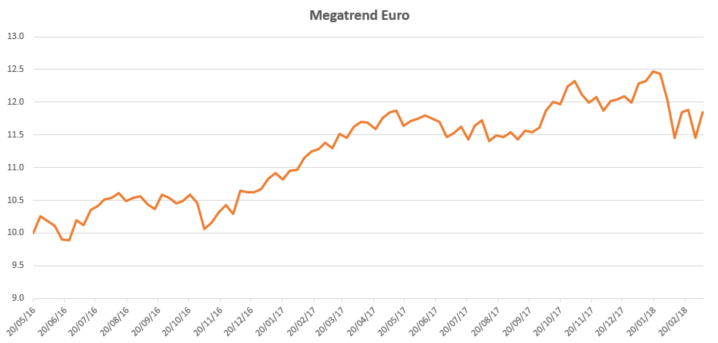

A European sector in our ETF Watchlist – 15/03/2018

A European sector in our ETF Watchlist – 15/03/2018

…forms a credible rebound which is due to lower concerns on rates and inflation, but also the consolidation movements that drive the sector in Germany…

Cet article est réservé aux abonnés...

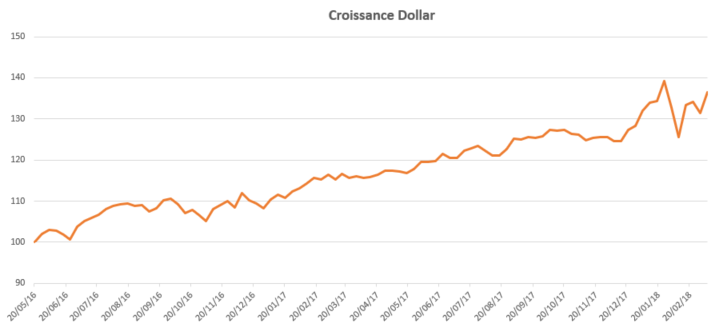

A US sector in our ETF Watchlist – 14/03/2018

A US sector in our ETF Watchlist – 14/03/2018

…The index is sensitive to D.Trump’s policy, both for tax cuts but also for fears about global trade to which the sector is highly exposed…

Cet article est réservé aux abonnés...

A Europe sector in our ETF Watchlist – 13/03/2018

A Europe sector in our ETF Watchlist – 13/03/2018

…which fared better than the major indices during the correction phase coming from the United States…

Cet article est réservé aux abonnés...

A European sector in our ETF Watchlist – 12/03/2018

A European sector in our ETF Watchlist – 12/03/2018

…spread shows a particularly bullish relative behavior both in the long term and in the short term. The recent rebound is very strong, after…

Cet article est réservé aux abonnés...

An arbitrage in our Active Euro Portfolio – 12/03/2018

An arbitrage in our Active Euro Portfolio – 12/03/2018

An ETF enters into our Active Euro portfolio. We are using our cash line now that our crash indicator has returned below 40/100 …

Cet article est réservé aux abonnés...

Our Asset Allocation Strategy: 11/03/2018

Our Asset Allocation Strategy: 11/03/2018

Our Krach indicator has dropped significantly, to 36/100 now.

This level of indicator leads our Robot to remove the cash portion of its Asset Allocation…

Cet article est réservé aux abonnés...

A European sector in our ETF Watchlist – 15/03/2018

A European sector in our ETF Watchlist – 15/03/2018