France CAC40 (PX1) - 30/05/19

Short Term trend: Neutral (50/100)

Long Term trend: Positive (85/100)

(scores computed by our proprietary algorithms - cf methodology)

Index profile

It should be noted that the top 10 stocks (which represent about 55% of the index) belong to very different sectors, unlike the DAX (overweight in industrial stocks) or the FTSE100 (pharmacy and financial), the CAC40 is indeed more composite in its sectoral composition.

However, three heavily weighted stocks, Total (10%), LVMH (8%) and Sanofi (7%) can influence the index according to their own fundamental factors, which represents a bias in values.

From a sectoral point of view, we can see that the consumer goods sector represented by luxury goods and cosmetics such as LVMH or Loreal, is one of the most important for the index (18%) behind the industry (20%), ahead of financials (10%) or energy (11%).

The CAC40's stocks are often world leaders with a very international exposure, with little dependence on the domestic market and with a fairly strong dollar sensitivity.

In 2017, the CAC40 achieved a performance of 9.3% which was more than offset by a -11% in 2018. As on the other European or North American indices, the decrease is mainly due to the fall of the markets launched in October against the backdrop of a trade war between the US and China, a rate hike policy considered too aggressive by the FED, and more specifically for France, the fear of stopping reforms because of the social protest that has increased at the risk of destabilizing the government.

Since January 2019, the index is rebounding (+ 10.4%), but is already relapsing before the accumulation of risks on global growth, with the first rise in tension between China and the US , the return of fears on Italy and a possible hard Brexit.

Instruments: CAC (Lyxor in Euros), C4D (Amundi in Euro), E40 (BNP Easy in Euro)

Technical analysis

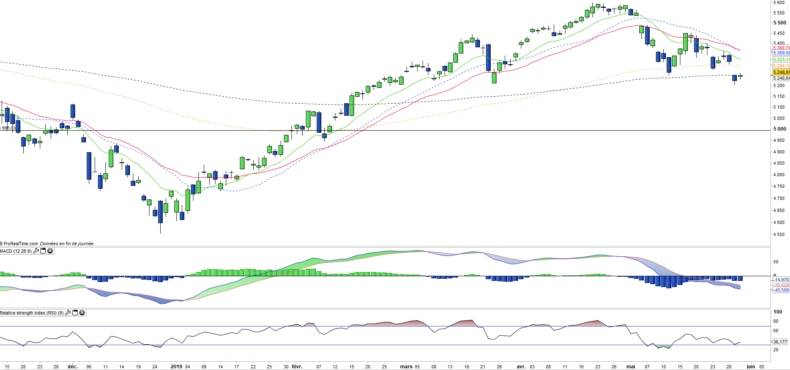

Weekly data analysis

Weekly data shows a bearish reversal during acceleration with the downward reversal of the MACD and major technical oscillators. The prices are momentarily supported by the EMA100 and the resistance of 5200 pts, which may not last given the rapid deterioration of the trend and the accumulation of negative signals on all world markets. In case of a downward crossing of the EMA100, the next support to consider would be that of the EMA200 located a little lower.

Daily data analysis

The daily chart shows the quick weakening of the index, with a new bearish gap that engulf the EMA100 and the EMA200 at the same time. The index should try to close the gap over the next few days, but the task may be complicated. A bearish acceleration seems the most likely hypothesis in the short term. A “head & shoulder” pattern has been validated, which makes the phase all the more dangerous and opens a goal at 4800pts.

Country breakdown

| France | 97% |

| Netherlands | 1% |

| Luxembourg | 1% |

| United Kingdom | 1% |

Sector Breakdown

| Industrials | 20% |

| Consumer discretionary | 18% |

| Consumer staples | 13% |

| Energy | 11% |

| Financials | 10% |

| Health Care | 10% |

| Materials | 5% |

| Others | 14% |

Top Ten holdings

| Total | 10% |

| LVMH | 8% |

| Sanofi | 7% |

| Airbus | 6% |

| L'Oreal | 5% |

| BNP Paribas | 4% |

| Air Liquide | 4% |

| Danone | 4% |

| Axa | 4% |

| Vinci | 4% |