Market Analysis

Our Asset allocation strategy: 04/03/2018

Our Asset allocation strategy: 04/03/2018

Our Crash indicator has increased to 47.6 / 100 now.

This level of indicator leads our Robot to increase the share of cash in its Asset Allocation (10%)…

Our Market Analysis: 03/03/2018

Our Asset Allocation strategy: 25/02/2018

Our Asset Allocation strategy: 25/02/2018

Our crash indicator fell again to 44.2 / 100 now (vs 45.5 the previous week).

This level of indicator leads…

Our market analysis: 24/02/2018

Our Asset Allocation Strategy: 18/02/2018

Our Asset Allocation Strategy: 18/02/2018

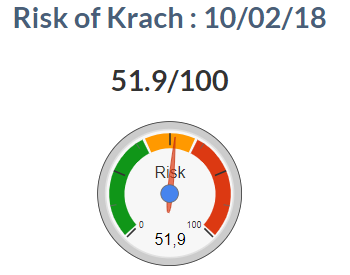

Our Krach indicator fell with the rebound recorded last week, to 45.5 / 100 now (vs 51.9 the previous week)…

Our Market analysis: 17/02/2018

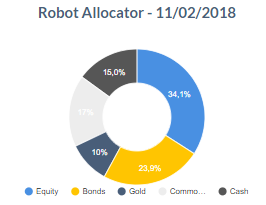

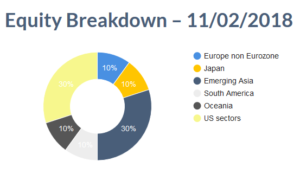

Our Asset Allocation Strategy: 11/02/2018

Our Market Analysis : 10/02/2018

Our Asset Allocation strategy : 05/02/2018

Our Asset Allocation strategy : 05/02/2018

Our Krach indicator is approaching the trigger zone of a cash share in our allocation…

This week was marked by a great hesitation before the US markets finally decide to opt for the rise.

The week was marked by two major events, the first being the ratification by D.Trump protectionist measures on aluminum and steel that will ultimately affect mainly Europe and China, in the background of resignation of the chief economic adviser of President, Gary Kohn, Tax Plan Architect and supporter of free trade.