An african ETF in our Watchlist – 30/04/2018

An african ETF in our Watchlist – 30/04/2018

…is expected to reach 4.1% in 2018, supported by exports in a context of strong global demand, but for the moment it is a “jobless growth” due to the lack of investment in…

Cet article est réservé aux abonnés...

Bullish / Bearish Alerts – 29/04/2018

Bullish / Bearish Alerts – 29/04/2018

Bullish / Bearish indices alerts of the week…

Cet article est réservé aux abonnés...

Our Asset Allocation strategy: 29/04/2018

Our Asset Allocation strategy: 29/04/2018

Our Crash indicator is maintained this week under 40/100, 37.7 / 100. At this level, our Asset Allocation Robot does not…

Cet article est réservé aux abonnés...

An Asian ETF in our Watchlist – 27/04/2018

An Asian ETF in our Watchlist – 27/04/2018

…remain solid, with inflation prospects revised up (+ 0.9% in December) due to full employment and rising raw materials. Moreover valuations are reasonable at around 16x earnings at…

Cet article est réservé aux abonnés...

A US ETF in our Watchlist – 26/04/2018

A US ETF in our Watchlist – 26/04/2018

…the return of inflation due to tax cuts and the rise in oil, and a possible trade war with China that would challenge global growth. The US economy appears to…

Cet article est réservé aux abonnés...

An african ETF in our Watchlist – 30/04/2018

An african ETF in our Watchlist – 30/04/2018

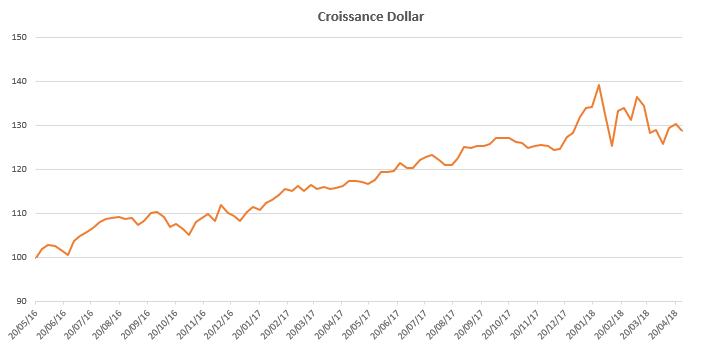

This week was fairly stable for the equity markets, with a stable S & P500 and a Nasdaq100, which fell slightly by 0.2% over the period, while in Europe the Stoxx600NR recorded an increase of 0.93%, and a CAC40 rising by 1.3%, driven by good corporate results and the rise of the dollar to 1.21.