Europe - MMS | Positive | Positive | |||||||

| UK Equities | FTSE 100 - L100 | Positive | Positive | |||||||

| Japan Equities | Japan Topix - JPN | Positive | Positive | |||||||

| Asia Pacific ex Japan Equities | Lyxor ETF - AEJ | Positive | Positive | |||||||

| China Equities | Amundi ETF China - CC1 | Positive | Positive | |||||||

| Latin America Equities | Lyxor ETF Latam - LTM | Positive | Positive | |||||||

| Africa Equities | Lyxor Pan Africa - PAF | Positive | Positive | |||||||

| Govt Bonds EUROMTS 7-10 Years | Amundi ETF- C73 | Positive | Positive | |||||||

| Corporate Bonds Euro | Amundi ETF - CC4 | Positive | Positive | |||||||

| Emerging Countries Bonds | Amundi ETF - AGEB | Positive | Positive | |||||||

| US Treasury Bonds 7-10 years | Amundi ETF - US7 | Positive | Positive | |||||||

| Corporate US Bonds | Lyxor ETF - USIG | Positive | Neutral | |||||||

| Golds | ETFS - BULLP | Positive | Positive | |||||||

| Agricultural Commodities | ETFS - AIGAP | Negative | Negative | |||||||

| Energy Commodities | ETFS - AIGE | Neutral | Negative | |||||||

| Industrial Metals Commodities | ETFS - AIGI | Positive | Positive | |||||||

Methodology:

Crash indicator

Our indicator is calculated based on quantitative criteria that qualify crash's risk based on the volatility market behavior (VIX), gold, US bonds (10 years) and the MSCI World. We adopt weightings of these different criteria in order to assess the market risk and its evolution on a weekly basis.

Short Term and Long Term Scores

The scores are calculated by our algorithms on the basis of quantitative criteria over several time horizons. These scores are between 0 and 100. Beyond 50 points the momentum is considered positive, under 50 points the momentum is negative, and the 50 points represent a neutral score. Dynamically, all comparisons are based on scores calculated one week earlier

Equities:

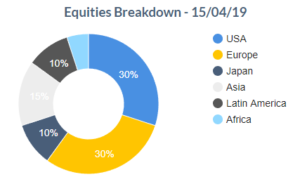

Stocks remain bullish: all zones are in positive short-term and long-term trends. Even the Russel 2000 (US broad index), which was in short-term neutral territory, has just turned positive.

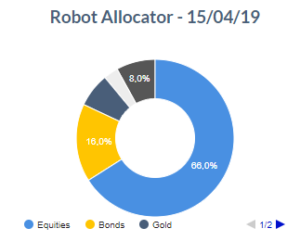

Our Global Global Macro portfolio therefore always includes all geographies in its Allocation, for a total of 66% of equities.

Bonds:

Bonds weaken very slightly again in the short term, but nevertheless remain in a positive trend, both in the short term and in the long term.

All categories of Bonds are currently eligible in our Global Macro portfolio, which therefore includes 16% of Bonds in its allocation.

Gold:

The short-term and long-term gold scores still show a positive trend, which allows us to keep it in our Global Macro portfolio (7% of the portfolio).

Commodities:

Only Industrial Metals have a positive short-term and long-term trend, with unchanged scores compared to the previous week. These are therefore included in our Global Macro portfolio (3% of the total portfolio).

Agricultural Commodities and Energy are excluded from our portfolio, as they were the week before, as they remain in a negative long-term trend.

Note, however, that Energy (ETF AIGE) is very close to giving a positive Long Term signal, while its Short Term trend is already neutral and could also switch to green in the week.

Cash:

In the Global Macro portfolio, we hold 8% of cash.