Lyxor ETF stoxx 600 Healthcare (HLT) - 31/01/2018

Short Term strategy : Neutral (50%) / Trend +

Long Term strategy : Positive (55%) / Trend =

Characteristics of the ETF

The Lyxor HLT ETF (UCITS), created in 08/2006 is listed in Euro on Euronext and reproduces the Stoxx600 Healthcare Europe index, which is made up of the 47 main European stocks in the sector.

It should be noted that non-eurozone stocks represent 68% of the index which is not insignificant given the potentially significant fluctuations of the £ and CHF against the Euro.

The fees of this ETF are 0.3% in the average of our selection and the AUM is approximately € 222m. The replication method is indirect (via a swap) and dividends are capitalized. This ETF is eligible for PEA (France)

Alternative ETFs: SYH (BNP THEAM Euro), CH5 (Amundi Euro).

Index & components

The two major Swiss pharmaceutical stocks (Novartis and Roche) account for around 30% of the capitalization.

The five largest stocks are in addition to the two Swiss stocks: Glaxosmithkline, Novo Nordisk and Sanofi, which account for 54% of the index.

Market capitalizations are also enormous: more than CHF 200 billion for Roche and Novartis, while the following 3 are around € 100 billion; this is a very important factor of inertia and offsets the relative narrowness of the index.

We also note that the overwhelming majority of companies that make up the ETF are pharmaceuticals, with the exception of Essilor (Ophthalmic Lenses) and Fresenius (Healthcare Facility), so we view HLT essentially as an ETF pharma Europe.

The pharmaceutical index is not very volatile, because of the weight of its constituents as well as because of a proven defensive profile, which is explained by the fact that the discovery of molecules and their distribution is little related to economic cycles, while that in developed countries medicines are reimbursed by mutuals or by the State. In addition, health is a growth sector whose main drivers are innovation and growing markets linked to the pathologies of the developed world (aging and diabetes), as well as new viruses and antibiotic resistance.

Emerging markets are an important market for the European pharmaceutical industry.

The sector is facing the increasing maturity of molecule portfolios, price pressure in some areas (eg diabetes) and state budget efforts to reduce health costs. The solution lies in the innovation and partnerships / buyouts of biotech companies that should accelerate in the coming months-because valuations have become attractive again-with the key to new molecules with high potential to boost existing portfolios.

Large tax-motivated mergers seem to have long been buried since the failure of the AstraZeneca / Pfizer operation, but the consolidation of the sector was also triggered by US regulatory uncertainties during the campaign about lowering drug prices. The multiple failures of the Trump administration to reform the Obamacare adds a significant level of uncertainty on drug reimbursements, which affects the visibility of the sector.

Latest developments

The ETF HLT rose by 4.8% in 2017, well below the Stoxx600NR (10.6%) and has so far posted a performance of + 1.3% since the beginning of the year.

The performance of the various components is very heterogeneous with a very strong performance of Novo Nordisk (+ 54% in 2017) which continues in 2018 (+ 7.2%) and to a lesser degree for Novartis (+ 15% in 2017 and +4 % since the beginning of the year), while Roche has fallen by almost 6% since the beginning of the year after a moderate increase in 2017 (+ 6%). Sanofi is also under heavy pressure (-3.5% in 2017 and + 0.6% since the beginning of the year) as well as Glaxo (-10% in 2017 and + 1% in 2018).

However, the external growth operations seem to start again in 2018 with the acquisitions of Sanofi (Ablynx and bioverativ) for more than $ 15bn in January which could contribute to its "rerating" in the coming weeks as these operations are likely to consolidate the long-term pipeline.

In addition, pharmaceutical stocks are lagging behind the rest of the market, and unlike other defensive sectors (Utilities, Telecoms, Real Estate) are not very sensitive to interest rates, even if the sector offers a significant yield of c.3.5%. On the other hand, the decline of the US dollar is penalizing for the sector which realizes a significant part of its sales in the US currency.

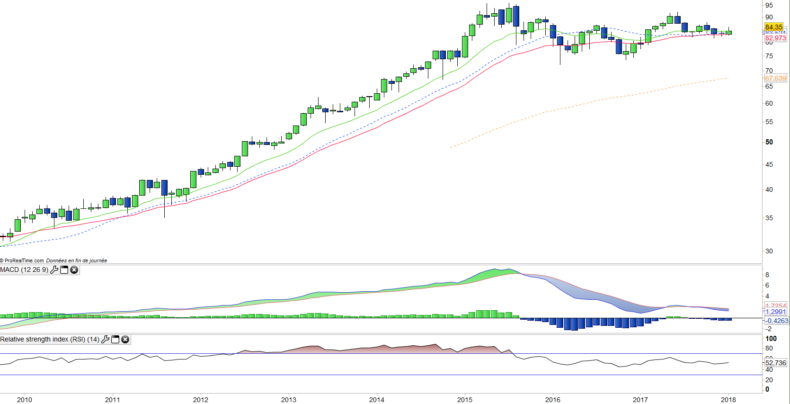

Monthly data

The monthly chart shows a bullish trend that is running out, but for the moment there is no sign of a downward reversal. Moving averages and technical oscillators evolve flat in a non-directional sequence. However, the vast majority of long-term signals remain well oriented, which predisposes the index to a bullish breakout rather than a bearish one. The January candlestick is encouraging but still insufficient to boost the uptrend.

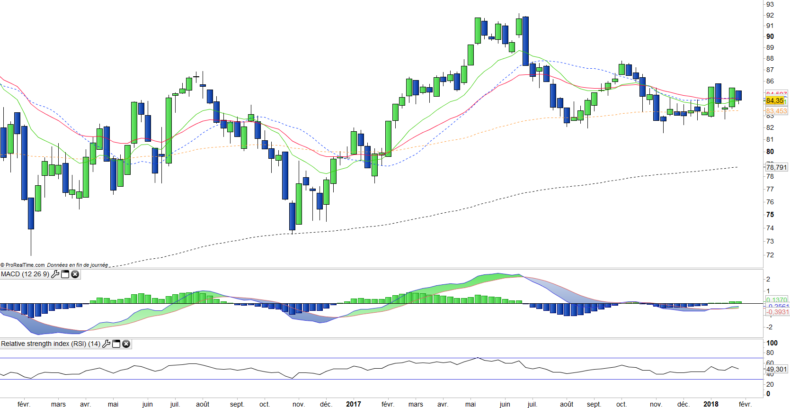

Weekly data

On the weekly chart, we can observe that the weekly EMA100 plays perfectly its role of support and that a bottom pattern is in formation. Prices must confirm that moving averages are exceeded, so that a bullish wave can occur and trigger positive signals on the oscillators. In case of bearish breakout of the EMA100, the trend would take a turn to bearish, therefore index is at a crossroads.

ETF Objective

HLT is a UCITS ETF which replicates the Stoxx Europe 600 Healthcare Net Return (47 companies).

Characteristics

| Inception date | 18/08/2006 |

| Expense ratio | 0,30% |

| Issuer | Lyxor |

| Benchmark | Stoxx 600 Healthcare |

| Replication Method | Indirect (swap) |

| Ticker | HLT |

| ISIN | FR0010344879 |

| UCITS | Yes |

| EU-SD Status | Out of Scope |

| Currency | € |

| Exchange | Euronext Paris |

| Assets Under Management | 222 M€ |

| Dividend | Capitalization |

| PEA (France) | Yes |

| SRD (France) | Yes |

| Number of Holdings | 47 |

| Global Risk | 3/5 |

Country Breakdown

| Switzerland | 34% |

| United Kingdom | 16% |

| Germany | 14% |

| Danemark | 12% |

| France | 11% |

| Netherlands | 4% |

| USA | 3% |

| Others | 6% |

Sector Breakdown

| Health Care | 95% |

| Industrials | 3% |

| Materials | 2% |

Top Ten Holdings

| Novartis | 17% |

| Roche | 13% |

| Bayer | 8% |

| Sanofi | 8% |

| Novo Nordisk | 8% |

| Glaxosmithkline | 7% |

| Astrazeneca | 7% |

| Shire | 3% |

| Koninklijke | 3% |

| Fresenius | 3% |