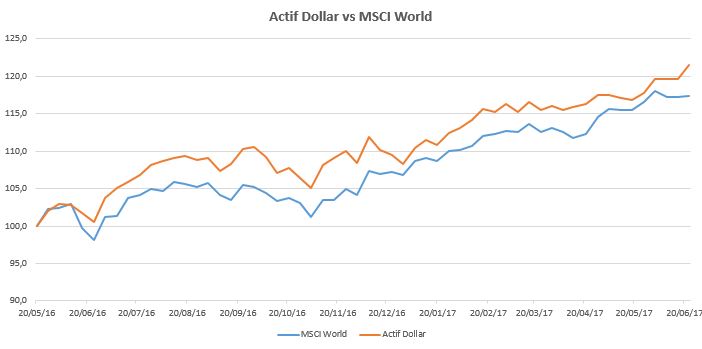

| Performance since 20/05/16 | +21,6% |

| Weekly Performance | +1,6% |

Active Dollar Portfolio analysis

| Ticker | ETF | Issuer | Curr. | nb | entry date | entry price | curr. price | variation | weekly var. | valo. € |

| IWO | US Russel 2000 Growth | iShares | $ | 80 | 20/05/16 | 131,83 | 170,26 | 29,2% | 2,0% | 13 621 |

| PKB | US Building & Construction | PowerShares | $ | 350 | 06/12/16 | 28,38 | 29,63 | 4,4% | 0,2% | 10 371 |

| ECH | Chile | iShares | $ | 280 | 20/05/16 | 35,28 | 42,14 | 19,4% | -2,9% | 11 799 |

| IAU | Gold Trust | iShares | $ | 900 | 27/02/17 | 12,11 | 12,08 | -0,2% | 0,1% | 10 872 |

| EBND | Emerging Local Bond | SPDR | $ | 400 | 27/03/17 | 28,45 | 28,96 | 1,8% | -0,2% | 11 584 |

| XHS | US Health Care Services | SPDR | $ | 200 | 13/03/17 | 57,74 | 64,36 | 11,5% | 3,1% | 12 872 |

| IHI | Medical Devices | iShares | $ | 70 | 20/05/16 | 129,22 | 167,81 | 29,9% | 2,0% | 11 747 |

| THD | MSCI Thailand | iShares | $ | 140 | 06/02/17 | 76,43 | 78,36 | 2,5% | -1,4% | 10 970 |

| NOBL | US dividend Aristocrat | ProShares | $ | 190 | 20/05/16 | 52,26 | 58,00 | 11,0% | -0,9% | 11 020 |

| XBI | US Biotech | SPDR | $ | 180 | 20/05/16 | 54,09 | 80,34 | 48,5% | 12,2% | 14 461 |

| cash | 2 248 | |||||||||

| Total | MSCI World | 1 925,0 | 121 565 | |||||||

| Perf Hebdo | 1 923,2 | +0,1% | Active Dollar Portfolio weekly performance | +1,6% | ||||||

| since 20/5/17 | 1 639,9 | +17,4% | Active Dollar Portfolio perf. since 20/5/16 | +21,6% | ||||||

| Relative performance since 20/5/16 | +4,2% | |||||||||

The Active Dollar portfolio performed very well this week: + 1.6%.

This performance is mainly due to our overweight in healthcare sectors, particularly biotechnology (XBI: + 12.2%), which reacts strongly to rumours of a more favourable than expected Trump decree. In the same time XHS (US healthcare services: + 3.1%) and IHI (US medical equipment: + 2.0%) were large contributors to the week's performance.

The Growth theme was also positive, with + 2.0% for our Russell 2000 Growth ETF (IWO).

Emerging market themes were less helpful and adversely impacted by the continued fall in commodity prices. Chile (ECH) fell 2.9% and Thailand (THD) lost 1.4%. Our defensive positions gold (IAU) and bonds (EBND) remained neutral over the week.