Portfolios

21

Juil

2017

19

Juil

2017

US Pharmaceuticals : An attractive short-term opportunity? (XPH) – 19/07/17

15

Juil

2017

Global Macro Portfolio – 14/07/17

15

Juil

2017

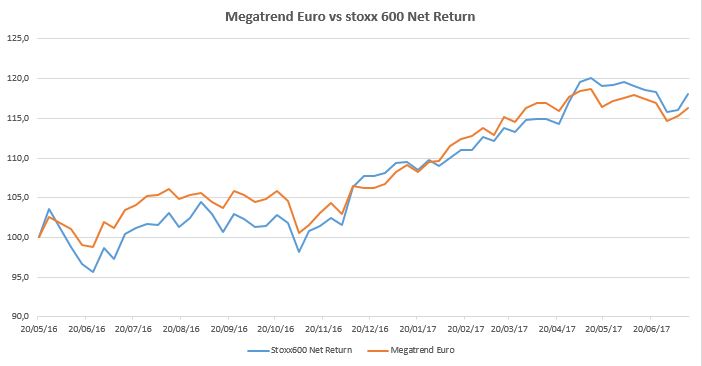

Megatrend Euro Portfolio – 14/07/17

15

Juil

2017

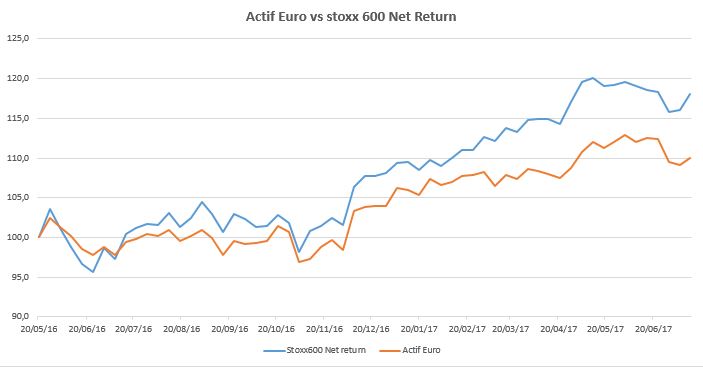

Active Euro Portfolio – 14/07/17

15

Juil

2017

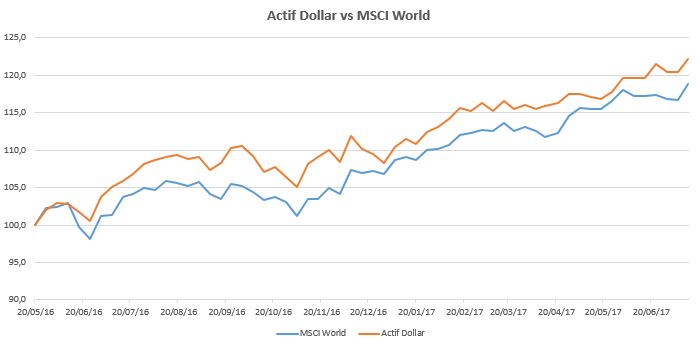

Active Dollar Portfolio – 14/07/17

15

Juil

2017

Our Market Analysis : 15/07/2017

14

Juil

2017

Copper : A long term reversal on the horizon? (JJC) – 14/07/17

12

Juil

2017

U.S. Metals & Mining : A more favourable conjuncture? (XME) – 12/07/17

10

Juil

2017

We decided to exit the ETX Lyxor HLT (Health Care Europe) of the Active Euro portfolio, while the index continues to underperform the stoxx600. We are replacing it with an ETF with a positive short term momentum and significant short and medium term bullish potential : the Lyxor ETF BRE (Basic Resources Index).