Lyxor ETF Assurance - INS - 20/04/2018

Short Term strategy: Positive (90%) / Trend +

Long Term strategy: Positive (95%) / Trend =

Characteristics of the ETF

The Lyxor INS ETF (UCITS), created in 08/2006 is listed in Euro on Euronext and replicates the Stoxx 600 Europe Insurance NR index which is composed of the 33 main European insurance values. It should be noted that stocks outside the euro zone represent 47% of the index, which is not insignificant given the potentially significant fluctuations of the £ and CHF against the Euro.

The cost of this ETF is 0.3% and the AUM is approximately € 92m, against € 887m for BNK, which replicates the European banking sector. The replication method is indirect (via a swap) and the distribution method is capitalized.

Alternative ETFs: SYI (BNP Easy in Euro), EXH5 (iShares in Euro),

Latest developments

After a year of slight consolidation in 2016 (-2.5%) due to the fall in interest rates, INS resumed its upward path in 2017 (+ 11.2%), which strengthened with the recovery in growth European and equity markets.

In 2018, the sector is currently up 3.6%, compared to a 1% drop for the Stoxx600NR. The insurance sector is benefiting from relatively good market conditions, the economic recovery and the hope of improving rate curve. Moreover, the dividends proposed by the insurance sector are high, of around 5%, which is likely to support the sector while the associated risk remains moderate and that earnings growth should be sustained this year (+ 9%).

Arbitrage in favor of insurance companies versus Banks may be an explanation for the relative good behavior of the sector.

Index & components

The stocks in this index are mainly British (27%), German (24%), Swiss (17%) and French (11%).

The top 10 stocks of the index represent 72% of the weighting, among which we find giants like Allianz, Axa, Prudential or Zurich Insurance Group. About 53% of companies in the index are listed in Euro, the other part mainly in Pounds Sterling and Swiss Francs.

The insurance sector is largely influenced by the macroeconomic environment that directly conditions demand, except for the insurance-damage component, which depends on statistical and exogenous factors. More specifically, interest rates are the main factor of performance because they make insurance products (including life insurance) more or less attractive. They also largely determine profitability because insurers, as long-term savers, invest premiums primarily in bonds. In recent years, low interest rates imply a contraction in spreads that negatively impacts profits. However, only new premiums are invested at lower returns, and insurers can rely on higher rate levels from previous years that allow for some smoothing. When investment returns are falling, insurers clearly need to improve their bottom line and portfolio management becomes the engine of performance. The quest for return requires a gradual return to risky assets or alternative investments.

It also implies that geographic exposure has a strong impact on sales depending on the country's macroeconomic environment and also on the balance sheet because insurers tend to invest their assets in the same area as their liabilities.

The rise in the sector remains a bet on the rise in long-term interest rates, which seems well underway in the United Kingdom while the euro zone should follow thereafter, while the ECB is just starting to give the first signals of future normalization of its monetary policy, with a view to a gradual reflation of the European economy.

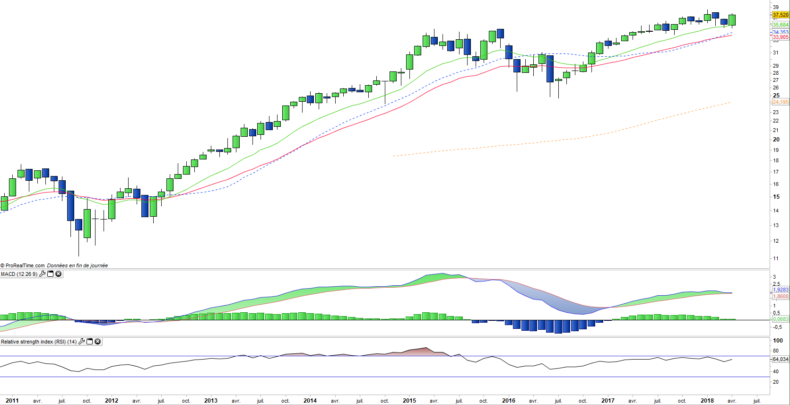

Monthly data

The monthly chart shows that the positive trend on INS is intact. The correction of the last two months has been stopped at the EMA13 level and a significant rebound is being built on the month of April. A large white candlestick appears and forms a bullish engulfing to be confirmed at the end of the month. This structure is likely to boost the rise for several months.

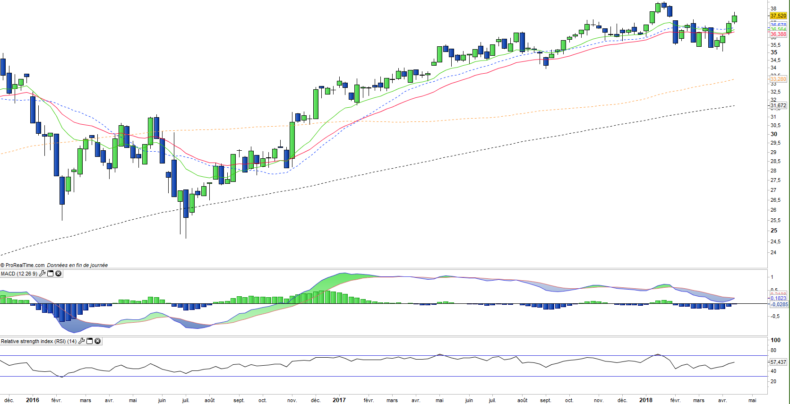

Weekly data

On the weekly chart, we can see that the February-March correction was weaker than for the other indices, while the rebound is more pronounced. The prices are already ironed over the EM13 and 26 weekly and the MACD is about to turn upward. Moving averages rebounded after a "false crossover" and February's bearish gap was filled. The index resumes its bullish momentum.

ETF Objective

INS is a UCITS ETF listed in €, which seeks to replicate the STOXX Europe 600 Insurance Net Return EUR index (33 european companies)

Characteristics

| Inception date | 18/08/2006 |

| Exepnse ratio | 0,30% |

| Issuer | Lyxor |

| Benchmark | stoxx 600 Insurance net return |

| ticker | INS |

| ISIN | FR0010344903 |

| UCITS | Yes |

| EU-SD status | Out of scope |

| Currency | € |

| Exchange | Euronext Paris |

| Assets Under Management | 93 M€ |

| Dividend | Capitalization |

| PEA (France) | Yes |

| SRD (France) | Yes |

| Currency risk | Low |

| Number of Holdings | 33 |

| Risk | 3/5 |

Country Breakdown

| United Kingdom | 27% |

| Germany | 24% |

| Switzerland | 17% |

| France | 11% |

| Netherlands | 6% |

| Italy | 5% |

| Others | 11% |

Sector Breakdown

| Financials | 100% |

Top Ten Holdings

| Allianz | 17% |

| Prudential | 11% |

| AXA | 10% |

| Zurich Ins. Group | 8% |

| Muenchener Rueckver | 6% |

| Swiss Re | 5% |

| Aviva | 5% |

| Sampo OYJ | 4% |

| Assicurazioni Generali | 4% |

| Legal and General Group | 4% |