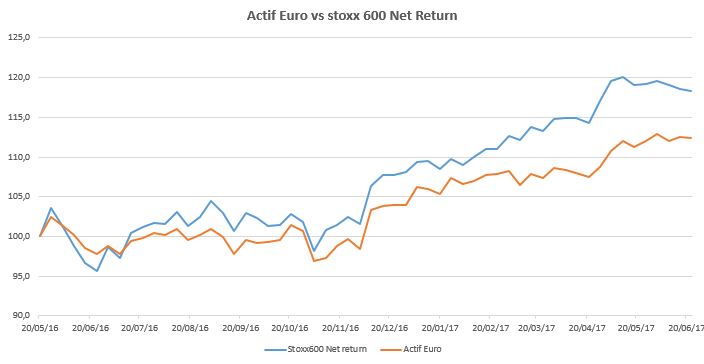

| Performance since 20/05/16 | +12,4% |

| Weekly performance | -0,1% |

Active Euro portfolio analysis

| Ticker | ETF | Issuer | Curr. | nb | entry date | entry price | current price | var. | weekly var. | valo € |

| MDA | Stoxx 600 Media | Lyxor | € | 300 | 18/04/17 | 34,08 | 34,57 | 1,4% | -0,5% | 10 371 |

| HLT | Stoxx 600 Healthcare | Lyxor | € | 120 | 27/02/17 | 84,70 | 91,65 | 8,2% | 2,4% | 10 998 |

| TRV | Stoxx 600 Travel & Leisure | Lyxor | € | 350 | 13/02/17 | 26,70 | 29,68 | 11,2% | -0,6% | 10 388 |

| CNB | CBDFI | Lyxor | € | 80 | 27/02/17 | 134,10 | 134,45 | 0,3% | 0,2% | 10 756 |

| GRE | MSCI Athex Large Cap | Lyxor | € | 12 000 | 02/05/17 | 0,92 | 1,04 | 13,0% | 1,5% | 12 480 |

| FOO | Stoxx 600 Food & Beverage | Lyxor | € | 150 | 06/06/17 | 75,63 | 74,47 | -1,5% | -1,2% | 11 171 |

| JPN | Topix | Lyxor | € | 90 | 20/05/16 | 106,42 | 125,67 | 18,1% | 0,4% | 11 310 |

| TEL | Stoxx 600 Telecom | Lyxor | € | 300 | 20/03/17 | 38,31 | 38,61 | 0,8% | -1,0% | 11 583 |

| MAL | Malaisie | Lyxor | € | 700 | 24/04/17 | 14,39 | 14,41 | 0,1% | -1,1% | 10 087 |

| UTI | Stoxx600 Utilities | Lyxor | € | 300 | 23/03/17 | 36,54 | 40,18 | 10,0% | -1,0% | 12 054 |

| cash | 1 212 | |||||||||

| Total | Stoxx 600 NR | 784,23 | 112 410 | |||||||

| Weekly perf | 786,03 | -0,2% | Active Euro Portfolio weekly perf. | -0,1% | ||||||

| since 20/5 | 663,04 | +18,3% | Active Euro portfolio perf. since 20/5/16 | +12,4% | ||||||

| Relative performance since 20/5/16 | -5,9% | |||||||||

The Active Euro portfolio ended the week almost stable and broadly in line with the Stoxx600.

The two best performances were the health sector (HLT), which reacted positively on both sides of the Atlantic to the rumour of a Trump decree that was more favourable than expected for the pharmaceutical industry.

Most other ETFs finished the week with limited variations, either negative or positive. Telecom Europe (TEL : -1.0%) continued to fall since the beginning of June after a good rebound in May. TEL is expect to rebound on key support lines that will likely drive the trend forward.