Portfolios

09

Sep

2017

09

Sep

2017

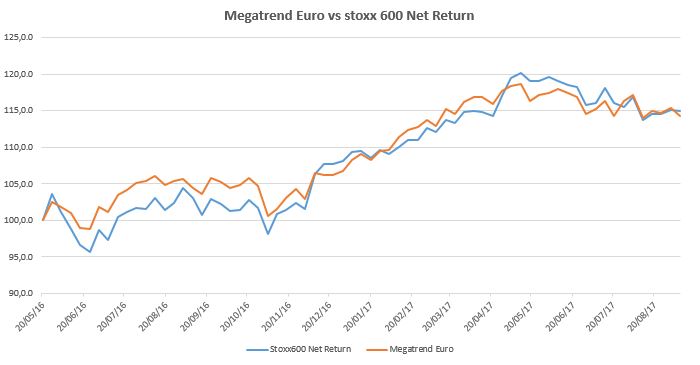

Megatrend Euro Portfolio – 08/09/17

09

Sep

2017

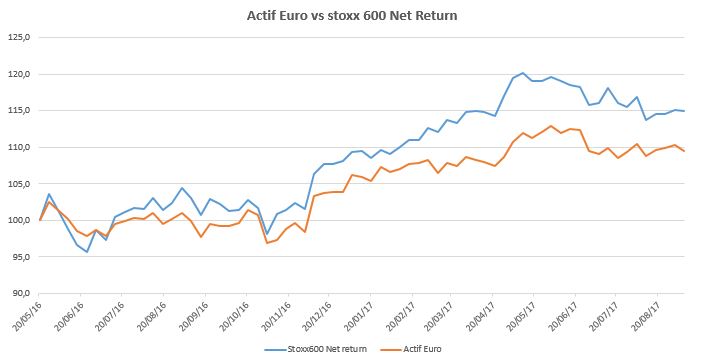

Active Euro Portfolio – 08/09/17

09

Sep

2017

Our Market Analysis : 09/09/2017

08

Sep

2017

One entry and one exit in our Active Euro Portfolio – 08/09/17

08

Sep

2017

We integrate European Banks (BNK) in our Watchlist (short) – 08/09/17

06

Sep

2017

We include in our watchlist AUT (Automotive Index Europe – Lyxor) – 06/09/17

05

Sep

2017

One entry and one exit in our Megatrend Euro Portfolio – 06/09/17

02

Sep

2017

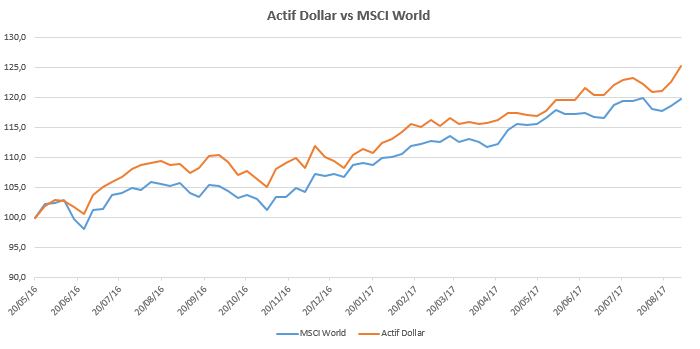

Global Macro Portfolio – 01/09/17

02

Sep

2017

The markets ended once again on a stable note (Stoxx600: -0.1% and S & P500: -0.6%) after a difficult start to the week following the North Korean nuclear test. Market reaction was ultimately more measured than expected, and investors seem to continue betting on a diplomatic outcome.