Lyxor Small Cap Europe (MMS) - 13/04/2018

Short Term strategy: Positive (70%) / Trend +

Long Term strategy: Positive (95%) / Trend =

Characteristics of the ETF

The ETF MMS (Lyxor), listed in Euro, replicates the UCIT Small Cap Europe Index, which targets Eurozone companies whose market capitalization is between € 200 and € 1500m, ie companies that are ultimately more medium in size than microstructures.

The ETF charges are 0.4%, and the replication mode is indirect (via swaps), with a reasonable AUM of approximately 362M€. The dividend distribution policy is carried out by distribution.

Alternative ETF: IEIS ( iShares USD), SMAE (Lyxor EUR)

Latest developments

The MMS ETF rose by 21.9% in 2017, which is more than twice the performance of the Stoxx600NR (+ 10.6%) and is slightly negative in 2018 (-1.9%).

Growth companies, especially those part of the technology segment, have been impacted by the US correction, in the wake of the GAFAs in particular Facebook and Amazon. This correction seems to be coming to an end which requires confirmation.

In the industrial sector (industry and materials), the large operating leverage of medium-sized companies should ensure a new round of rising profits while demand and investment tend to strengthen, including in France and Italy. As a result, the average EPS growth rate should again be higher than that of the larger Stoxx600NR stocks, which are particularly exposed to currency fluctuations and geopolitical issues that may impact a particular region.

In addition, the absence of banks that have underperformed the benchmark for a few weeks is currently a good thing.

Index & components

The index replicated by the ETF includes 479 companies with wide sectoral and geographic diversification which makes it a broad and very diversified index.

The specific risk is low because the first 10 lines represent approximately 10.2% of the fund, or about 1.5% for the most important lines, including iconic growth stocks such as Moncler, Rheinmetall or Orpea. The major economies (Germany, France and Italy) account for 54% of the selection, leaving a significant share for the Nordic economies such as Finland or the Benelux.

The Small Cap ETF represents an opportunity to play the growth of the euro area with a risk even below the benchmark index (stoxx600) - due to the absence of large banks - a policy of dividend distribution and with a much more assumed growth profile. Indeed, sectors considered defensive-telecoms, basic consumption, utilities and energy represent only 13% of the MSCI Small caps index, while growth sectors (Technology / Hardware, Consumer Discretionary , health) represent about 1/3 of the index, the first sector remains the industry with nearly 21% of the capitalization.

It should also be noted that unlike the Stoxx600, the United Kingdom is not part of the selection, MMS is therefore only focused on continental Europe and therefore there is no currency problem. We believe that the Eurozone is attractive in the medium term as the economic recovery is confirmed (+2.1% in 2018e), supported by rather low interest rates and energy costs, while the political cycle is completed.

Although valuations of growth stocks are still fairly demanding, and a temporary return to "value" cannot be ruled out, new technologies and new economic models, particularly those resulting from digitization, make this theme a " megatrend ". The long-term potential is clearly in favor of growth stocks and MMS which also includes industrial stocks seems to us to represent an excellent risk / reward ratio in a long-term perspective with a positioning more advantageous than the stoxx600.

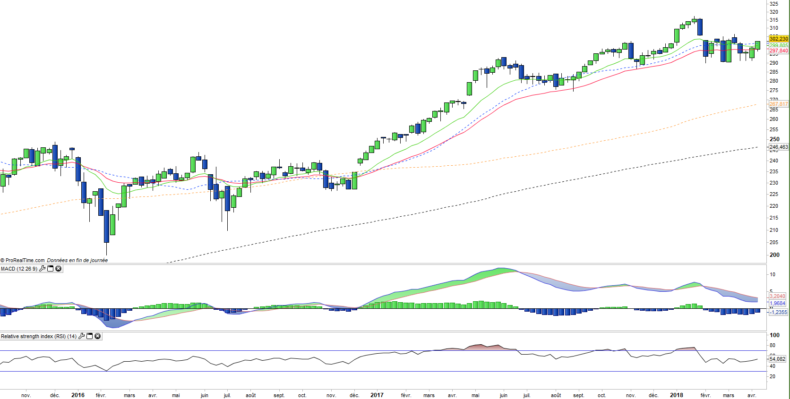

Weekly data

The weekly chart shows an ongoing recovery of the positive trend in the medium term horizon. It is more precisely the first stage of recovery with prices coming back above moving averages (13,26 and 100) and stabilizing technical oscillators. The second step will be to fill the gap opened at the beginning of February which would allow to finish this corrective phase.

Daily data

On the daily chart, the reversal attempt is clearly visible with prices accelerating upwards above moving averages. The EMA13 and 26 are about to cross each other, which will confirm a short-term rise signal, especially since this signal is coupled with a generalized reversal of technical oscillators. The index is again bullish in the short term.

ETF Objective

MMS is a UCITS ETF which seeks to replicate the MSCI EMU Small Cap Net Return EUR Index (479 european small & Mid Cap companies)

Characteristics

| Inception date | 01/04/2005 |

| Expense ratio | 0,40% |

| Benchmark | Euro Stoxx 50 Net Return |

| Issuer | Lyxor |

| Ticker | MMS |

| ISIN | LU1598689153 |

| UCITS | Yes |

| EU-SD status | Out of scope |

| Currency | € |

| Exchange | Euronext Paris |

| Assets Under Management | 333 M€ |

| Replication Method | Indirect |

| Dividend | Distribution |

| PEA (France) | Yes |

| SRD (France) | Yes |

| Currency risk | No |

| Number of holdings | 479 |

| Risk | 3/5 |

Country Breakdown

| Germany | 24% |

| Italy | 17% |

| France | 14% |

| Netherlands | 11% |

| Spain | 11% |

| Belgium | 8% |

| Finland | 6% |

| Ireland | 4% |

| Austria | 4% |

| Others | 2% |

Répartition sectorielle

| Industrie | 21% |

| Finance | 14% |

| Biens de consommation cyclique | 13% |

| Technologies de l'information | 12% |

| Immobilier | 10% |

| Matériaux | 9% |

| Santé | 8% |

| Autres | 13% |

Top Ten Holdings

| Smurfit Kappa Group | 2% |

| LEG Immobilien | 1% |

| ASR Nederland | 1% |

| Moncler Spa | 1% |

| Kingspan Group Plc | 1% |

| Rheinmetall AG | 1% |

| Rubis | 1% |

| Orpea | 1% |

| Sartorius AG | 1% |

| Merlin Properties | 1% |