SPDR S&P 500 (SPY) - 21/08/2017

Short term strategy : Negative (20%) / Trend -

Long term strategy : Positive (95%) / Trend -

Characteristics of the ETF

SPY (SPDR) replicates the S&P500 Index, which is composed of the top 506 US stocks that are representative of the main representative sectors, while stocks are selected based on the size of their market capitalization.

The top 10 stocks include 4 major technology stocks (Apple, Amazon, Microsoft and Facebook), as well as more classic and iconic US companies such as GE or Exxon mobile. The interest of this index is first and foremost its depth, which allows it to be a good proxy of the US economy, with a sectoral weighting that favors a little more the growth sectors, like Technology who represent 21% of the weighting. Financials represent 15% of the index and energy values 7% are well offset by defensive sectors such as health (14%) and discretionary consumer goods (12%).

The index responded positively to the election of Donald Trump, driven by values like energy, defense and financials but also by some cyclical sectors like construction. In particular, the massive infrastructure program promised by the president-elect was appreciated by the markets for its positive impact on growth, while the announced deregulation on shale oil and banks could also benefit these sectors.

The new round of rate increases confirmed by the FED will be gradual and should not threaten US growth at this time. The multiples of the S & P 500 are currently around 19x the 2017 results, which is rather at the top of the range (historically between 15 and 20x) but must be compared with an economic growth of more than 2% in a context of low interest rates.

After a stagnation of earnings per share in 2016, the consensus for 2017 is expected to rise by 11.5% and a 6% increase in revenues. The US index has grown by 15% since D.Trump's election at the beginning of November, but the increasing lack of power of Donald Trump, which is becoming more and more discredited, is worrying the markets, while deregulation and tax cut considered by the new administration had to act as powerful stimuli for the economy.

However, the index has been particularly resilient for several weeks thanks to the Utilities and the Basics however the oil sector begins to weigh negatively. The increasingly chaotic US domestic policy and the return of geopolitical fears are beginning to weigh on the US benchmark.

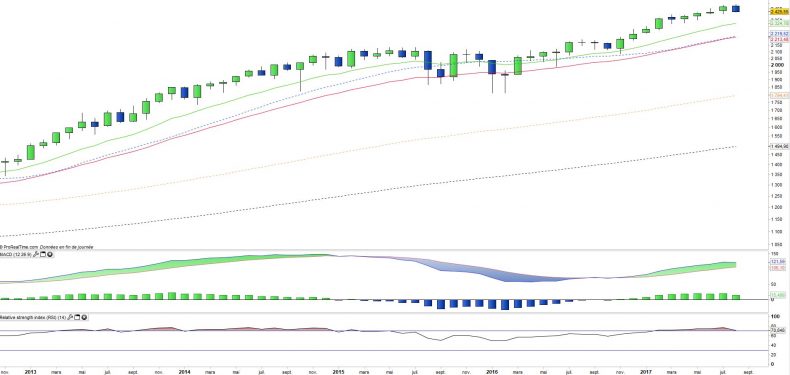

Monthly data

Analysis of the monthly charts shows a very strong upward trend. However, the August candlestick, which remains to be confirmed, is a bearish engulfing that has a good chance of launching a medium-term correction signal in the direction of the EMA13 and then EMA26.

The oscillators begin to fall downward, RSI in particular, which confirms this potential medium-term correction scenario.

Weekly data

The analysis of the weekly charts shows that a correction is in progress, with two rather corrective weekly candlestisks which led to turning the oscillators down.

The EMA26 should play its role of short-term support, but a deeper correction towards the EMA100 remains possible later on if a bearish structure emerged especially if the rebound proved insufficient to revive upward momentum.

ETF Objective

SPY is an ETF which seeks to replicate the price and yield performance of the S&P500 Index

Characteristics

| Inception date | 22/01/1993 |

| Expenses | 0.09% |

| Benchmark | S&P 500 |

| Issuer | SPDR |

| Ticker | SPY |

| CUSIP | 78462F103 |

| Currecy | $ |

| Exchange | NYSE Arca |

| Assets Under Management | 235 000 M$ |

| Replication Method | Direct (Physical) |

| Dividend | distribution |

| Currency Risk | No |

| Number of Holdings | 506 |

| Risk | 3/5 |

Country Breakdown

| United States | 100% |

Sector Breakdown

| Information Technology | 23% |

| Financials | 14% |

| Health Care | 14% |

| Consumer discretionary | 12% |

| Industrials | 10% |

| Consumer Staple | 9% |

| Energy | 6% |

| Others | 11% |

Top Ten Holdings

| Apple | 4% |

| Microsoft Corp | 3% |

| Alphabet | 3% |

| Amazon | 2% |

| Exxon Mobil | 2% |

| Johnson & Johnson | 2% |

| 2% | |

| Berkshire Hathaway | 2% |

| JP Morgan Chase | 2% |