Portfolios

Megatrend Euro Portfolio – 30/03/2018

Active Euro Portfolio – 30/03/2018

Our Market Analysis: 30/03/2018

A European sector in our ETF Watchlist – 30/03/2018

A European sector in our ETF Watchlist – 30/03/2018

…sector is recovering its defensive role, while the theme of interest rates and inflation seems to have taken a back seat for the moment. In addition, the restructuring of…

A european index in our Watchlist – 28/03/2018

A european index in our Watchlist – 28/03/2018

…export companies are in the crosshairs of the US administration while the huge profits made in China by the automotive industry and equipment manufacturers seem…

Trading ideas : an arbitrage – 28/03/2018

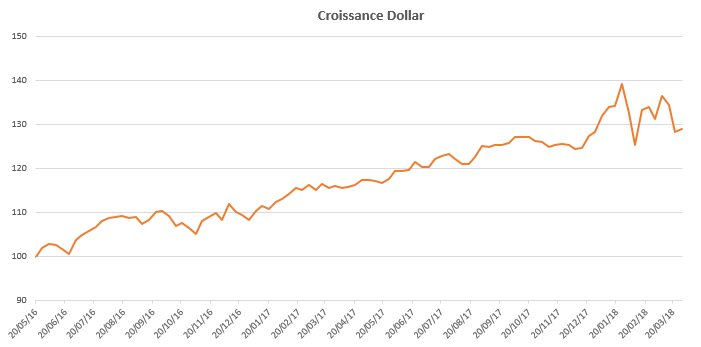

Arbitrage in our Dollar Growth Portfolio – 28/03/2018

Arbitrage in our Dollar Growth Portfolio – 28/03/2018

We exit the Proshares NOBL ETF (Dividend Aristocrats US) from our Dollar Growth portfolio following the absolute and relative technical…

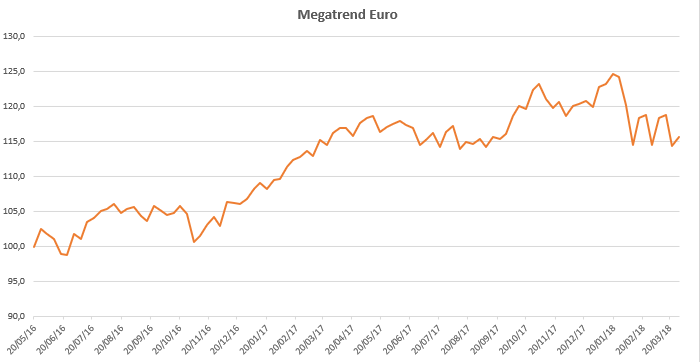

Two exits and one entry in our Megatrend Euro portfolio – 28/03/2018

Two exits and one entry in our Megatrend Euro portfolio – 28/03/2018

Two exits and one entry into our Megatrend Euro portfolio, which allows to set up 10% cash…

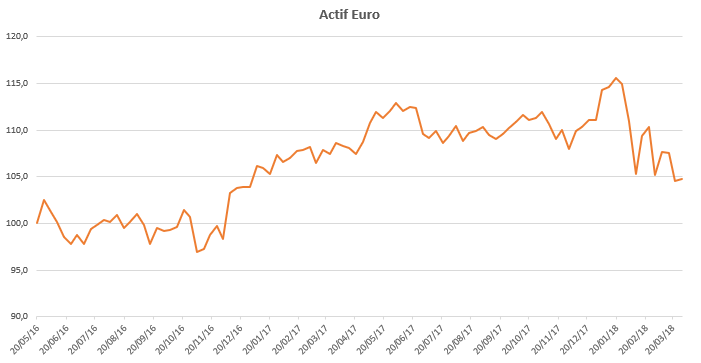

An ETF comes out of our Active Euro Portfolio – 28/03/2018

An ETF comes out of our Active Euro Portfolio – 28/03/2018

An ETF out of our Euro Assets portfolio, setting up a cash line in the face of deteriorating markets…

This week marks the return to a phase of hesitation after the sharp decline in indices last week in the United States and Europe.

This week ends with a rise in indices, 2% for the S & P500 and 1.4% for the Stoxx600NR, knowing that the outperformance of the US index has occurred after European closing.