Portfolios

24

Juin

2017

24

Juin

2017

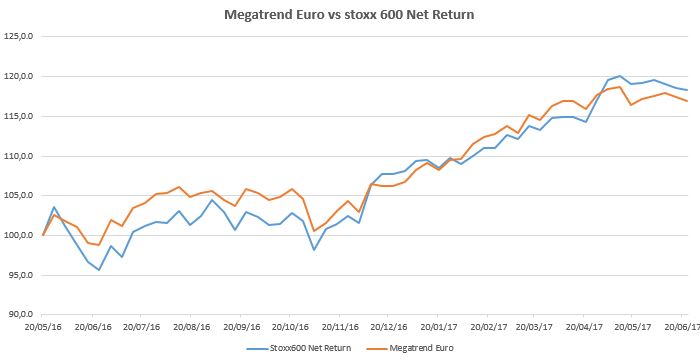

Megatrend Euro Portfolio – 23/06/17

23

Juin

2017

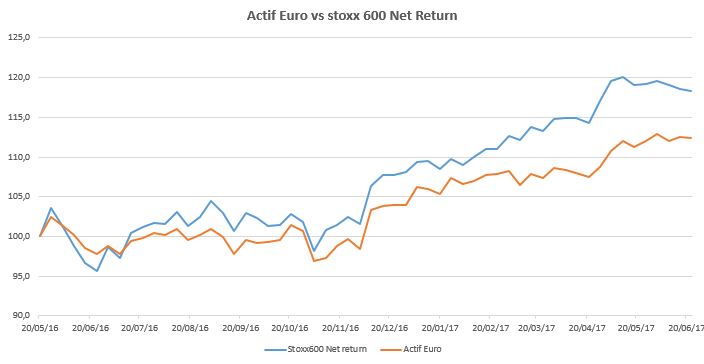

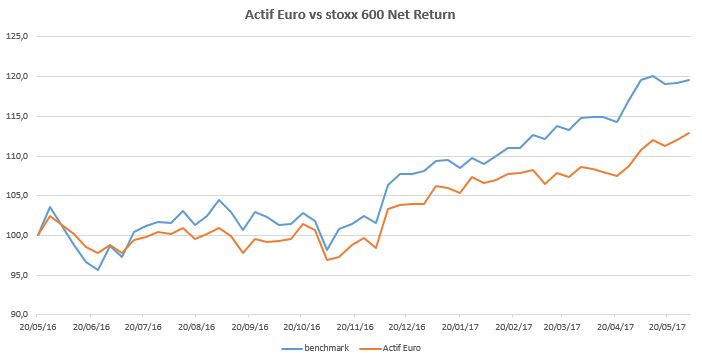

Active Euro Portfolio – 23/06/17

23

Juin

2017

Canada : Moving forward? (EWC) – 23/06/17

22

Juin

2017

China Small Caps : Rise in sight? (HAO) – 22/06/17

20

Juin

2017

Global Macro Portfolio : an ETF out – 20/06/17

17

Juin

2017

Our market analysis : 17/06/2017

10

Juin

2017

Our market analysis : 10/06/2017

02

Juin

2017

We integrate the iShares MSCI Canada ETF (EWC) into our Watchlist. This index is broad and well diversified, including 94 companies, and is composed of big companies mainly focused on the financial sector (42% of capitalisation), energy (23%) and mines (11%), the remaining 24% for all other industrial sectors and services.