Lyxor ETF stoxx 600 Healthcare (HLT) - 14/11/2017

Short term strategy : Negative (0%) / Trend -

Long term strategy : Negative (30%) / Trend -

Characteristics of the ETF

The Lyxor HLT ETF (UCITS) was created in 08/2006, is listed in Euro on Euronext and tracks the Stoxx600 Healthcare Europe index, which is composed of the 40 largest European stocks in the sector.

It should be noted that non-euro area stocks represent 73% of the index, which is not harmless in view of the potentially significant fluctuations of the £ and the CHF in relation to the Euro.

The cost of this ETF is 0.3% in the average of our selection and the AUM is approximately € 234m. The replication method is indirect (via a swap) and dividends are capitalized.

Alternative ETF: SYH ( BNP THEAM Euro), CH5 ( Amundi Euro).

Index & components

The two major swiss pharmaceutical stocks (Novartis and Roche) account for approximately one-third of the capitalization. The five largest holdings, beside the two Swiss stocks: Glaxosmithkline, Novo Nordisk and Sanofi, represent together 58% of the index. The market capitalization are also huge: more than CHF 200bn for Roche and Novartis, while the next three are around € 100bn; this is a very important factor of inertia and this offset the relative narrowness of the index.

We also note that the overwhelming majority of the companies that compose the ETF are pharmaceuticals, with the exception of Essilor (Ophthalmic Glasses) and Fresenius (Care Facility), so we consider HLT essentially as an ETF pharma Europe.

The pharmaceutical index is relatively non-volatile, due to the weight of its constituents as well as to a proven defensive profile, which is explained by the fact that the discovery of molecules and their distribution is not linked to economic cycles, while in developed countries drugs are reimbursed by mutuals or by the State.

Moreover, health is a growth sector whose main drivers are innovation and increasing markets linked to pathologies of the developed world (aging and diabetes) as well as new viruses and resistance to antibiotics. Emerging markets are also an important outlet for the European pharmaceutical industry.

The sector face the increasing maturity of molecule portfolios, price pressures in certain areas (eg diabetes) and government budgetary efforts to reduce healthcare costs. The solution lies in the innovation and partnerships / acquisitions of biotech companies that are expected to accelerate in the coming months - due to valuations that become attractive again - with new molecules with high potential to boost existing portfolios.

Major mergers with fiscal incentives seem to have been buried for a long time since the failure of the AstraZeneca / Pfizer operation, but the consolidation of the sector (2015/2016) was also caused by US regulatory uncertainties during the US elections about lowering prices of drugs. The multiple failures of the Trump administration to reform the Obamacare adds a significant level of uncertainty on drug reimbursements, which affects the visibility of the sector.

Latest developments

The ETF HLT has risen by only 3.7% since the beginning of the year, significantly less than the Stoxx600 (9.5%), but nevertheless significantly improved compared to 2016 (-9.7% against + 1.7% for the Stoxx600).

The year 2016 was marked by the fall of two heavyweights: Novo Nordisk (-36% after a warning due to the pressurized diabetes market in the US) and Roche (-14% due to disappointments on its pipeline). In 2017, it is the rebound of Novo Nordisk (+ 24% since the beginning of the year), and Novartis (+ 15.4%) which supports the index while Sanofi has just consolidated heavily after a very mixed Q3 and increase by only 2.6% YTD, as well as Roche which, following disappointing results, has fallen by 1.85% since the beginning of the year.

Increased competition in the various pharmaceutical markets leading to price pressure and the arrival of generics, while the moderate new molecules flow to the market eventually weigh on the operational performance of many big pharmas. Reimbursement problems, especially in the US, are also becoming an issue.

Despite valuations that become overall attractive (PER at 18x 2018), the sector seems increasingly risky and offers less long-term visibility.

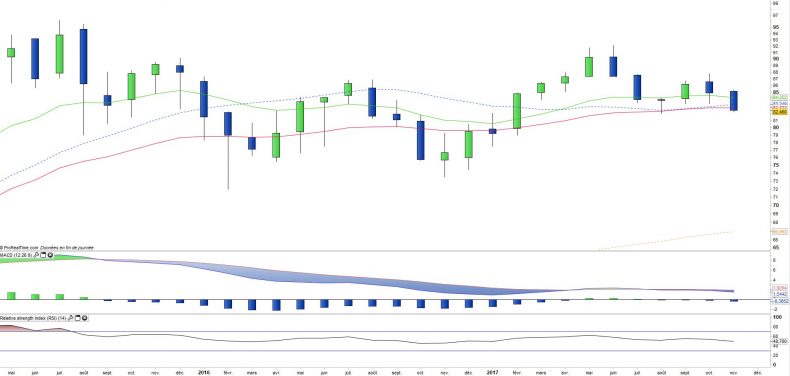

Monthly data

The monthly chart shows a positive long-term trend that is running out of steam and appears increasingly threatened. A new bullish attempt failed again in recent weeks, which should strengthen the selling flow. Oscillators reverse down (MACD and RSI) and prices cross the M26E down, which if confirmed could lead to a negative crossover of the 13Ex26E moving averages.

A general flattening of the chart should lead at best to a soft stability over the coming months, but a bearish start is not excluded.

Weekly data

On the weekly chart, we can see that prices are going down some significant levels. First, a 13Ex26E moving averages crossover has occurred, but at the same time prices crossed the EMA100 downward, while the MACD has just crossed the zero line.

More significantly, it remains the EMA200 located 5% below at around 78 € which constitutes the major support before the beginning of a downward trend.

ETF Objective

HLT is a UCITS compliant ETF that seeks to replicate the benchmark index Stoxx Europe 600 Healthcare Net Return.

The Stoxx Europe 600 Healthcare index is constituted with the largest stocks of the healthcare industry in Europe (46 companies).

Characteristics

| Inception date | 18/08/2006 |

| Expense ratio | 0,30% |

| Issuer | Lyxor |

| Benchmark | Stoxx 600 Healthcare |

| Replication method | Indirect (swap) |

| Ticker | HLT |

| ISIN | FR0010344879 |

| UCITS | Yes |

| EU-SD status | Out of scope |

| Currency | € |

| Exchange | Euronext Paris |

| Assets Under Management | 233 M€ |

| Dividend | Capitalization |

| PEA (France) | Yes |

| SRD (France) | Yes |

| Number of Holdings | 46 |

| Risk | 3/5 |

Country Breakdown

| Switzerland | 37% |

| United Kingdom | 18% |

| France | 13% |

| Danemark | 13% |

| Germany | 7% |

| Netherlands | 4% |

| USA | 4% |

| Others | 4% |

Sector Breakdown

| Health Care | 95% |

| Indutrials | 3% |

| Materials | 2% |

Top Ten Holdings

| Novartis | 19% |

| Roche | 14% |

| Sanofi | 10% |

| Glaxosmithkline | 8% |

| Novo Nordisk | 8% |

| Astrazeneca | 7% |

| Shire | 4% |

| Koninklijke | 3% |

| Fresenius | 3% |

| Essilor | 2% |