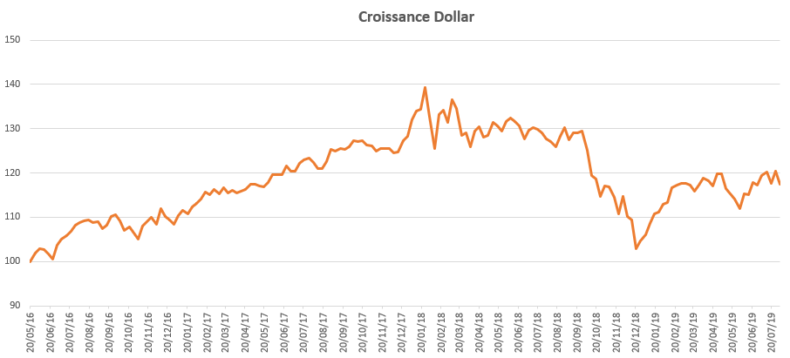

| Performance since 20/05/16 | +17,4% |

| Weekly performance | 0.0% |

Retrouvez-nous désormais sur https://phi-advisor.com/fr/

pour bénéficier de nos signaux d’achat et de vente de plus de 300 ETFs !

My Weblog:

Ümraniye elektrikçi

üsküdar elektrikci

usta elektrikci

sisli elektrikci

https://www.enigma-furnishings.co.uk/?p=584

https://alhajjabulkashemhosnearastudentconsultancy.com/?p=16620

https://asociacionderecicladoresdelmeta.org/?p=17407

https://contractorresults.com/?p=357

https://gabon-environnement.com/?p=3703

https://igyoushu.biz/?p=248

https://immd.kiev.ua/?p=5735

https://kimnammarine.com/?p=1366

https://kinglouis.fr/?p=3167

https://shemirancenter.com//?p=5652

https://smartaxconsultancy.co.uk/?p=929

https://tsamadopaco.fr/?p=4222

https://tvnasalsinus.com/?p=2111

https://yypark.net/?p=135