DB X-Trackers (DBXD) - 08/01/2018

Short Term strategy : Positive (90%) / Trend +

Long Term strategy : Positive (95%) / Trend +

Characteristics of the ETF

The DBXD ETF (db x-trackers), quoted in Euro, replicates the DAX 30 index which is composed of the 30 largest listed German stocks, representative of the main sectors of the economy, while the holdings are selected according to the importance of their market capitalization.

The costs of this ETF are low at 0.09% and AUM is quite high at € 4002m, making it one of the best vehicles in terms of costs / liquidity. The replication method is direct (physical) and the dividend distribution is capitalized.

Alternative ETFs: DAX (Lyxor in Euro), DAXEX (iShares in Euro)

Index & components

The top 10 stocks are mainly large industrial stocks such as Siemens or Bayer while there are only 2 financial stocks: Allianz and Deutsche Post, the German master index is relatively small and mostly composed of large companies, mostly industrial groups.

Unlike the English, French or Italian indices, the DAX is also distinguished by the absence of large oil companies that weigh heavily in the weighting of the CAC40, FTSE100 or FTSEMIB40, which is double-edged according to the energy sector momentum.

In addition, the financials weigh only 16.5% of the index, of which almost half for the insurance giant Allianz, so the banking sector has a rather low weight reflecting the well-known weakness of Deutsche Bank and Commerzbank.

Conversely, the automotive and chemical sectors are heavier than the other European indices, while the technology sector is mainly represented by SAP (9.4%) whose market capitalization is close to € 120bn.

In summary, the DAX is a rather strong index from a sectoral point of view which can make it evolve differently from other European indices.

Germany fundamentals are very solid (GDP growth around 2%, historically low unemployment rate at less than 6% and accelerated deleveraging up to 2020). The main risks concern Germany's main customers, namely the United Kingdom, which could suffer from Brexit, the US in political uncertainty and threatening it with a trade war, Russia which remains a difficult and aggressive neighbor and China because of its commercial practices which also tend to limit access to its domestic market to Western industrialists, particularly in the automotive and technology sectors.

Latest developments

After a 6.9% increase in 2016, the DAX30 grew by 12.5% in 2017, more than the stoxx600 (+ 10.6%) and has already increased by 3% since the beginning of the year. This performance is mainly due to the cyclical sectors, automobile and chemistry which represent a large part of the weighting and compensate for the lack of oil and mining stocks which are currently the main engines of the market. Volkswagen and Bayer posted increase of 5.6% and 4.1% respectively in the first week of January. These good performances are linked to the excellent economic statistics of the area, with Markitt's PMIs, showing an acceleration of activity in the main member countries, as well as business and household confidence at the highest level. This should result in job creation and a marked recovery in investment in the area. The short-term risks for the DAX are mainly political and essentially related to the formation of a coalition in the coming weeks. A new round of negotiations starts on January 7th between the conservatives (CDU-CSU) and the social democrats (SPD) in the hope of forming a “big coalition”. After a week-long exploratory period, negotiations should move towards the conditions of the coalition. The next few weeks are therefore key and in case of failure, new elections will have to take place and the political future of Mrs Merkel would be threatened. A little later, on March 4, will hold the Italian poll with much uncertainty about the country's ability to find a stable government.

Monthly data

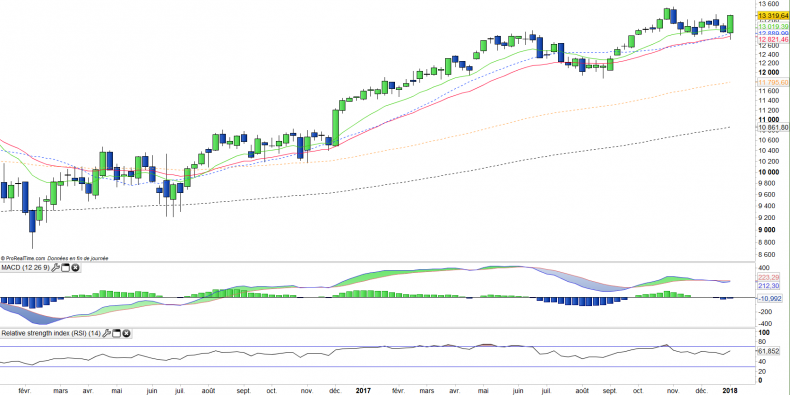

The monthly chart shows that the long-term trend of the DAX remains very bullish. After a moderate consolidation of two months, the index resumes the assault of historical highs through a very strong beginning of the year and while the oscillators remain far from the exuberance and clearly below the 2007 and 2015 levels.

So there is still upward potential, the line that link the previous summits of 2007 and 2015 represents the next resistance that is around the 14,000 points level or 6% higher.

Weekly data

On the weekly chart, we can see that after several weeks of stagnation, the DAX has just made a bullish engulfing, which sign the end of the correction and the likely continuation of the bullish movement, as suggested by the upward reversal of the main oscillators, with the exception of the MACD which should confirm the bullish signal a little later.

The achievement of new highs should occur in the coming weeks.

ETF Objective

DBXD is a UCITS ETF which replicates the DAX index (30 German companies)

Characteristics

| Inception date | 10/01/2007 |

| Expense | 0,09% |

| Issuer | Lyxor |

| Benchmark | DAX30 index |

| Code/Ticker | DBXB |

| ISIN | LU0274211480 |

| UCITS | Yes |

| Currency | € |

| Exchange | XETRA |

| Assets Under Management | 4 020 M€ |

| Replication method | Direct (Physical) |

| Dividend | capitalization |

| Currency Risk | No |

| Number of Holdings | 30 |

| Global Risk | 3/5 |

Country Breakdown

| Germany | 100% |

Sector Breakdown

| Consumer Discretionary | 20% |

| Financials | 18% |

| Industrials | 15% |

| Health Care | 14% |

| Information Technology | 12% |

| Materials | 11% |

| Telecom | 5% |

| Others | 5% |

Top Ten Holdings

| Siemens | 9% |

| SAP | 9% |

| Bayer | 8% |

| BASF | 8% |

| Allianz | 8% |

| Daimler | 7% |

| Deutsche Telekom | 5% |

| Deutsche Post | 4% |

| Linde | 3% |

| Adidas | 3% |