Lyxor Korea (KRW) - 07/07/2017

Short term strategy : Negative (20%) / Trend -

Short term strategy : Positive (95%) / Trend -

Characteristics of the ETF

KRW (Lyxor) tracks the MSCI Korea Index of the 112 largest Korean stocks.

The index therefore is pretty deep, but this tracker has a specificity : it is very focused on technology, which represents 44% of the capitalization, but even more so a single company, Samsung, accounts for 32% of the Index. The other main sectors are finance (13%), consumer goods (12%), industrials (9%) and mining (7%). The top 10 stocks represent a little more than 50% of the index, or some 20% excluding Samsung.

This tracker embeds naturally the Risk linked to the country’s currency, the Won (which mean ‘round’ in Korean), more volatile than the global currencies, but the larger companies, such as Samsung derive most of their revenues from the USA, China or Europe and have ultimately a limited exposure to the Korean Won.

The expenses are higher than the average at 0.65% and Assets Under Management are 116 M€.

Korea is at the 11th World economy in terms of GDP (1400 Bn$), between Russia and Canada; the country posted a spectacular growth since 30 years, but it was hit hard during the 2008 financial crisis due to its strong exposure to global trade and finance. If its economy was one of those most affected, South Korea has also been one of the first to recover, helped by exports and the fiscal stimulus. In 2017, in the context of increased tensions with North Korea, South Korea has granted a record amount to the defence budget, but it also aims to support job creation and develop the health system. The country faces structural problems such as the lack of critical size of the financial market, an ageing population, dependence on exports and the erosion of competitiveness against the qualitative ramp up of the Chinese economy.

The main country’s sectors are the textile, steel industry, manufacture Auto, Shipbuilding and electronics. South Korea is the world’s largest producer of semiconductor (including main foundries). The trade balance is a large surplus since February 2012 and should remain so in the coming years, while the main trading partners are China, Japan, and the United States. Korea is an important actor in the global technology landscape with leading players, which affords a high growth potential but it is at the same time reliant on complex geopolitical issues, including historically bad relationship with Japan (because of the war), China (because of its military alliance with the US) and also North Korea that represents the threat of a nuclear strike.

The index demonstrated great resilience despite the fall in US technology stocks and tensions with North Korea that reached an ultimate high. A consolidation started but remains for the moment contained over the short-term horizon.

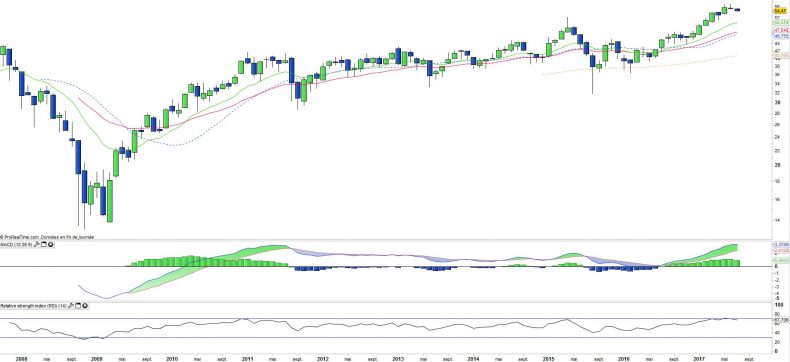

Monthly data

The analysis of monthly Charts shows a bullish trend, which has been severely disrupted in 2015/2016, but which has experienced a significant expansion phase of above 50% since the beginning of the year 2016. All-time highs were recorded in June, while July is so far corrective. The oscillators are in the upper zone which confirms the need for a correction.

A setback towards the EMA13 seems likely.

Weekly data

On the weekly charts, the emerging pattern is leading towards a bearish reversal in the short/mid term with the formation of a top and the bearish breakout of the EMA 13 as a first step. On top of this, the MACD just crossed downwards, a signal that had already been given some time before by the RSI.

The correction should continue to develop in the coming weeks.

ETF Objective

KRW is a UCITS compliant ETF that aims to track the benchmark index MSCI KOREA (112 companies)

Characteristics

| Inception date | 26/09/2006 |

| Expenses | 0,65% |

| Benchmark | Indice MSCI Korea |

| Issuer | Lyxor |

| Ticker | KRW |

| ISIN | FR0010361691 |

| Currency | € |

| Exchange | Euronext Paris |

| UCITS | Yes |

| EU-SD status | Out of scope |

| Assents Under Management | 116 M€ |

| Dividend | Capitalisation |

| PEA (France) | No |

| SRD (France) | No |

| Currency Risk | Yes |

| Number of Holdongs | 112 |

| Risk | 4/5 |

Country Breakdown

| South Korea | 100% |

Sector Breakdown

| Information Technology | 44% |

| Financials | 13% |

| Consumer Discretionary | 12% |

| Industrials | 9% |

| Materials | 7% |

| Consumer Staples | 7% |

| Energy | 3% |

| Others | 5% |

Top Ten Holdings

| Samsung Electronics | 28% |

| Hynix semiconductors | 5% |

| Samsung Electronics Pref | 4% |

| Hyundai | 3% |

| NHN Corp | 3% |

| Posco | 3% |

| Shinhan Financial Group | 3% |

| KB Financial Group | 3% |

| Hyundai Mobis | 2% |

| KT&G Corp | 2% |