Lyxor ETF Stoxx600 construction & materials (CST) - 21/02/19

Short Term strategy: Positive (70%) / Trend +

Long Term strategy: Positive (60%) / Trend +

Characteristics of the ETF

The ETF Lyxor CST (Materials & Construction Europe) created in 08/2006 is listed in Euro on Euronext and seeks to replicate the Stoxx600 Net Return Construction & Materials index composed of 22 European stocks including 38% outside the Euro zone, which implies a risk mainly related to the EURO / SEK and EURO / CHF parity.

The fees of this ETF are 0.3% and the AUM of approximately € 12m. Replication is indirect (via Swap) and there is a dividend capitalization policy.

Alternative ETFs: EXV8 (iShares in Euro)

Index & components

This index includes 22 stocks, specialized in the construction market through the cement and aggregates manufacturers such as Lafarge, CRH or Heidelberg, but also manufacturers specializing in building materials such as Saint-Gobain, as well as construction companies that can at the same time being engineering firms and dealers as Vinci, Ferrovial or Eiffage.

It should be noted that the first 4 stocks (Vinci, CRH, Saint Gobain and LafargeHolcim) alone represent almost half of the capitalization of the index (47%), which is focused on European companies but whose activities are very international and for certain holdings (as CRH) includes a strong presence in the United States, while others have exposure in the emerging markets (ex: LafargeHolcim).

The construction sector was particularly affected by the financial crisis and then the Eurozone crisis between 2008 and 2012, because it is an activity that depends mainly on financing, whether for infrastructure (public authorities) or for the residential sector. The construction index seems to be gradually picking up in Europe, with the increase in building permits but still waiting for a frank recovery in Europe while housing construction needs are also very significant.

The outlook for the sector is now more favorable, with interest rates that remain low and stable and large-scale domestic projects like Greater Paris which will represent more $ 30 billion in infrastructure investment, while in the US Donald Trump seems to have not given up on its infrastructure program, including its border wall with Mexico. Most of the growth in the sector is expected to be in the major regions of the world outside Europe, with interesting prospects in India and Africa in the medium term.

China is seen as a separate market for cement-monopolized by highly competitive local price players-and hardly addressed by Western multinationals.

Latest developments

After 6 years of positive performance since 2012 (end of the crisis), CST fell 16.7% in 2018 against -10.7% for the Stoxx600 which reflected the fear of world recession under the background of US-China trade war and restriction of liquidity in the USA. However, the negotiations on the way between China and the US and the FED's turnaround in January, coupled with reassuring corporate results have reversed market prices and the index has rebounded 12.5% since the beginning of the year, wiping out most of the last year decline.

The evolution of oil prices remains to be monitored, as the cement industry is one of the biggest consumers of fossil energy. A prolonged rise in crude prices, which are currently rising rapidly to $ 60, would penalize margins of cement and construction companies. The bullish reversal of Vinci (19% of the index) and CRH (9.8%), explain partly the better performance of the index in recent weeks.

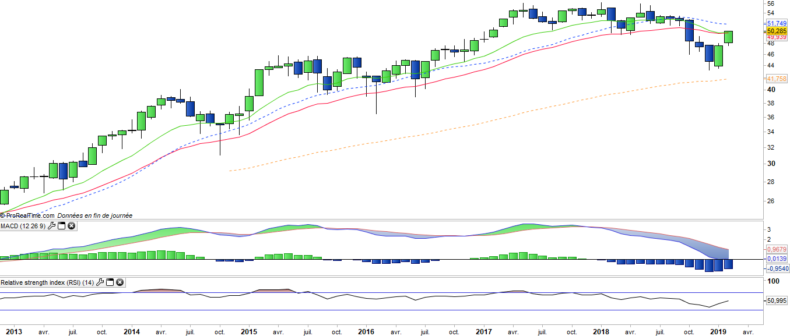

Monthly data

The monthly chart shows a bullish reaction of an unexpected magnitude, which erases the decline of the Q418. Prices have returned above the EMAs13 & 26, which de facto prevents their downward crossing. Oscillators have begun to turn upwards, and confirm the recovery of the index in its long-term uptrend. Confirmation at the end of the month of prices above moving averages is however necessary to validate this recovery.

Weekly data

On the weekly chart, we clearly visualize a "V bottom" pattern which directly joined the EMA100 without any pull-back. It is a rather rare but very strong configuration, which puts back the index in its mid-term uptrend. However, the index must confirm that the EMA100 will be exceeded in the coming days to validate its recovery.

Theme

CST is a UCITS ETF, listed in EUR, which seeks to replicate the STOXX Europe 600 Construction & Materials (Net Return) EUR index (22 companies)

Characteristics

| Inception date | 18/08/2006 |

| Expense ratio | 0,30% |

| Issuer | Lyxor |

| Benchmark | Stoxx 600 Const. & Materials |

| Ticker | CST |

| ISIN | LU1834983808 |

| UCITS | Yes |

| EU-SD Status | Out of scope |

| Currency | € |

| Exchange | Euronext Paris |

| Assets Under Management | 12 M€ |

| Dividend | Capitalization |

| PEA (France) | Yes |

| SRD (France) | Yes |

| Number of Holdings | 22 |

| Risk | 4/5 |

Country Breakdown

| France | 34% |

| Switzerland | 20% |

| Ireland | 12% |

| Sweden | 12% |

| Spain | 9% |

| Germany | 5% |

| Others | 8% |

Sector Breakdown

| Industrials | 70% |

| Materials | 30% |

Top Ten Holdings

| Vinci | 19% |

| CRH | 10% |

| LafargeHolcim | 9% |

| Saint-Gobain | 8% |

| Assa Abloy | 8% |

| Sika | 6% |

| Geberit | 5% |

| ACS | 4% |

| Ferrovial | 4% |

| HedelbergCement | 4% |