Markets ends this week with a rise of 0.6% on the Stoxx600NR and 0.4% on the S&P500 despite the rise in long rates that continues in the United States (2.64% or + 10BP) which corresponds to a high of 10 months and this time seems due to Chinese growth stronger than expected.

US 10-year bonds are poised to return to a bearish trend, with a possible acceleration in rate increases which could potentially revive risk aversion and trigger declines in equity markets for cash or gold. The level of long US rates is to be monitored closely.

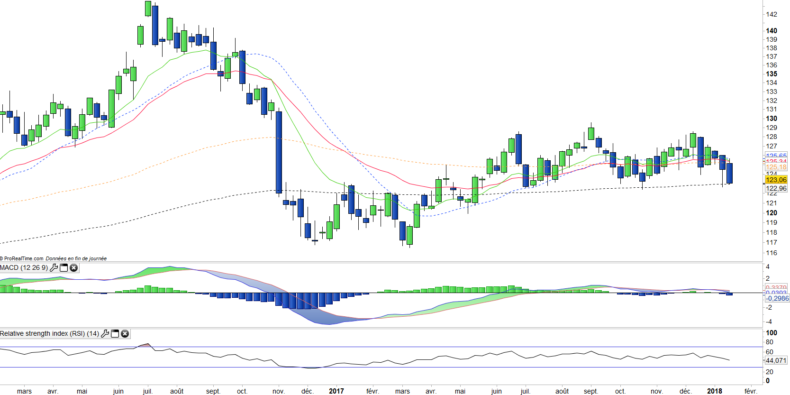

US long-term rate hike impacts long-term US treasury bonds (ETF iShares TLT) : weekly data

German long-term rates are also 0.58% for 10 years, but still far behind US yields. The equity markets remain robust, with a particularly strong momentum in Asia whose indices are breaking records, as in Japan to the extent that the support of the Japanese central bank which has also intervened on the stock indexes becomes difficult to justify.

Nikkei225 at the highest (ETF lyxor JPN, iShares EWJ) : weekly data

The US dollar continues to fall against major currencies due to fears of a government shutdown as US lawmakers struggle to reach a budget deal. The US dollar has also been depressed recently as a result of the global economic recovery exceeding US growth and prompting other large central banks, including the European Central Bank, to begin normalizing monetary policy at a faster pace.

The Chinese Yuan crossed for the first time the psychologically important level of USD 6.4 in two years, the day after the announcement of the country's annual growth of 6.8% in the fourth quarter, slightly better than expected, and above all, accelerated growth for the first time in seven years.

Optimism over the outlook for global economic growth and improved corporate earnings explain the current euphoria in equity markets in early 2018.

Retrouvez-nous désormais sur https://phi-advisor.com/fr/

pour bénéficier de nos signaux d’achat et de vente de plus de 300 ETFs !

Nous utilisons des cookies pour vous garantir la meilleure expérience sur notre site. Si vous continuez à utiliser ce dernier, nous considérerons que vous acceptez l'utilisation des cookies.Ok

Markets ends this week with a rise of 0.6% on the Stoxx600NR and 0.4% on the S&P500 despite the rise in long rates that continues in the United States (2.64% or + 10BP) which corresponds to a high of 10 months and this time seems due to Chinese growth stronger than expected.

US 10-year bonds are poised to return to a bearish trend, with a possible acceleration in rate increases which could potentially revive risk aversion and trigger declines in equity markets for cash or gold. The level of long US rates is to be monitored closely. US long-term rate hike impacts long-term US treasury bonds (ETF iShares TLT) : weekly data

German long-term rates are also 0.58% for 10 years, but still far behind US yields. The equity markets remain robust, with a particularly strong momentum in Asia whose indices are breaking records, as in Japan to the extent that the support of the Japanese central bank which has also intervened on the stock indexes becomes difficult to justify. Nikkei225 at the highest (ETF lyxor JPN, iShares EWJ) : weekly data

The US dollar continues to fall against major currencies due to fears of a government shutdown as US lawmakers struggle to reach a budget deal. The US dollar has also been depressed recently as a result of the global economic recovery exceeding US growth and prompting other large central banks, including the European Central Bank, to begin normalizing monetary policy at a faster pace.

The Chinese Yuan crossed for the first time the psychologically important level of USD 6.4 in two years, the day after the announcement of the country's annual growth of 6.8% in the fourth quarter, slightly better than expected, and above all, accelerated growth for the first time in seven years.

Optimism over the outlook for global economic growth and improved corporate earnings explain the current euphoria in equity markets in early 2018.