Portfolios

06

Août

2017

06

Août

2017

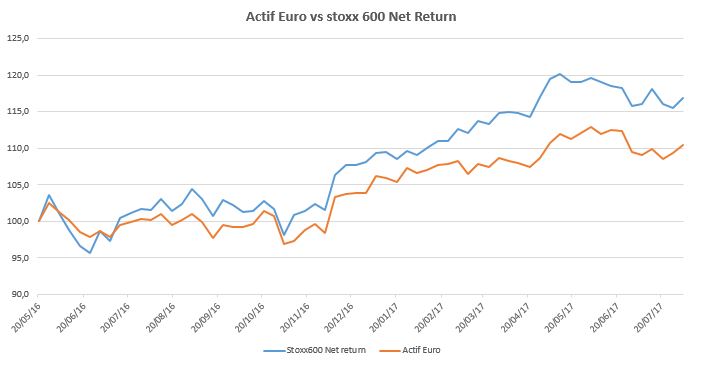

Active Euro Portfolio – 04/08/17

05

Août

2017

Our Market Analysis : 05/08/2017

04

Août

2017

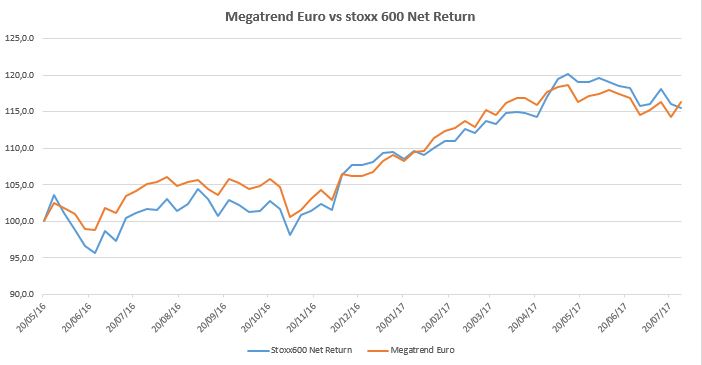

One exit and one entry in our Megatrend Euro Portfolio – 04/08/17

03

Août

2017

One exit and one entry in our Active Euro Portfolio – 03/08/17

02

Août

2017

One exit and one entry in our Active Euro Portfolio – 02/08/17

29

Juil

2017

Portefeuille Global Macro – 28/07/17

29

Juil

2017

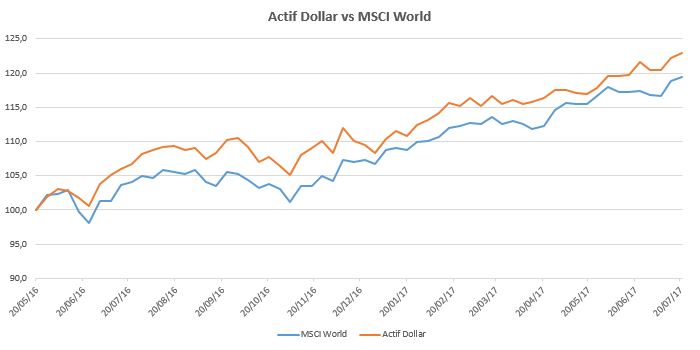

Active Dollar Portfolio – 28/07/17

29

Juil

2017

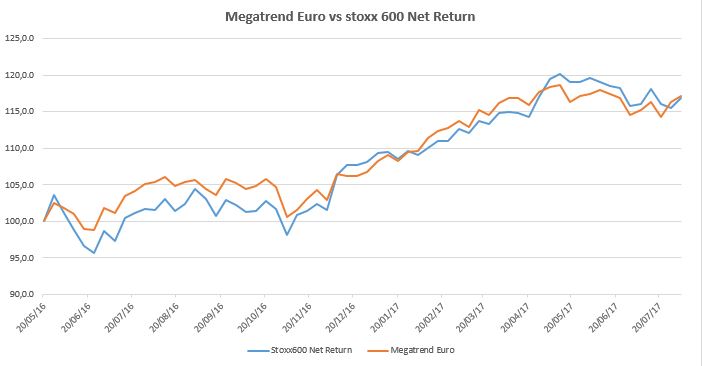

Megatrend Euro Portfolio – 28/07/17

29

Juil

2017

Markets confirmed this week some decorrelation / fragmentation among the major indices.

First of all in the US, as the Dow Jones 30 continues its progression mainly driven by 3 stocks (Apple, Nike and Intel) that allow it to set a new historical record and break the 22000 pts level, while the Nasdaq and The S & P500 remained stable.