Lyxor ETF Stoxx600 Chemicals - CHM - 22/05/2018

Short Term strategy: Positive (100%) / Trend +

Long Term strategy: Positive (100%) / Trend +

Characteristics of the ETF

The ETF CHM (Lyxor) replicates the Stoxx Europe 600 Chemicals Index, which is composed of the main European stocks of the sector. This index is rather concentrated since it has only 25 holdings. By geography, the index is predominantly German with a weighting of nearly 50%, about 17% for France and 12% for the Netherlands. The ETF CHM bears costs of 0.3% which are in the market average with AUM of approximately €16M. The replication method is indirect (via a swap) and the dividend distribution policy is by capitalization.

Alternative ETF : EXV7 (iShares in Euro),

Latest developments

After a rise of 12.8% in 2017, the sector's trend is still positive for 2018, which has increased by 4.5% since the beginning of the year with double-digit earnings growth prospects.

The two largest stocks (BASF and Air Liquide), which account for around 40% of the index's capitalization, are well-positioned thanks to solid earnings prospects and should carry the index in the coming weeks.

The strong global demand for complex materials, mergers & acquisitions and the strength of the oil sector are positive factors, as is global growth, which is now affecting all geographic areas, particularly Asia and Europe.

Index & components

The CHM ETF (Lyxor) gives the investor access to a basket of 25 stocks in the chemicals sector, which have the characteristics of being mainly German.

These are large market capitalizations that have a global turnover with mostly cyclical characteristics (to varying degrees, however) and more or less strong links with the price of oil which is used as raw material for many products.

It should also be noted that BASF, which accounts for almost a quarter of the index, is a highly cyclical company, partly linked to the oil sector. The group weighs over € 80bn in capitalization, and is the driving force behind the rise.

In addition, the chemical index is much less homogeneous than it appears with companies that have very different specialties with for example Givaudan and DSM who are specialists in food extracts, while Air liquid is the number 1 Global industrial & medical gases, and Syngenta is a company specializing in fertilizers and GMOs competing with Monsanto.

The end markets are therefore very different and the growth and cyclical profiles also, in the end the European Chemical Index represents a very interesting basket that can be considered to preserve in the long term.

In addition, the index is essentially made up of euro area securities, with a limited currency risk and corresponding mainly to the Swiss franc (around 7% of the capitalization) while the British pound, which is more at risk, represents only 5%. of the index. The volatility of this tracker is relatively low in the "normal regime" but strong consolidations can occur during fears of economic downturns, or decline in global growth, so it is an interesting vehicle to play the medium term trends.

The chemicals sector should be one of the main beneficiaries of the new growth cycle in Europe.

Monthly data

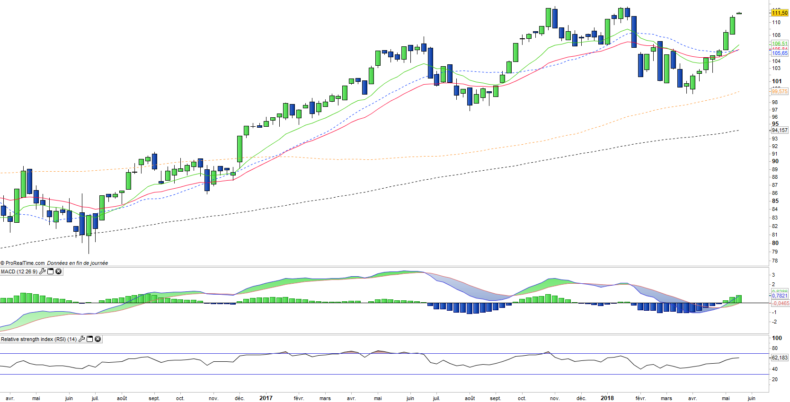

The monthly chart shows a long-term, well-established trend that has been very consistent with only two large corrections since the financial crisis, without long averages being crossed. The MACD has so far been a good indicator of these medium-term reversals. All technical indicators are positive for this index, which has a relative strength greater than stoxx600.

Données hebdomadaires

On the weekly chart, we can see that the rebound that took place on the MME100 helped revive the trend in the medium term. Prices returned to the highs, moving averages back up as well as the MACD which also crossed the zero zone. A point of intervention could be at the EMA13 level, as part of a minor consolidation.

ETF Objective

CHM is a UCITS ETF, listed in €, which seeks to replicate the STOXX Europe 600 Chemicals Net Return EUR index (25 european companies)

Characteristics

| Inception date | 25/08/2006 |

| Expense ratio | 0,30% |

| Issuer | Lyxor |

| Benchmark | Stoxx 600 Chemical |

| Ticker | CHM |

| ISIN | FR0010345470 |

| UCITS | Yes |

| EU-SD status | Out of scope |

| Currency | € |

| Exchange | Euronext Paris |

| Assets Under Management | 16 M€ |

| Dividend | Capitalization |

| PEA (France) | Yes |

| SRD (France) | Yes |

| Number of Holdings | 25 |

| Risk | 3/5 |

Country Breakdown

| Germany | 50% |

| France | 17% |

| Netherlands | 12% |

| Switzerland | 7% |

| Belgium | 6% |

| United Kingdom | 5% |

| Others | 3% |

Sector Breakdown

| Materials | 97% |

| Industrials | 3% |

Top Ten Holdings

| BASF | 25% |

| Air Liquide | 15% |

| Linde | 10% |

| Akzo Nobel | 6% |

| Givaudan | 5% |

| Koninklijke | 5% |

| Covestro | 4% |

| Umicore | 3% |

| Symrise | 3% |

| Solvay | 3% |