Lyxor ETF Goods & Services - IND - 03/10/2017

Short Term strategy : Positive (100%) / Trend +

Long Term strategy : Positive (100%) / Trend +

Characteristics of the ETF

The ETF Lyxor IND (UCITS), created in 08/2006 is listed in Euro on Euronext and tracks the Stoxx600 Industrial Goods & Services Europe index, which is composed of the 104 largest European stocks in the sector.

The share of stocks outside the Eurozone represent 45% of the index, which is not insignificant in view of the potentially significant fluctuations of the £ and the CHF in relation to the Euro.

The expense ratio of this ETF is 0.3% in the average of our selection and the AUM is approximately € 54m. The replication method is indirect (via a swap) and dividends are capitalized.

Alternative ETFs: EXH4 ( iShares in Euro)

Index & components

This is a broad index since it contains 104 stocks, 55% of which are quoted in euro, the remainder being in pounds sterling, Swiss Franc and northern currencies.

Among the 10 largest stocks, which represent about 43% of the index, are large capitalization stocks, with Siemens in the first place, which accounts for 10.4% of the index and weighs more than € 100m of capitalization. The asset of this basket is its diversification from a business point of view. We find major companies related to electrical equipment such as ABB, Siemens and Schneider, but also major aerospace and defense stocks such as BAE, Airbus or Safran.

The world of capital goods also addresses the health sector (Philips and Siemens), construction with elevators (Kone and Schindler), mining equipment (Atlas Copco and Sandvik). The index also includes services companies, especially logistics specialists such as Deutsche Post DHL Group. This diversity makes it a varied index that moderates sectoral risk, while Siemens represents a pole of stability by its weight and conglomerate status.

Although this sector is cyclical because it is linked to investment, it benefits from the diversity of the markets addressed, that allows compensation between customer cycles (for example, the aeronautics or health cycle is uncorrelated to the oil and mining cycle or from the construction). The sector remains quite volatile as prices and valuations are mainly influenced by order intake, which is subject to certain macroeconomic factors (commodity prices, global growth), while emerging markets account for an ever-increasing share of the overall market.

Latest developments

IND is up 16% since the beginning of the year, well above the Stoxx600 (11%), after a 10.75% increase in 2016 thanks to the rebound in oil prices in the second half of the year.

The sector enjoys the highest visibility in the Eurozone and in China, whose macroeconomic figures are improving. The sharp rise in prices over the past month also appears to be attributable to higher crude oil prices, which benefited from various exogenous factors (hurricanes, Kurdish problem), while the energy sector is a major customer for the industrial sector.

The sector also enjoys strong momentum on both growth themes (robotics, smart grid, 3D printer ...) and M & A operations (Alstom / Siemens, Philips' refocusing on health, etc.). Another positive factor is the good performance of emerging countries since the beginning of the year, which also reflects the rise in commodities.

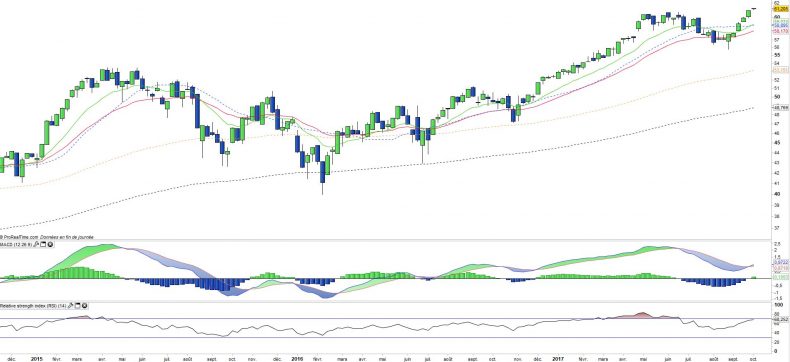

Monthly data

The monthly chart shows a very positive long-term trend. After reaching the EMA13 support line, the prices have just recorded new highs and show a significant relative strength versus the Stoxx600.

All indicators are bullish, and after a 6.6% rise in September, it is nevertheless necessary to monitor any signs of overheating. The oscillators are in the high zone but without being in overbought area as it was the case in spring 2015.

Weekly data

On the weekly chart, it can be observed that a very strong dynamic propelled the prices on the highest of the year in 1 month. This movement caused the upward crossing of the MACD, a positive medium-term factor. But at the same time, after 5 weeks of rising there is a need for short-term pause / correction.

Given the strength of the index we expect rather flat consolidation, time to digest the September rise.

ETF Objective

IND is a UCITS compliant ETF that aims to track the benchmark index Stoxx Europe 600 Industrial Goods & Services Net Return (104 companies)

Characteristics

| Inception date | 18/08/2006 |

| Expense ratio | 0,30% |

| Issuer | Lyxor |

| Benchmark | Stoxx Europe 600 industrial Goods & Services NR |

| Ticker | IND |

| ISIN | FR0010344887 |

| Currency | € |

| UCITS | Yes |

| EU-SD Status | Out of scope |

| Exchange | Euronext Paris |

| Assets Under Management | 54 M€ |

| Dividend | Capitalisation |

| PEA (France) | Yes |

| SRD (France) | Yes |

| Currency Risk | Yes |

| Number of Holdings | 104 |

| Risk | 3/5 |

Country Breakdown

| France | 21% |

| United Kingdom | 21% |

| Germany | 19% |

| Switzerland | 11% |

| Sweden | 10% |

| Spain | 5% |

| Finland | 4% |

| Others | 9% |

Sector Breakdown

| Industrials | 90% |

| Inforation Technology | 6% |

| Materials | 3% |

| Others | 2% |

Top Ten Holdings

| Siemens | 10% |

| Airbus | 5% |

| ABB | 4% |

| Schneider | 4% |

| Deutsche Post | 4% |

| Safran | 3% |

| Volvo | 3% |

| Amadeus | 2% |

| Atlas Copco | 2% |

| BAE Systems | 2% |