SPDR S&P 500 (SPY) - 26/02/2018

Short Term strategy : Positive (70%) / Trend +

Long Term strategy : Positive (95%) / Trend =

Characteristics of the ETF

The SPY ETF (SPDR) created in 01/1993 replicates the S & P 500 index, which is composed of the 500 main US stocks representative of the main sectors, while the stocks are selected according to the size of their market capitalization.

The ETF fees are quite low at 0.0945% and the AUM is $ 270bn. Replication is direct (physical) and there is a dividend distribution policy on a quarterly basis.

Alternative ETFs: AUM5 (Amundi in Euro), SP5 (Lyxor in Euro), IVV (Ishares, in USD)

Index & components

The top 10 stocks of the S & P500 include five major technology stocks (Apple, Amazon, Microsoft, Alphabet and Facebook), but also larger, more classic and iconic American companies such as JP Morgan or Exxon Mobil.

The main advantage of this index is its depth, which allows it to be a good proxy for the US economy, with a sector weighting that favors the growth sectors a little more, just like the technology stocks that represent about 24% of the weighting. Financials account for just under 15% of the index, and energy values of 6% are well balanced by defensive sectors such as health (about 14%) and consumer discretionary (13%).

The index has benefited from a strong momentum since the election of D. Trump, more than a year ago, while alongside the technology that remains the engine of the US market, new sectors have joined the trend, however a correction is now underway on the index because of fears of a return of inflation following the program of lower taxes for US businesses and households that should have a positive impact on growth, while announced deregulation on shale oil and banks could also benefit these sectors.

However the multiples of the S & P 500 are currently quite high, even after the ongoing correction at around 19x the results at 12 months, which is at the top of range (historically between 15 and 20x) even if it must be put in American economy growth estimated at around 3% in 2018. The whole question is now about the duration of the US cycle in a context of rising rates which is still progressive for the moment while the level of margins companies is at its highest level and seems to have lost much upside potential, even though the consensus is again on double-digit earnings growth in 2018 driven by the energy / oil sector, banks and technological values.

Latest developments

After a rise of 19.4% in 2017, and a strong January rise (+ 5.6%) the S & P500 suffered a phase of sharp correction in February and only progresses by 2.8% since the beginning of the year.

The February correction came on fears of a return of inflation and long-term interest rates that rose to 2.95% while they were only 2.45% at the beginning of the year. the speed of the rise in rates causing fear of a bond Krach and its lot of negative consequences on businesses and the financial system.

However, despite statistics that have recently been in the direction of a resurgence of inflation (unemployment in January and CPI) the Fed is reassuring and said in a report made public Friday that it is not at all worries for the moment of a slippage of inflation. The Fed is now at risk of setting the tone on the markets, as a faster and more severe tightening of liquidity would have a significant impact on US growth prospects and, of course on the markets.

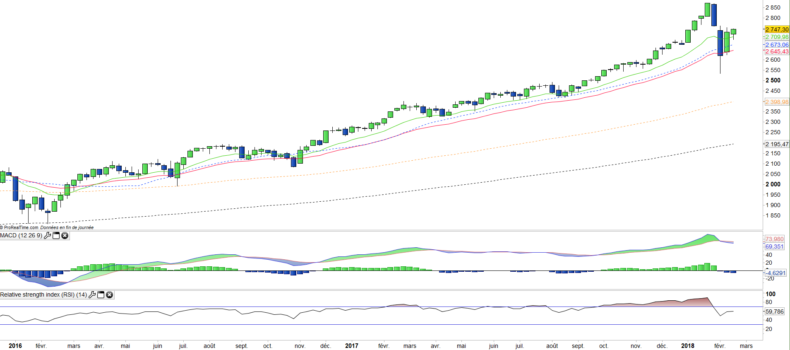

Weekly data

The weekly chart shows the sharp fall of the last two weeks, as well as the rebound that has just been confirmed just by the end of the week. The confirmed bullish breakout of the EMA13 is decisive for the trend and seems to confirm the end of the correction. However, the index may take a while before recording new highs. The index is leaving the high-risk area, and the likelihood of relapse in the very short term is now reduced.

Daily data

On the daily chart, the technical situation shows a situation that has been clarified in the short term. At first the rebound stumbled several times on the SMA20, but finally decided to cross it at the end of the week. This crossing will have to be confirmed at the next cession but becomes very likely and implies the return to the underlying bullish trend.

ETF Objective

SPY is an ETF which seeks to replicate the S&P500 Index (505 US companies)

Characteristics

| Inception date | 22/01/1993 |

| Expense ratio | 0.09% |

| Benchmark | S&P 500 |

| Issuer | SPDR |

| Ticker | SPY |

| ISIN | US78462F1030 |

| Monnaie | $ |

| Exchange | NYSE Arca |

| UCITS | No |

| Assets Under Management | 270 372 M$ |

| Replication Method | Direct (Physical) |

| Dividend | Distribution |

| Currency Risk | No |

| Number of Holdings | 505 |

| Risk | 3/5 |

Country Breakdown

| USA | 100% |

Sector Breakdown

| Information Technology | 25% |

| Financials | 15% |

| Health Care | 14% |

| Consumer Discretionary | 13% |

| Industrials | 10% |

| Consumer Staples | 8% |

| Energy | 6% |

| Others | 9% |

Top Ten Holdings

| Apple | 4% |

| Microsoft Corp | 3% |

| Alphabet | 3% |

| Amazon | 2% |

| 2% | |

| JPMorgan Chase | 2% |

| Berkshire Hathaway | 2% |

| Johnson & Johnson | 2% |

| Exxon Mobil | 1% |