Portfolios

08

Juil

2017

08

Juil

2017

Our Market Analysis : 08/07/2017

07

Juil

2017

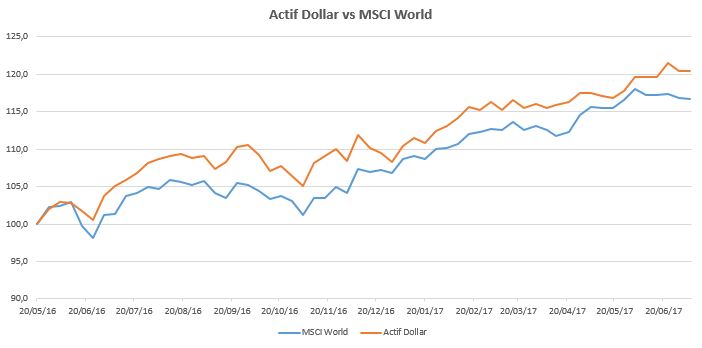

Global Macro Portfolio – 07/07/17

07

Juil

2017

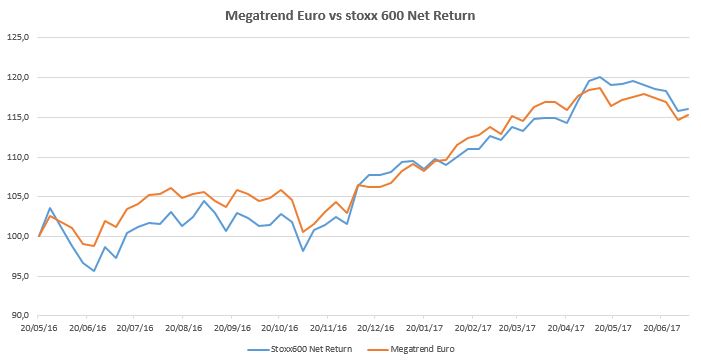

Megatrend Euro Portfolio – 07/07/17

07

Juil

2017

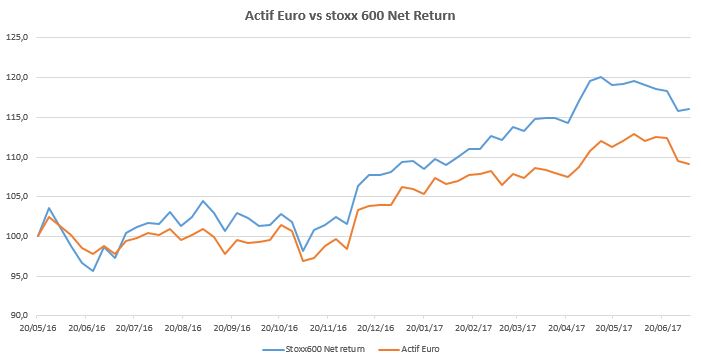

Active Euro Portfolio – 07/07/17

07

Juil

2017

China Large Cap : Ready to accelerate upwards? (FXI) – 07/07/17

07

Juil

2017

One exit in our Actif Euro Portfolio – 07/07/17

05

Juil

2017

Double Short Bund : to play the long-term cycle of rising rates? (DSB) – 05/07/17

03

Juil

2017

Global Macro Portfolio : one exit, two entries – 03/07/17

03

Juil

2017

This week was marked by huge sector rotations in both the US and Europe, while overall markets were flat or reported a slight negative week on week performance.

These rotations were mainly driven by central banks that now look more focused on inflation risks despite lower energy prices.