Invesco Dynamic Building & Construction - PKB - 08/06/2018

Short Term strategy: Positive (60%) / Trend +

Long Term strategy: Positive (55%) / Trend +

pour accéder à nos achats / ventes sur les indices

Characteristics of the ETF

The PKB ETF (Powershares) created in 10/2005 replicates an index based on a narrow selection of 30 securities specialized mainly in the construction, construction and engineering business. This is a very specialized index from a geographical point of view, composed mainly of US stocks and quoted in USD. The Fund and the index are readjusted on a quarterly basis in February, May, August and November according to various criteria (including quality and momentum).

The ETF fee is 0.63% and the AUM is approximately $ 258m. The replication method is direct and there is a dividend distribution policy.

Alternative ETFs: ITB (iShares, USD), XHB (SPDR, USD)

Index & components

This ETF is quite diversified from a sub-segment point of view with 29% of home retail construction-related securities, around 22% in building materials, 7% in machinery and equipment manufacturing companies, 5% in forestry industry...

PKB is composed of quality values like Home Depot or Martin Marietta and has a growth, bias which explains its dynamism.

The ETF has experienced somewhat lower volatility than the US market (S & P500) despite cyclical characteristics related to the construction and building market (influenced by GDP growth and interest rates), while pre-crisis (2007) peak was exceeded by the end of 2013.

The interest of this ETF lies in the originality and quality of its selection. PKB reproduces its benchmark (S & P500 Construction & Engineering) quite poorly due to a different and much more open selection. In this basket, we will find a certain number of themes among which the individual or collective construction which is of course very correlated with the American growth cycle which remains supported at a rate of 2 to 2.5% per year, and also dependent of a reasonably low rate environment, because despite the recent rise, the 10-year US remains around 2.9%.

Trump's election favored this sector as the new US president is considering a major infrastructure program that would directly benefit US industry, and has voted massive tax cuts. However, the US president has already lost a lot of political capital on a number of topics, and it is not sure that he can carry out his projects, which are falling behind. It is likely that the president's ambitions will be revised downward, while the Republicans in power in both houses want to avoid further slippage in terms of budget deficit.

The growth cycle of the US economy is the other unknown, while the US economic cycle has a certain maturity and the FED should continue to raise rates gradually in the coming months. However a recession seems unlikely before 2020.

Latest developments

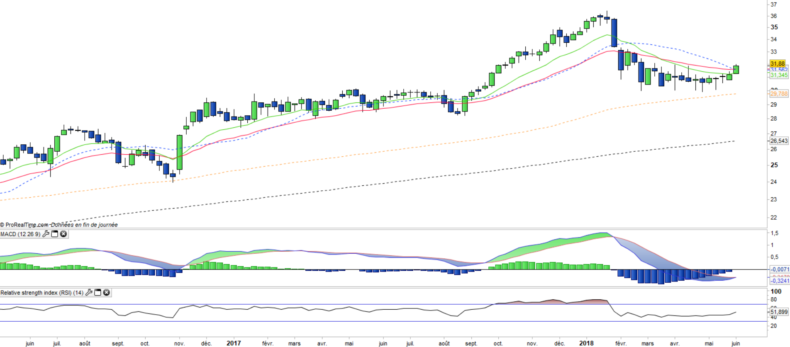

The performance of PKB reached 24.4% in 2017, which is once again higher than the S & P500 (+ 19.4%), but the index has consolidated significantly since the beginning of the year (-8.3%) against +3.7 % for the US benchmark.

The index suffered in the first part of the year from the rise in long-term interest rates (10 years bonds), which exceeded 3%, while construction is by nature correlated with interest rates. However, this increase seems for the moment stabilized around 3%, in spite of the very good performance of the global economy in general and American in particular.

D.Trump's protectionist policy will have no impact on the highly local economy sector, which will be all the more protected. The US growth cycle still seems far from overheating or ready for a downturn while full-employment is only moderately fueling inflation. This is a very buoyant context for this sector.

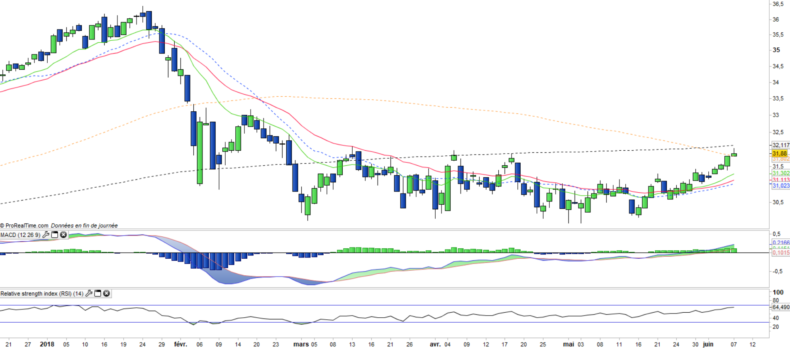

Daily data

The daily chart shows a sharp upward crossing of the EMA100 while forming a rounded bottom structure, which represents a very bullish short-term structure. The resistance of $ 32 will however have to be exceeded for the movement to release its full potential and allow the index to return to its year highs, at around $ 36.

ETF Objective

PKB is an ETF listed in $, which seeks to replicate the Dynamic Building & Construction Intellidex Index (30 US companies)

Characteristics

| Inception date | 26/10/2005 |

| Expense ratio | 0,63% |

| Issuer | PowerShares - Invesco |

| Benchmark | Dyn. Buil&Cons. Intellidex index |

| Code / Ticker | PKB |

| ISIN | US73935X6664 |

| UCITS | No |

| Currency | $ |

| Exchange | NYSE |

| Assets Under Management | 259 M$ |

| Dividend | Distribution |

| Currency risk | No |

| Number of Holdings | 30 |

| Risk | 3/5 |

Country Breakdown

| USA | 100% |

Sector Breakdown

| Home Building | 29% |

| Building products | 22% |

| Construction Machinery | 7% |

| Construction & Engineering | 7% |

| Forest Products | 5% |

| Others | 30% |

Top Ten Holdings

| Martin Marietta Materials | 5% |

| NVR | 5% |

| Home Depot | 5% |

| PulteGroup | 5% |

| Tractor Supply | 5% |

| Vulcan Materials | 5% |

| Dr Horton | 5% |

| AO Smith Corp | 5% |

| Cavco Industries | 3% |

| Continental Building Products | 3% |