Lyxor Euro Stoxx50 Net Return (MSE) - 11/06/2018

Short Term strategy: Negative (10%) / Trend -

Long Term strategy: Positive (55%) / Trend -

Characteristics of the ETF

The MSE ETF (Lyxor) replicates the European benchmark EURO STOXX 50 Net Retun, which is composed of the 50 largest stocks belonging to the Eurozone member countries, selected on the basis of their market capitalization, liquidity and market value and sectoral representativeness. The index strives to maintain a weighting by country and by economic sector reflecting at most the economic structure of the Euro zone.

The ETF MSE faithfully reproduces the Euro Stoxx50, with a reasonable fee of 0.2% and with an AUM of € 6762m. The replication method is direct (physical) and there is a dividend distribution policy.

Alternative ETFs: EUE (iShares in Euro), C50 (Amundi in Euro).

Index & components

This index is dominated by the Franco-German couple, which represents around 70% of the index's capitalization, the remaining 30% mainly for the southern European countries (mainly Italy and Spain) as well as the Benelux countries.

The 10 largest stocks represent around 36% of the index and have a very large market capitalization of around € 100bn, including five German companies (Siemens, SAP, Bayer, BASF and Allianz) and two French companies (Total and LVMH).

The index is fairly balanced from a sector perspective, of which the most represented is financials (19.4%), followed by Industry (15.5%), cyclical (12.3%) and durable goods ( 10.4%) and health (9.2%). There is no direct currency risk within the Eurozone, but for large global companies there is sensitivity to currencies including Euro / dollar in the first place. The Euro Stoxx50 is representative of the euro area economy because of its sector weighting, which is less favorable to energy than in some national indices (such as the CAC40), while the financial sector (banks + insurance) remains a key compartment but does not reach the weight of the Italian or Spanish indices (around 33%).

The volatility of the Euro Stoxx50 is rather lower than that of the national indices, due to geographical diversification, the absence of sectoral bias and the greater inertia due to the size of the market capitalizations. If we compare the Eurostoxx50 with the Stoxx600, we will find a much more concentrated index on the heart of the euro zone and large market capitalizations, also narrower geographically due to the absence of the United Kingdom, Switzerland and the Nordic countries.

The political cycle remains an important parameter for the zone and was at first particularly favorable, with the victory of the liberals in the Netherlands then in France, and finally Germany which managed to constitute a great coalition. But the situation has not changed as favorably in Italy, which is now governed by an anti-system coalition and in Spain, with a socialist government weakened by the lack of a majority in the assembly.

Latest developments

The Euro Stoxx50 rose by 6.5% in 2017 but is currently down -1.6% in 2018 compared to a rise of 0.9% for the stoxx600.

The Eurostoxx50 is currently in the correction phase, which is linked to the indices and values of southern Europe (Italy and Spain) penalized by the political context, while Germany is also under pressure due to the protectionist actions of D. Trump that could target the automotive sector in the coming weeks.

The European banking sector represents the transmission belt for new fears about the integrity of the Eurozone, which is weighing on Italy and its considerable debt and especially its new government that wants to overcome the constraints of Brussels. Italian 10-year rates have returned to 4-year highsat above 3%, which should limit the new government's room for maneuver.

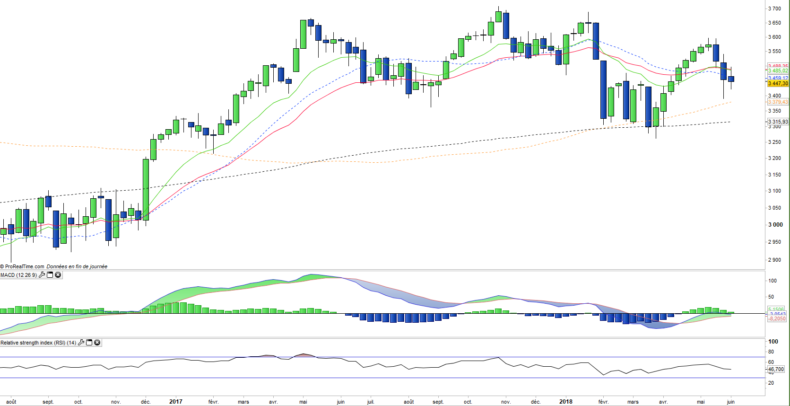

Monthly data

The monthly chart shows a long-term trend that remains moderately bullish but with a tendency to flatten, which is visible on the EMA100 and the MACD. The EMA100 plays the role of major support and a moderate increase may be considered as long as the index manages to maintain itself above this level. The next impetus will be key in the sense that it will raise the uptrend or will probably test the long-term support.

Weekly data

On the weekly chart, we can see that prices come again to test the EMA100, level from which a rebound is likely. The MACD remains upward and the oscillators are positioned at the limit of the turnaround. The immediate sequence ahead will be key to the trend of the index, but the general market environment remains favorable and we favor the scenario of a rebound.

ETF Objective

MSE is a UCITS ETF, listed in €, which seeks to replicate the EURO STOXX 50 Net Return EUR index (50 european companies)

Characteristics

| Inception date | 19/02/2001 |

| Expense ratio | 0,20% |

| Benchmark | Euro Stoxx 50 Net Return |

| Issuer | Lyxor |

| Ticker | MSE |

| ISIN | FR0007054358 |

| UCITS | Yes |

| EU-SD Status | Out of scope |

| Currency | € |

| Exchange | Euronext Paris |

| Assets Under Management | 6 753 M€ |

| Replication Method | Direct (Physical) |

| Dividend | Distribution |

| PEA (France) | Yes |

| SRD (France) | Yes |

| Currency risk | No |

| Number of Holdings | 50 |

| Risk | 3/5 |

Country Breakdown

| France | 38% |

| Germany | 33% |

| Spain | 9% |

| Netherlands | 8% |

| Italy | 5% |

| United Kingdom | 3% |

| Belgium | 2% |

| Others | 2% |

Sector Breakdown

| Financials | 20% |

| Industrials | 16% |

| Consumer discretionary | 12% |

| Consumer staples | 10% |

| Health Care | 9% |

| Information Technology | 9% |

| Energy | 7% |

| Others | 17% |

Top Ten Holdings

| Total | 6% |

| SAP | 5% |

| Siemens | 4% |

| Bayer | 4% |

| LVMH | 3% |

| Allianz | 3% |

| BASF | 3% |

| Banco Santander | 3% |

| ASML Holding | 3% |

| Sanofi | 3% |