iShares Russel 2000 ETF - IWM - 17/12/2018

Short Term strategy: Negative (0%) / Trend -

Long Term strategy: Negative (30%) / Trend -

pour accéder à nos achats / ventes sur les indices

Characteristics of the ETF

The IWM (iShares) ETF replicates the RUSSELL 2000 Index, which is a subset of the Russell 3000 Index of the 3,000 largest US companies representing approximately 98% of the US market capitalization. The Russell 2000 Index represents only about 10% of the market capitalization of the Russell 3000 and consists of approximately 2,000 small cap companies ($ 2bn market cap on average).

The Russell 2000 Index seeks to be truly representative of the mid-cap segment, and is fully reconstituted each year to ensure that larger caps do not distort performance and that corporate characteristics actually correspond to the mid-cap segment.

The ETF IWM is currently the benchmark tracker for replicating this US small cap index with fees limited to 0.19% and AUM of $ 41456M. Replication is direct (physical) and there is a dividend distribution policy on a quarterly basis.

Alternative ETFs: VTWO (Vanguard in USD), RUS2 (Lyxor in USD)

Index & components

The Russell 2000 Index is a very broad index that can be used to profoundly address the universe of US mid caps.

The interest of this index is in addition to the high number of components, characterized by the great diversity of the sectors addressed: the financials (c.18%), the technological compartment (c.14%), the industry (c.15). %), health (c.16%) and consumer goods (c.12%) are the main sectors, in a very balanced index in the end and very representative of the US economy. However, we can notice that the growth themes are more represented, compared to sectors considered as defensive as for exemple energy (3.8%), utilities (3.8%) or telecommunications (3.4%) which are historically heavily represented in the big indices like the Dow Jones or the S&P500.

The valuation multiples of the Russell 2000 are currently not really higher than those of the major indices. Moreover, the companies that make up the Russell 2000 are often companies that are already well structured internationally and therefore in a position to benefit fully from the recovery of the global cycle, but which are also more economically sensitive by their average size. The small valuation differential against large indices may appear as an opportunity as the growth gap could be quite large if US growth remains robust.

The rate hike cycle will remain, according to the latest Fed statements, gradual and should not pose a threat in the short term, but many risks are weighing on US economic growth whose cycle could come to an end by 2020 .

Latest developments

The Russell 2000 is down -7.8% since the beginning of the year (against -2.8% for the S & P500), after a rise of 13% in 2017 (against + 19.4% for the S & P500).

Russell 2000 is currently the weakest index in the US market, which confirms investors' risk aversion. The downtrend on the Russell2000 is often a leading indicator of the overall fall in the US indexes of large stocks, particularly expectations of a decline in growth or even a recession with a more pronounced impact on the growth theme.

Markets seem to be once again favoring so-called "value" themes offering dividends and a certain security of cash-flows such as Utilities or Telecoms rather than stocks offering high growth potential coupled with demanding multiples. The average P / E of the index is currently at 16x the 12-month forward results versus 16x for the S & P500, which remains acceptable unless the earnings momentum weakens or turns around. The investment on the Russell 2000 is therefore a bet on the US GDP growth in 2019, on which the risks accumulate in recent months due to the trade war between China and the US.

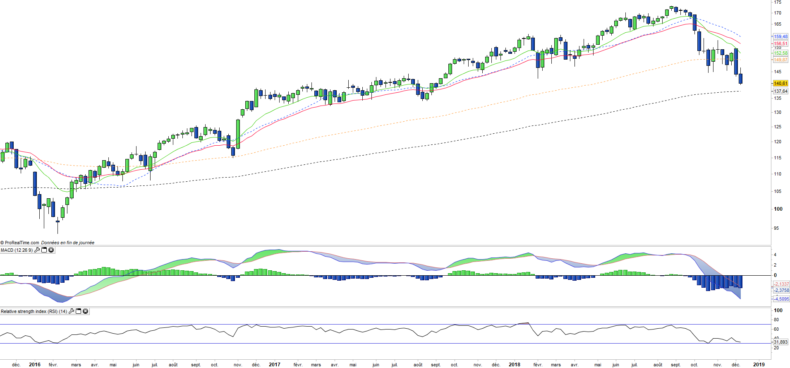

Monthly data

The monthly chart shows a restart of the decline in the form of a powerful bearish candlestick in progress for the month of December, which should be confirmed at the end of the month. The previous corrections, in 2012 and 2016 have systematically been stopped on the EMA100 level which is located 16% lower, which shows that the downturn phase still has some strong potential. Oscillators are bearish but still have a lot of downside.

Weekly data

On the weekly chart, we can see that a second leg of decline is under construction after the break of the EMA100, and the pull-back on the EMAs13 and 26 that has relaunched the downtrend. The prices arrive on a new medium materialized by the EMA200, not far from a large support area around $ 130. The oscillators are in clear oversold zone which should favor the formation of a rebound on the supports level.

Theme

IWM is an ETF, listed in USD, which seeks to replicate the US Russel 2000 index (2 015 US companies)

Characteristics

| Inception date | 22/05/2000 |

| Expense ratio | 0,19% |

| Benchmark | Russel 2000 |

| Ticker | IWM |

| ISIN | US4642876555 |

| Currency | $ |

| UCITS | No |

| Exchange | NYSE |

| Assets Under Management | 41 456 M$ |

| Replication Method | Direct (Physical) |

| Dividend | Distribution |

| Currency risk | No |

| Number of Holdings | 2 015 |

| Risk | 3/5 |

Country Breakdown

| USA | 100% |

Sector Breakdown

| Financials | 18% |

| Health Care | 16% |

| Industrials | 15% |

| Information Technology | 14% |

| Consumer discretionary | 12% |

| Real Estate | 8% |

| Energy | 4% |

| Others | 10% |

Top Ten Holdings

| Etsy Inc | 0.4% |

| Integrated Device Technology | 0.3% |

| Five below | 0.3% |

| BLK CSH FND Treasury SL Agency | 0.3% |

| Haemonetics Corp | 0.3% |

| Idacorp | 0.3% |

| Ciena Corp | 0.3% |

| Hubspot Inc | 0.3% |

| Planet Fitness Inc | 0.2% |

| Livanova Plc | 0.2% |