Lyxor Stoxx 600 Financial Services (FIN) - 27/02/19

Short Term strategy: Positive (60%) / Trend +

Long Term strategy: Positive (60%) / Trend +

Characteristics of the ETF

The ETF Lyxor FIN (European Financial Services) created in 08/2006 is listed in Euro on Euronext and seeks to replicate the STOXX600 Financial Services Europe index composed of 27 European securities of which approximately 30% are English, which implies a risk related to the Euro - Pound Sterling parity which can be quite volatile in the Brexit period.

The costs of this ETF are 0.3% and the AUM approximately 20M €. Replication is indirect (via Swap) and there is a dividend capitalization policy.

Alternative ETFs: EXH2 (iShares in Euro), EUFN (iShares in USD).

Latest developments

After an increase of + 20.2% in 2017 (against + 10.6% for the Stoxx600), the index strongly consolidated in 2018 in the wake of the markets and posted a decline of 11.3%, against - 10.7% for the stoxx600 NR. Marketplaces that represent about 30% of the capitalization are indeed quite sensitive to market fluctuations, since they depend in part on volumes, and market participants using their indices, the 15% fall in the index in the last quarter of 2018 is therefore not a surprise as well as the rebound of 9.1% since the beginning of the year.

In addition, the uncertainties surrounding Brexit remain total at 1 month of the deadline (March 29), while 30% of the index is directly affected, and the marketplace industry as a whole could be impacted by a "hard Brexit" while the situation remains very uncertain especially at the level of clearing houses.

The index could strengthen significantly if a postponement or a last-minute solution was found before the deadline, as was the case in recent European crises.

Index & components

ETF FIN is composed of financial services companies, including major European marketplaces, as well as listed investment companies or funds whose main activity is to manage investments in listed or unlisted companies (Private Equity) at different stages of their development. In addition, the ETF FIN includes holding companies such as Investor (12% of capitalization), which has holdings in its portfolio of large Nordic listed companies such as Atlas Copco, Alfa Laval and Enskilda; this is also the case for the Brussels Lambert Group (French and Belgian holdings) or Exor (Italy).

The holding / private equity sector takes advantage of the low interest rate environment, which makes it possible to benefit from a high level of financial leverage. Companies are considered as financial companies. In addition, the sector benefits from innovation and new paradigms that tend to multiply with the "uberisation" of many sectors, it is therefore a sector of the future that is essential for start-ups to finance their development. We consider it an investment that has its place in a long-term strategy.

However, this theme is sensitive to long-term rates and could suffer from a rapid rise in the US or Europe, which is not our central scenario given the structural deflationary pressures (technology, increase in the labor force, emerging markets, lower prices of raw materials).

The index also includes major marketplaces such as LSE (11%) and Deutsche Boerse (14%), which are true software companies, producing indices and derivatives used by market participants. These companies have an increasingly high-tech profile, with high margin profiles. This index can, however, record significant episodes of volatility during periods when the financial system is involved, such as 2008, 2011 (sovereign debt crisis in Europe) or more recently in early 2016 with the episode of fears over high yield funds following the sharp drop in oil prices.

Weekly data

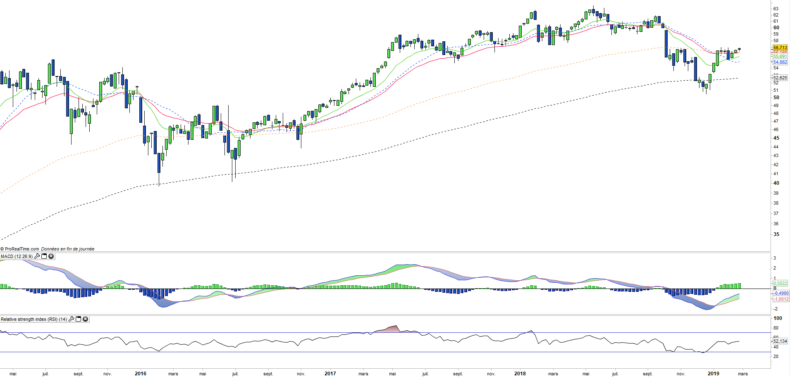

The weekly chart shows a gradual recovery of the uptrend. The prices have just exceeded the short term moving averages (EMAs13 and 26) as well as the EMA100, which is a key step. In addition, a "Reverse Head & Shoulders" pattern pleads for the continuation of the current bullish movement. A confirmation step that consists of a crossing of the EMAs13 & 26 or / and the passage of the zero line by the MACD, would definitely validate the bullish reversal.

Daily data

On the daily chart, we can observe the short-term turnaround that stumbles for the third time in a row on the EMA200, weakening the resistance. The MACD seems poised to reverse upward, following the other oscillators. The confirmed overtaking of the EMA200 would be a positive signal for the continuation of the movement towards the 60 € level.

Theme

FIN is a UCITS listed in EUR, which seeks to replicate the Stoxx Europe 600 Financial Services Net Return index (27 companies)

Characteristics

| Inception date | 18/08/2006 |

| Expense ratio | 0,30% |

| Issuer | Lyxor |

| Benchmark | Stoxx Europe 600 Financial Services |

| ISIN | LU1834984798 |

| Ticker | FIN |

| Currency | € |

| Exchange | Euronext Paris |

| Assets Under Management | 20 M€ |

| Replication Method | Indirect (via a swap) |

| Dividend | Capitalization |

| PEA (France) | Yes |

| SRD (France) | Yes |

| Number of Holdings | 27 |

| Risk | 4/5 |

Country Breakdown

| United Kingdom | 30% |

| Sweden | 18% |

| Germany | 17% |

| Switzerland | 11% |

| Belgium | 8% |

| France | 6% |

| Italy | 4% |

| Others | 5% |

Sector Breakdown

| Financials | 100% |

Top Ten Holdings

| Deutsche Boerse | 14% |

| Investor AB | 12% |

| London Stock Exchange | 11% |

| Partners Group Holding | 9% |

| Standard Life | 5% |

| Groupe Bruxelles Lambert | 5% |

| Exor NV | 4% |

| Hargreaves Landsdown | 4% |

| Investment AB | 3% |

| Schroders | 2% |