PowerShares ETF Nasdaq 100 - QQQ - 09/04/2018

Short Term strategy: Positive (20%) / Trend =

Long Term strategy: Positive (90%) / Trend -

Characteristics of the ETF

The QQQ ETF (Powershares), which is quoted in USD on the Nasdaq, replicates the Nasdaq 100 index which is composed of the top 100 non-financial US stocks, mainly in the technology sector and listed on the Nasdaq, selected according to the importance of their market capitalization.

The ETF fees are 0.2% and the AUM is very high at $ 58bn. Replication is direct (physical) and there is a dividend distribution policy.

Alternative ETFS: ANX (Amundi in Euro), UST (Lyxor in Euro), CNDX (iShares in USD)

Latest developments

The Nasdaq100 rose 31.5% in 2017, the largest annual increase since the rebound in 2009, the rise of the beginning of the year was completely erased by the correction in progress and the index now displays a modest + 0.6% since the beginning of the year 2018. The 12-month PER is currently 22X while the earnings growth should be again higher than 10% in 2018.

The GAFAs are currently under pressure with Facebook in the line of fire after its scandal on the data, while Amazon is in the sights of D.Trump. However Facebook has held up better than the index last week (-1.6%) and Apple finished in the green (+ 0.3% over the whole week).

The results of the technology companies that will be unveiled in the second half of April are likely to have a decisive impact on the short-term trend of markets that are currently on major supports and pivotal levels for medium-term trends. Events related to the beginning of the trade dispute between China and the US will continue to significantly influence the index in the coming weeks.

Index & components

The top 10 stocks in the index, including Apple, Amazon, Alphabet, Facebook and Microsoft, account for about 54% of the market capitalization of the index, while Apple alone accounts for 11.6% of the index.

The interest of this index lies in the fact of taking a diversified bet but concentrated on the most beautiful technological stocks, giving a good share to the "GAFA" (Google, Apple, Facebook and Amazon) which represent 35% of the capitalization. The index is particularly influenced by Apple's prices, which fluctuate according to the success of its new smartphones.

Note that large technology stocks have generally performed very well in 2017, especially GAFA but also semiconductors (Intel) and Microsoft. Large biotech stocks such as Gilead and Amgen have been less buoyant despite a year-end rebound due to uncertainties in both their pipeline and US health policy, as well as the decline in speculative premiums after the failure of major transatlantic operations. However, the attractiveness of US biotech companies remains significant at a national level, and these are prime targets for major US laboratories, as well as an alternative to transcontinental operations. The volatility of the index is not very marked, which reflects the considerable weight of market capitalizations often above $ 300 billion for the top 10 companies, see $ 500 billion for the top 5.

But the Nasdaq 100 is not just about its top 10 stocks, and the depth of the index makes it possible to invest in companies that are already established but still have a strong appreciation potential like Tesla, Xilinx or Symantec.

The hegemonic position of the GAFA in the world begins to provoke reactions, especially in Europe, both on competitive positions or abuse of dominant positions could trigger heavy fines, as seems to be emerging for Google, but also on taxation while European countries seek to find an agreement to tax the revenues generated on their territory. Chinese competitors are becoming more and more present, such as Alibaba or Tencent, and could soon threaten the supremacy of the leaders of American technology.

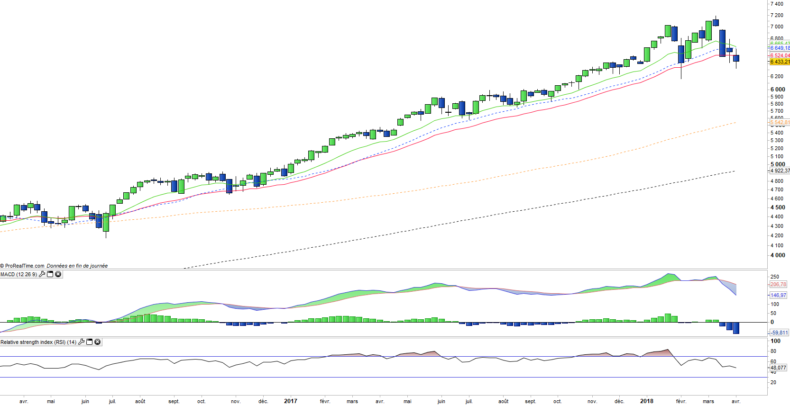

Weekly data

The monthly chart shows a weak medium-term uptrend, with a summit structure starting to take shape. The amplitude of the candlesticks decreases but no rebound is able to form for the moment at the weekly level. Moreover the EMA13 and 26 are gradually turning downwards, a powerful rebound is now mandatory to maintain the medium-term uptrend.

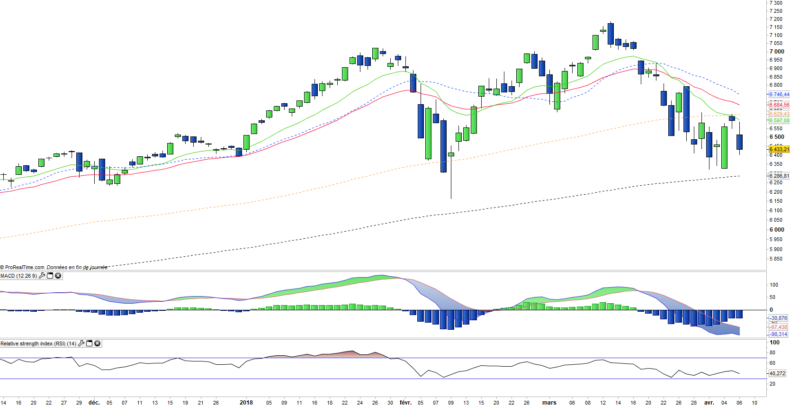

Daily data

On the daily chart, we can see a new bearish start after a rebound attempt that failed on the EMA100. The bearish candlestick on Friday is less powerful than those of previous movements but the many attacks of the EMA200 end up weakening it. By staying in contact with this support level, it may end up giving way. We will therefore particularly watch the beginning of the week, while time is now playing against the bullish recovery.

ETF Objective

QQQ is an ETF listed in USD, which seeks to replicate the Nasdaq 100 index (103 companies)

Characteristics

| Inception date | 10/03/1999 |

| Expense ratio | 0,2% |

| Benchmark | Nasdaq 100 |

| Issuer | PowerShares |

| Ticker | QQQ |

| ISIN | US73935A1043 |

| Currency | $ |

| Exchange | Nasdaq |

| Assets Under Management | 58 000 M$ |

| Replication Method | Direct (Physical) |

| Dividend | Distribution |

| Currency risk | No |

| Number of Holdings | 103 |

| Risk | 3/5 |

Country Breakdown

| USA | 97% |

| Chine | 2% |

| Royaume Uni | 1% |

Sector Breakdown

| Information Technology | 61% |

| Consumer Discretionary | 22% |

| Health Care | 9% |

| Consumer Staples | 4% |

| Industrials | 2% |

| Telecom Services | 1% |

Top Ten Holdings

| Apple | 11% |

| Alphabet | 9% |

| Microsoft | 9% |

| Amazon | 9% |

| 5% | |

| Intel | 3% |

| Cisco | 3% |

| Comcast | 2% |

| Nvidia | 2% |