Portfolios

16

Sep

2017

16

Sep

2017

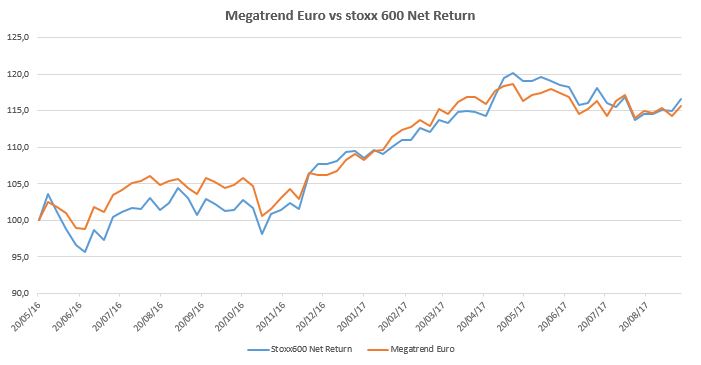

Megatrend Euro Portfolio – 15/09/17

16

Sep

2017

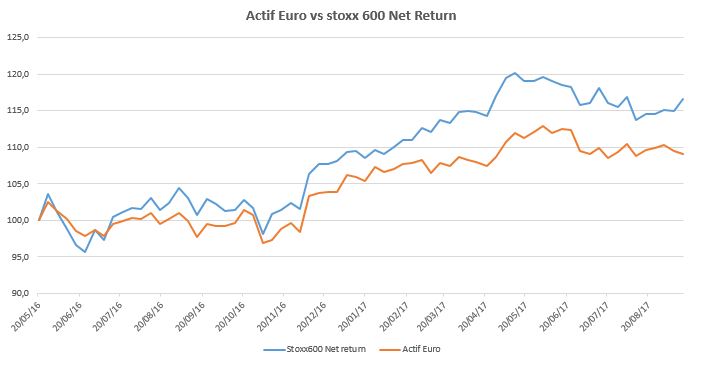

Active Euro Portfolio – 15/09/17

16

Sep

2017

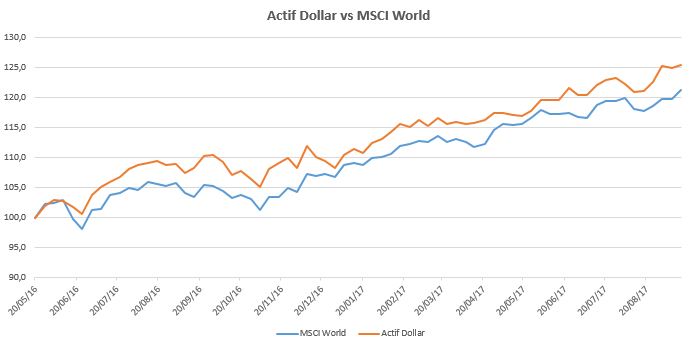

Global Macro Portfolio – 15/09/17

15

Sep

2017

Our Market Analysis : 16/09/2017

15

Sep

2017

Two exits and two entries in our Active Euro Portfolio – 15/09/17

13

Sep

2017

We include Thailand (THA) in our Watchlist – 13/09/17

13

Sep

2017

One exit and one entry in our Active Euro Portfolio – 13/09/17

10

Sep

2017

One entry and one exit in our Megatrend Euro Portfolio – 11/09/17

09

Sep

2017

European markets were out of their trading range this week and ended up sharply up (SXXR: + 1.4%), as did the S&P500 (+ 1.6%).

This bullish break out, which had been anticipated by the DAX the previous week, was mainly driven by the cyclical sectors (Automotive in the first place, which benefited from the announcements of the Frankfurt show) and the financials, while rates were back on the rise this week.