Portfolios

12

Août

2017

12

Août

2017

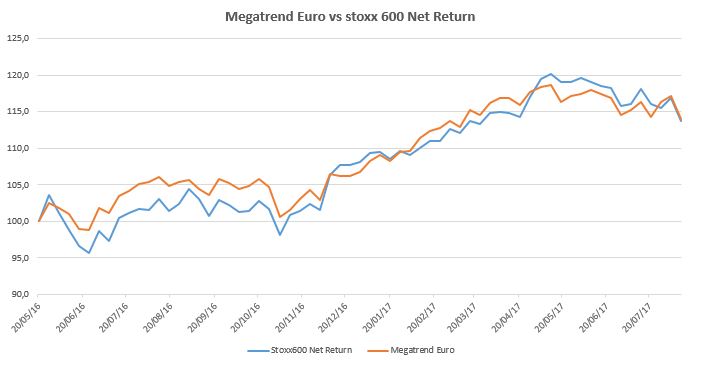

Megatrend Euro Portfolio – 11/08/17

12

Août

2017

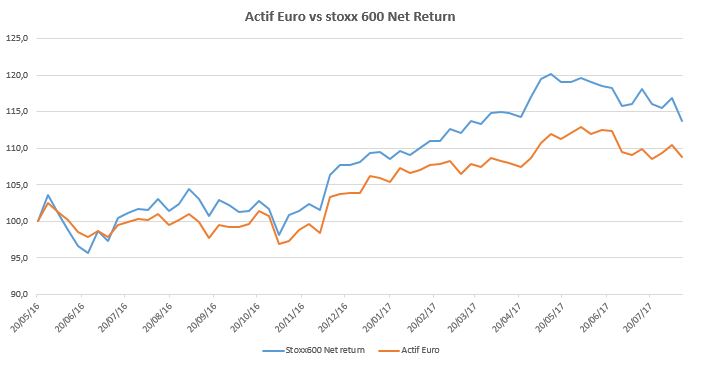

Active Euro Portfolio – 11/08/17

12

Août

2017

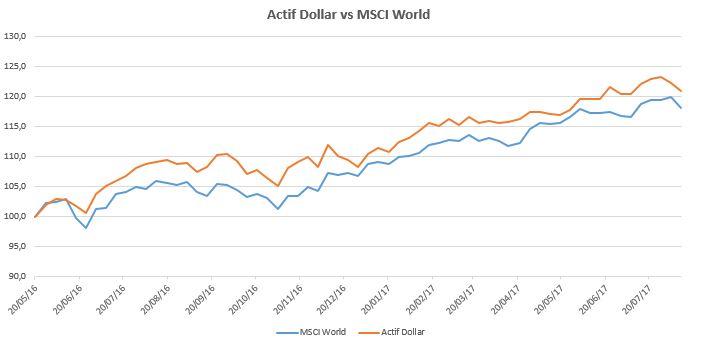

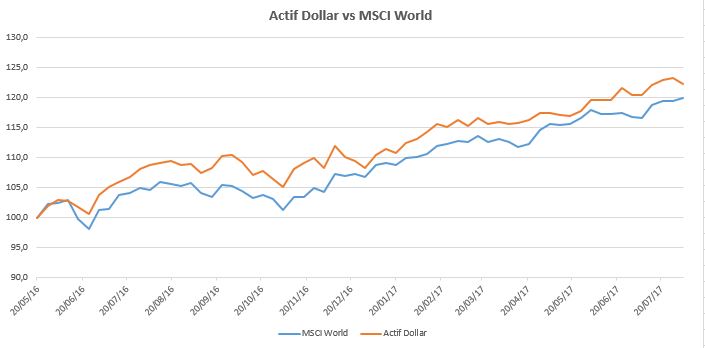

Global Macro Portfolio – 11/08/17

12

Août

2017

Our Market Analysis : 12/08/2017

11

Août

2017

Korea : The technical situation weakens (KRW) – 11/08/17

09

Août

2017

Cotton : Interesting technical short term configuration (BAL) – 09/08/17

07

Août

2017

Brésil : Technical profile improving (RIO) – 07/08/17

06

Août

2017

Portefeuille Global Macro – 04/08/17

06

Août

2017

This week was clearly a period of strong consolidation for the European equity markets (Stoxx600: -2.6%), US (S & P500: -1.4%) as well as the main emerging markets.

European Banks (BNK) under pressure this week (weekly data)

One reason for this is the escalation of the warmonger rhetoric between the US and North Korea, which now threatens US missile shots at Guam in the Pacific, while Donald Trump hardens its position leaving less room for a diplomatic solution.