Amundi Euro Corporate Bonds UCITS - CC4 - 09/06/2017

Short term strategy : Positive

Long term strategy : Positive

ETF Characteristics

CC4 ETF (AMUNDI ETF Euro CORPORATE UCITS) seeks to replicate the Markit iBoxx EUR Liquid Corporates 75 Mid Top TCA index.

This Fund provides a broad exposure to approximately 75 corporate bonds selected on the basis of liquidity criteria and denominated in euro.

The top 10 holdings of the index represent less than 20% of the weighting and are mainly large international companies such as Vodafone, Deutsche Telecom, IBM or Verizon. There is a diversification in terms of sectors, with 57% of industrial and technological companies while the remaining 43% are financial companies. In terms of geographic allocation, this ETF benefits of allocations on all continents but focused on developed countries : US accounts for 23%, UK 16.6%, Netherlands 16%. Europe represents the biggest part of the allocation, but some Asian countries (Japan 1.4%), Central America (Mexico 2.1%) and Saudi Arabia (1.4%) are marginally represented.

Corporate bonds/Fixed income based ETFs represent a rather moderate risk during low inflation and low interest rate periods, and are much less sensitive to economic fluctuations than equities. While a given stock may lose a large part of its value for a disappointing quarter, a corporate bond become volatile only if some doubts arise on the corporate’s solvency, which may occure during severe economic crises (such as the financial crisis of 2008) or specific problems which may lead to the company bankruptcy (Kodak, Enron, General Motors etc …) which is rare when it came to big ships. High quality corporate bonds (as opposed to high yield bonds), as it is the case for CC4, often behave as a safe haven for investors when risk off mood and volatily came back on equity markets.

The macro environment remains so far supportive : Yields should remain at moderate levels in the coming months, while inflation remains low, given the level of commodities, and especially as oil prices remain under pressure. While the risk of correction due to profit-taking is on the rise on equity markets, CC4 could prove to be an attractive alternative and relatively lower risky vehicle. The quality of the companies that are part of the index is high, with 17% rated AA, 40% rated A, 42% rated BBB and 1% with a BB rating. Maturity of bonds is mainly between 2 and 10-year yields, with the main piece for 5-year bonds (37%).

ETF expenses are moderated at 0.16% and the Replication Method is synthetic. The liquidity of the fund is approximately €400 M. CC4 price rose by almost 4% in 2016 and 0.4% in 2017, while variations are usually much less pronounced than in the equity markets.

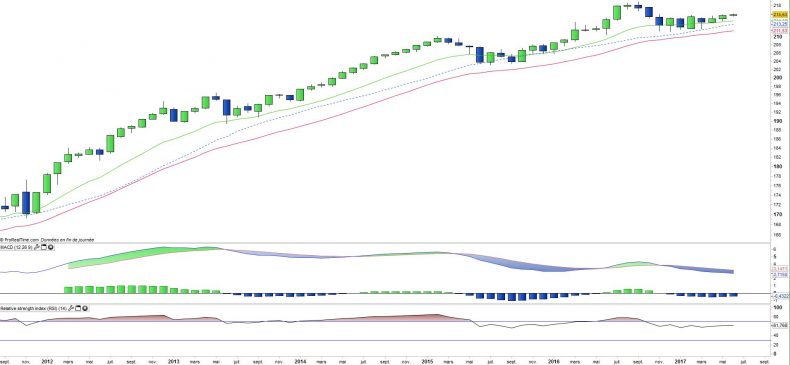

Monthly Charts

The monthly chart shows a rising trend firmly established and which has never been challenged since 2009. In 5 years, CC4 recorded few limited corrections (of c.5% maximum) while prices failed to reach the M26exp.Price variations are relatively moderate, and rising wave usually deliver around 10% increase, in 6/12 month. Volatility is therefore very limited on CC4, however this ETF benefits from a clear directional trend and looks fairly predictable.

The MACD is still on downward due to a correction which started last summer 2016 and is now over

Weekly Charts

Weekly analysis shows with more precision the current rebound following a long enough correction. The crossing of moving averages 13x26 is confirmed, while the oscillators were also headed north. The MACD crossed the line of zero, pointing to a new phase of expansion. This new phase of upward swing should lead CC4 to the €232 level within 6/12 months.

This corresponds to an increase of about 8%.

Investment Objective

To replicate the performance of the Markit iBoxx Euro Liquid Corporates Top 75 Mid TCA Index

To benefit from an exposure to 75 most liquid euro corporate IG bonds

Characteristics

| Inception Date | 22/06/2009 |

| Ongoing Charges | 0,16% |

| Issuer | Amundi |

| Benchmark | Markit iBox Euro Liquid Corporates Top 75 Mid TCA Index |

| code/ticker | CC4 |

| ISIN | FR0010754119 |

| UCITS | Yes |

| EU-SD Status | Out of scope |

| Currency | € |

| Listing Market | Euronext |

| Assets Under Management | 402 M€ |

| Method of replication | Indirect (swap based) |

| PEA (France) | No |

| SRD (France) | No |

| Dividend | Yes |

| Currency Risk | No |

| Number of Holdings | 75 |

| Risk | 3/5 |

Country Breakdown

| USA | 23% |

| United Kingdom | 17% |

| Netherlands | 16% |

| Italy | 9% |

| Germany | 8% |

| Switzerland | 4% |

| France | 4% |

| Luxembourg | 2% |

| Sweden | 2% |

| Mexico | 2% |

| Denmark | 2% |

| Others | 11% |

Breakdown by rating

| AA | 17% |

| A | 40% |

| BBB | 42% |

| BB | 1% |

Top ten Holdings

| CS 1.375% 11/19 | 2% |

| VZ 2.375% 2/22 | 2% |

| TEVA 0.375% 07/20 | 2% |

| VOD 2.20% 08/26 | 2% |

| DT 0.625% 03/04/23 | 2% |

| ACAFP 2.625% 3/27 | 2% |

| HSBC 1.5% 15/03/22 | 2% |

| IBM 1.875% 11/20 | 2% |

| GSK 0.625% 12/19 | 2% |

| BSY 1.5% 9/21 | 2% |