Lyxor Euro Stoxx50 Net Return (MSE) - 06/08/2018

Short Term strategy: Positive (70%) / Trend =

Long Term strategy: Positive (60%) / Trend =

Characteristics of the ETF

The MSE ETF (Lyxor) replicates the European benchmark EURO STOXX 50 Net Retun, which is composed of the 50 largest stocks belonging to the Eurozone member countries, selected on the basis of their market capitalization, liquidity and market value and sectoral representativeness. The index strives to maintain a weighting by country and by economic sector reflecting at most the economic structure of the Euro zone.

The ETF MSE replicates the Euro Stoxx50, with a fee of 0.2% and with an AUM of € 6540m. The replication method is direct (physical) and there is a policy of semi-annual distribution of dividends.

Alternative ETFs: EUE (iShares in Euro), C50 (Amundi in Euro).

Index & components

This index is dominated by the Franco-German couple, which represents around 70% of the index's capitalization, the remaining 30% mainly for the southern European countries (mainly Italy and Spain) as well as the Benelux countries.

The 10 largest stocks represent around 36% of the index and have a very large market capitalization of around €100bn including 5 German companies (Siemens, SAP, Bayer, BASF and Allianz) and 3 French (Total, Sanofi and LVMH).

The index is fairly balanced from a sector point of view, with the most represented being financials (19,7%), followed by Industry (13,8%), and cyclical consumer goods (11.3%) and durable (10.8%) as well as health (11%). As far as Eurozone stocks are concerned, there is no direct currency risk, however, for large global companies there is sensitivity to currencies including Euro / dollar in first place.

The Euro Stoxx50 is representative of the euro area economy because of its sector weighting, which is less favorable to energy than in some national indices (such as the CAC40), while the financial sector (banks + insurance) remains a key compartment but does not reach the weight of the Italian or Spanish indices (around 33%). The volatility of the Euro Stoxx50 is rather lower than that of the national indices, due to geographical diversification, the absence of sectoral bias and the greater inertia due to the size of the market capitalizations.

If we compare the Eurostoxx50 with the Stoxx600, we will find a much more concentrated index on the core of the euro zone and large market capitalizations, also narrower geographically due to the absence of the United Kingdom, Switzerland and the Nordic countries.

The political cycle remains an important parameter for the zone and has been particularly favorable for the moment, with the victory of the liberals in the Netherlands and then in France but Germany is now weakened by a coalition that has become very fragile. The situation has not changed favorably in Italy, which is now governed by an antisystem coalition and in Spain, with a socialist government weakened by the lack of a majority in the assembly.

Latest developments

The Euro Stoxx50 rose 6.5% in 2017 but is currently down 0.6% in 2018 compared with a rise of 2.2% for the stoxx600.

The Eurostoxx50 has been penalized by political uncertainties from Germany and southern Europe (Italy and Spain) while Germany is also under pressure due to the protectionist actions of D.Trump that could target the automotive sector in the coming weeks despite a hope of agreement that remains to be confirmed.

However, corporate results continue to carry the trend with Q2 better than expected and coupled with favorable macroeconomic factors (favorable euro / $, low interest rates and oil at moderate level). The major uncertainty now concerns the trade war waged by D.Trump which targets Europe as much as China.

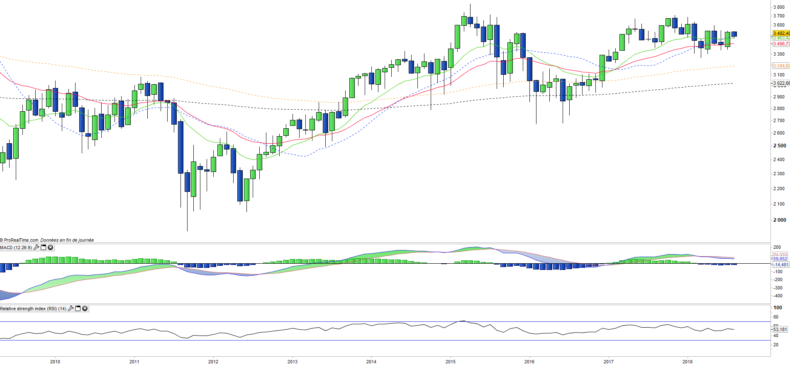

Monthly data

The monthly chart shows a long-term trend that remains positive but has a tendency to weaken, which can be observed by the flattening of moving averages and the reversal of technical oscillators which remain however in the high zone. The small candlesticks are a sign of relatively low volatility, which shows a hesitation as to the future direction of the index. A possible increase in volatility will be looked for as an indication of future direction.

Weekly data

On the weekly chart, we can see that the index is rebounding but is currently blocked by a bearish line. We also notice an inverted Head & Shoulder pattern whose neck line corresponds perfectly to the bearish line. The crossing of this line should lead to an acceleration of prices on the rise. Conversely, a failure would surely cause a return to the EMA100 then EMA200.

ETF Objective

MSE is a UCITS ETF listed in EUR, which seeks to replicate the EURO STOXX 50 Net Return index (50 european companies)

Characteristics

| Inception date | 19/02/2001 |

| Expense ratio | 0,20% |

| Benchmark | Euro Stoxx 50 Net Return |

| Issuer | Lyxor |

| Ticker | MSE |

| ISIN | FR0007054358 |

| UCITS | Yes |

| EU-SD Status | Out of scope |

| Currency | € |

| Echange | Euronext Paris |

| Assets Under Management | 6 467 M€ |

| Replication Method | Direct (Physical) |

| Dividend | Distribution |

| PEA (France) | Yes |

| SRD (France) | Yes |

| Currency Risk | No |

| Number of Holdings | 50 |

| Risk | 3/5 |

Country Breakdown

| France | 39% |

| Germany | 32% |

| Spain | 9% |

| Netherlands | 8% |

| Italy | 5% |

| United Kingdom | 3% |

| Belgium | 2% |

| Others | 2% |

Sector Breakdown

| Financials | 20% |

| Industrials | 14% |

| Consumer discretionary | 11% |

| Consumer staples | 11% |

| Health Care | 11% |

| Information Technology | 9% |

| Energy | 8% |

| Others | 17% |

Top Ten Holdings

| Total | 6% |

| SAP | 4% |

| Siemens | 4% |

| Bayer | 4% |

| Sanofi | 4% |

| Allianz | 3% |

| LVMH | 3% |

| Banco Santander | 3% |

| ASML Holding | 3% |

| Unilever | 3% |