Portfolios

02

Sep

2017

02

Sep

2017

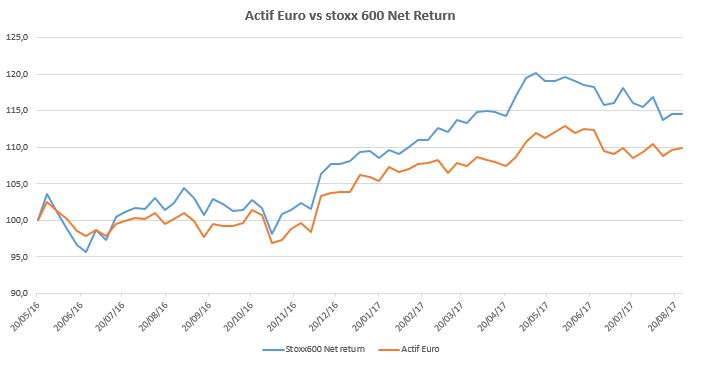

Active Euro Portfolio – 01/09/17

02

Sep

2017

Our Market Analysis : 02/09/2017

01

Sep

2017

We integrate Russia (RUS) in our Watchlist – 01/09/17

01

Sep

2017

One entry in our Active Euro Portfolio – 01/09/17

30

Août

2017

One exit and one entry in our Active Euro Portfolio – 30/08/17

26

Août

2017

Global Macro Portfolio – 25/08/17

26

Août

2017

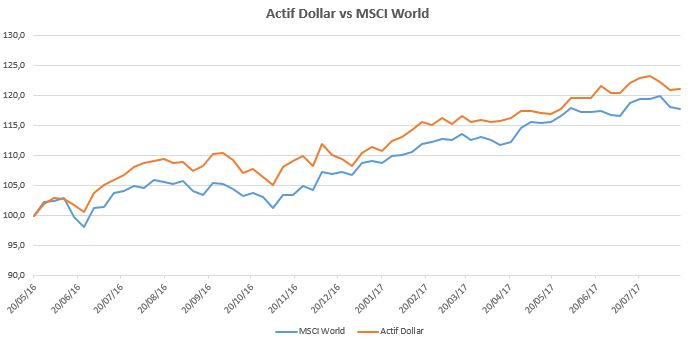

Portefeuille Actif Dollar – 25/08/17

26

Août

2017

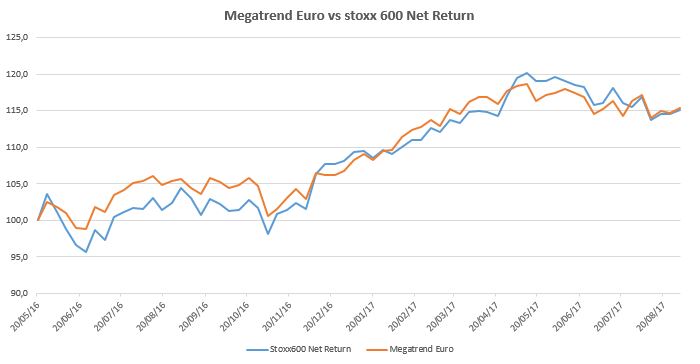

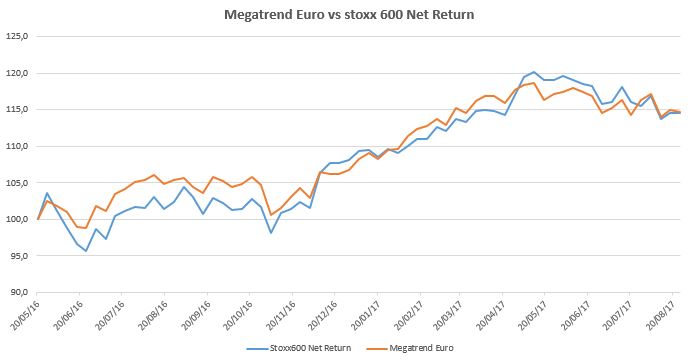

Megatrend Euro Portfolio – 25/08/17

26

Août

2017

This week was marked by greater volatility in the indices, particularly the Stoxx600NR, which ended with a 0.6% rise after a start of the week under pressure, due to the rise in the Euro, which surpassed the 1.20 level before to return to 1.18 / 1.19 on the weekend.