Lyxor ETF Media Europe - MDA - 22/08/2018

Short Term strategy: Positive (100%) / Trend +

Long Term strategy: Positive (100%) / Trend +

Characteristics of the ETF

The MDA ETF (Lyxor) replicates the Stoxx Europe 600 Media Index (SXXR) which is composed of the main European media values. This index is quite concentrated since it contains only 23 values. By geography, the index is predominantly English with a weighting of 59% for the United Kingdom and 21% for France and 20% for the rest of Europe. There is therefore a significant exposure to the EURO / POUND parity, which is not trivial in the Brexit period.

The ETF MDA bears a fee of 0.3% with AUM of € 10 millions. The replication method is indirect (via a swap) and there is a dividend capitalization policy.

Index & components

This index is quite concentrated since it contains only 23 stocks and is essentially composed of market capitalizations of between € 5 and € 30bn.

What characterizes it especially is a great diversity of business models: WPP and Publicis are advertisers in full digital transformation, ITV or SKY are broadcasters, that is to say distributors of contents which want more and more to ensure their own production deal with content giants like Netflix. This index also includes companies like RELX Group (Reed Elsevier) or Wolters Kluwer which are publishers of information and specialized content (scientific, legal etc ...).

The point common to all these sectors is to be currently in digital mutation facing the web giants. Current multiples are relatively reasonable at around 15x 2018 earnings but earnings growth remains uncertain. It should be noted that more than half of the index is represented by English values, which adds an additional risk to the currency as well as to the specific risk in the United Kingdom, particularly related to Brexit.

The volatility of the sector is not particularly high, as the media is considered by the market as a growth sector (reinforced with the digital), more than a cyclical sector what it is also. Margins and cash flows can be significant, and growth is also much by acquisitions which makes the media an attractive sector for the long term. The digital transition has been accelerated for a large number of players, bringing the business models of major IT companies such as Accenture or Cap Gemini or giants of US technology like Netflix for some broadcasters (eg ITV). The medium-term outlook is attractive.

Latest developments

The index fell 5.9% in 2016 and was stable in 2017 after returning all of its first-half gains from weaker-than-expected growth and higher competitive intensity as the market moves towards the cellphone.

However, in 2018, the index has risen by 8.7% since the beginning of the year, which is significantly higher than the Stoxx600NR (+ 1%). This good performance is linked to the good performance of certain stocks such as BskyB (+ 54%) thanks to the buyout by the US Comcast, Wolters Kluwer (+ 28%) or Informa (+ 9.5%).

Media stocks are benefiting from the European cyclical recovery, and a rerating of the market, after a difficult run in 2016/17. Facebook's problems with user data, as well as the new European regulation on the use of private data could be favorable elements for European media companies. Consolidation is also expected to continue in the sector.

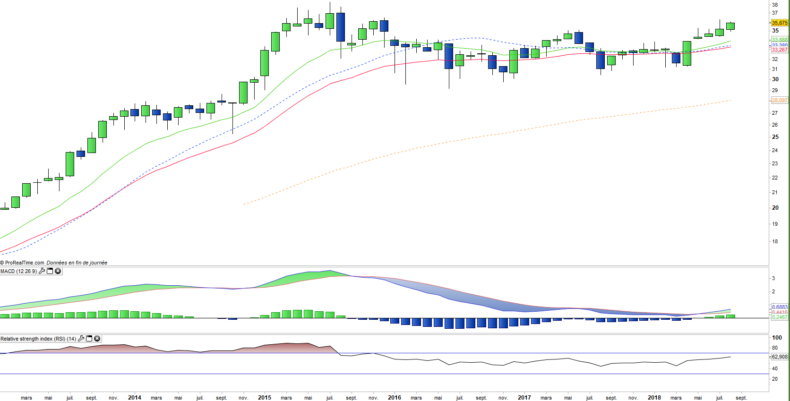

Monthly data

The monthly chart shows a long-term trend that is recovering sharply after a period of almost two years of wavering. The recovery is marked by the bullish reversal of the MACD, visible also on the other oscillators and the moving averages which become ascending again. The index should now tackle the main resistance of € 38 which corresponds to the 2015 peak.

Weekly data

On the weekly chart, we can see that the congestion zone of 2016/17 ended last June by exceeding the resistance of 35 €. This bullish exit strengthen the uptrend on the index, especially as the rounded bottom pattern is an additional positive factor. Breaking the resistance of € 38 would really boost the uptrend by crossing new highs for the first time in 3 years.

ETF Objective

MDA is a UCITS ETF, listed in EUR, which seeks to replicate the STOXX Europe 600 Media Net Return EUR index (23 european companies)

Characteristics

| Inception date | 18/08/2006 |

| Expense ratio | 0,30% |

| Benchmark | SXMR stoxx 600 media |

| Issuer | Lyxor |

| Ticker | MDA |

| ISIN | FR0010344929 |

| UCITS | Yes |

| EU-SD Status | Out of scope |

| Currency | € |

| Assets Under Management | 10 M€ |

| Exchange | Euronext Paris |

| Dividend | Capitalization |

| PEA | Yes |

| SRD | Yes |

| Currency Risk | Yes |

| Number of Holdings | 23 |

| Risk | 4/5 |

Country Breakdown

| United Kingdom | 59% |

| France | 22% |

| Netherlands | 8% |

| Germany | 5% |

| Luxemburg | 4% |

| Others | 2% |

Sectir Breakdown

| Consumer discretionary | 66% |

| Industrials | 28% |

| Information Technology | 6% |

Top Ten Holdings

| Vivendi | 12% |

| Reed Elsevier | 10% |

| WPP | 9% |

| Relx NV | 9% |

| British Sky Broadcasting | 9% |

| Wolters Kluwer | 8% |

| Publicis | 6% |

| Informa | 6% |

| Pearson | 4% |

| ITV | 4% |