Lyxor ETF Media Europe - MDA - 09/05/2018

Short Term strategy: Positive (100%) / Trend +

Long Term strategy: Positive (100%) / Trend +

Characteristics of the ETF

The MDA ETF (Lyxor) replicates the Stoxx Europe 600 Media Index (SXXR) which is composed of the main European media values. This index is quite concentrated since it contains only 24 values. By geography, the index is predominantly English with a weighting of 58% for the United Kingdom and 23% for France and 19% for the rest of Europe. There is therefore a significant exposure to the EURO / POUND parity, which is not trivial in the Brexit period.

The ETF MDA bears a fee of 0.3% with AUM of € 7 million. The replication method is indirect (via a swap) and there is a dividend capitalization policy.

Index & components

This index is quite concentrated since it contains only 24 stocks and is essentially composed of market capitalizations of between € 5 and € 30bn.

What characterizes it especially is a great diversity of business models: WPP and Publicis are advertisers in full digital transformation, ITV or SKY are broadcasters, that is to say distributors of contents which want more and more to ensure their own production deal with content giants like Netflix. This index also includes companies like RELX Group (Reed Elsevier) or Wolters Kluwer which are publishers of information and specialized content (scientific, legal etc ...). The point common to all these sectors is to be currently in digital mutation facing the web giants.

Current multiples are relatively reasonable at around 15x 2018 earnings but earnings growth remains uncertain.

It should be noted that more than half of the index is represented by English values, which adds an additional risk to the currency as well as to the specific risk in the United Kingdom, particularly related to Brexit.

The volatility of the sector is not particularly high, as the media is considered by the market as a growth sector (reinforced with the digital), more than a cyclical sector what it is also. Margins and cash flows can be significant, and growth is also much by acquisitions which makes the media an attractive sector for the long term. The digital transition has been accelerated for a large number of players, bringing the business models of major IT companies such as Accenture or Cap Gemini or giants of US technology like Netflix for some broadcasters (eg ITV). The medium-term outlook is attractive.

Latest developments

The index fell 5.9% in 2016 and was stable in 2017 after returning all of its first-half gains from weaker-than-expected growth and higher competitive intensity as the market moves towards mobile phone.

In 2018, the index has risen 4.9% since the beginning of the year, which is higher than the Stoxx600NR. This good performance is linked to the good performance of Vivendi (+ 5.5%), Publicis (+ 9.3%) and especially BskyB (+ 38%) thanks to the acquisition by the American Comcast.

Media stocks should benefit from the European cyclical recovery this year, while sector multiples are reasonable. Facebook's problems with user data, as well as the new European regulation on the use of private data could be favorable elements for European media companies. Consolidation is also expected to continue in the sector.

Monthly data

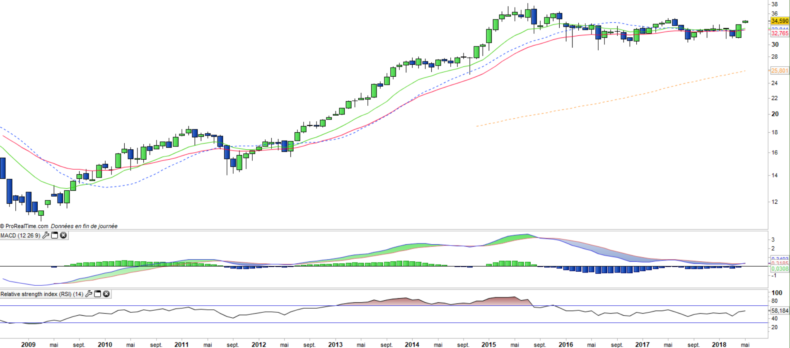

The monthly chart shows a bullish long-term trend that is trying to reactivate after a long flat 2-year period. The MACD is on the upside for the first time since September 2015, which represents a very powerfull signal. Prices are back above the main moving averages but must exceed the 2017 peak at € 35 then the 2015 highs at € 37 for the uptrend is really reactivated.

Weekly data

ETF Objective

MDA is a UCITS ETF, listed in €, which seeks to replicate the STOXX Europe 600 Media Net Return EUR index (24 european companies)

Characteristics

| Inception date | 18/08/2006 |

| Expense | 0,30% |

| Benchmark | SXMR stoxx 600 media |

| Issuer | Lyxor |

| Ticker | MDA |

| ISIN | FR0010344929 |

| UCITS | Yes |

| EU-SD Status | Out of Scope |

| Currency | € |

| Assets Under Management | 7,6M€ |

| Exchange | Euronext Paris |

| Dividend | Capitalization |

| PEA (France) | Yes |

| SRD (France) | Yes |

| Currency risk | £/€ |

| Number of Holdings | 24 |

| Risk | 4/5 |

Country Breakdown

| United Kingdom | 58% |

| France | 23% |

| Netherlands | 7% |

| Germany | 5% |

| Luxembourg | 4% |

| Others | 2% |

Sector Breakdown

| Consumer Discretionary | 68% |

| Industrials | 26% |

| Information Technology | 6% |

Top Ten Holdings

| Vivendi | 12% |

| WPP | 10% |

| Reed Elsevier | 10% |

| Relx NV | 9% |

| British Sky Broadcasting | 6% |

| Publicis | 7% |

| Wolters Kluwer | 7% |

| Prosieben Sat1 media AG | 4% |

| ITV | 4% |

| Informa | 4% |